Cash pours into stocks to start 2013: Start of the great rotation?

Since the financial crisis struck, investors—especially in the US—have been especially leery of equities, preferring to pump more and more of their money into mutual funds that buy bonds. So today’s numbers from mutual-fund flow tracker Lipper raised a few eyebrows when it showed a torrent of cash flooding into stock funds and exchange-traded funds during the first full week of trading, as the FT reports.

Since the financial crisis struck, investors—especially in the US—have been especially leery of equities, preferring to pump more and more of their money into mutual funds that buy bonds. So today’s numbers from mutual-fund flow tracker Lipper raised a few eyebrows when it showed a torrent of cash flooding into stock funds and exchange-traded funds during the first full week of trading, as the FT reports.

US equity funds drew in $18.3bn in 2013’s first full week of trading, making it one of the busiest weeks on record as investors took advantage of the positive market conditions in the wake of a compromise deal on the US fiscal cliff. Thomson Reuters’ Lipper service said the week to January 9 was the fourth largest for net inflows of equity funds since it began calculating weekly flows in 1992.

Nobody really knows what this means. After all, cash usually floods into the market early in the year. But if it does hold up, it could be a big change in the financial markets, perhaps presaging a “great rotation” from bonds back into stocks. Barron’s reports some $119 billion was yanked from actively managed stock funds last year, not even counting an ugly December.

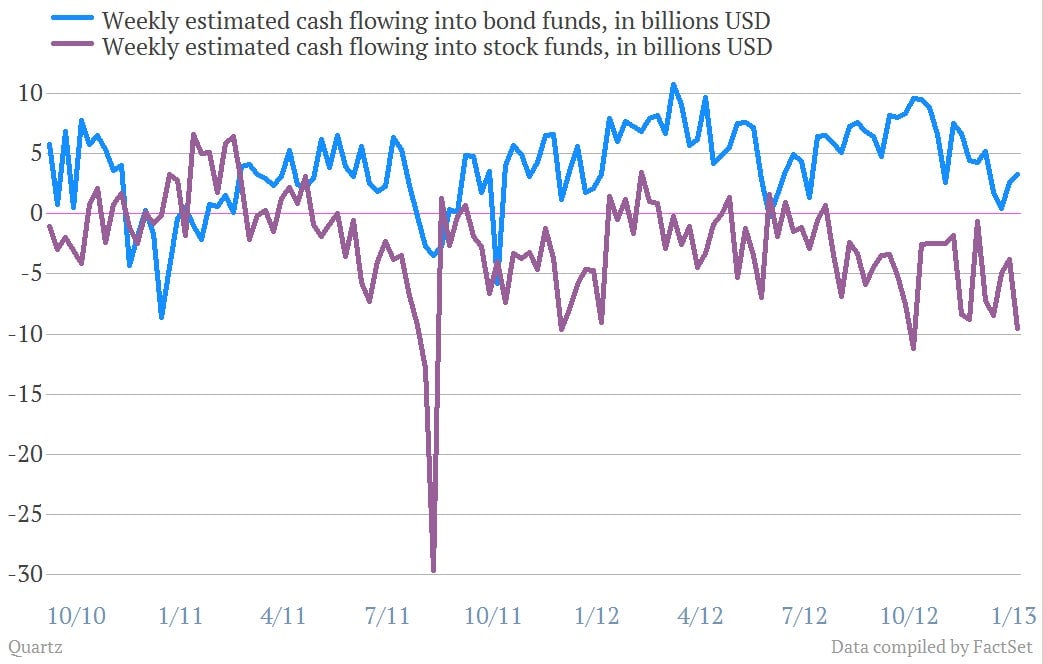

And this has been going on for some time. Here’s a chart that looks at similar fund flow data collected by the Investment Company Institute, a mutual fund trade group in the US. You can see that cash flow into stocks (the purple line) has been consistently negative, which means investors have been pulling cash out of stock funds and pouring it into bonds. (That short but massive dip in both stocks and bonds in August 2011 coincides with the showdown in Congress over the US debt ceiling.)

So is the great rotation back to stocks upon us? Nobody knows. (Especially us.) But we are a bit skeptical that we’re going to see the American public start salivating over stocks the way that they did in the 1990s any time soon. There’s a generational shift going on: Baby boomers, who poured money into stocks as working people, are starting to pull it out as retirees. This will exert a gravitational force in the financial markets in the coming years. And the baby boomers’ kids, having watched their parents sweat about their retirement money being tied up in a stock market prone to booms and busts, may not be as keen to invest in it.