How China’s stronger yuan pinches US consumers

For years, the US has called for China to let its currency—the renminbi, also known as the yuan—strengthen agains the dollar, with US officials and politicians arguing that an artificially weak yuan gives Chinese exporters an unfair advantage over their American counterparts. They also argue that allowing yuan appreciation is in China’s interest, given that the country has a stated goal of taming inflationary pressures and tilting its economy towards more domestic consumption. (All else being equal, a stronger currency would help on both fronts.)

For years, the US has called for China to let its currency—the renminbi, also known as the yuan—strengthen agains the dollar, with US officials and politicians arguing that an artificially weak yuan gives Chinese exporters an unfair advantage over their American counterparts. They also argue that allowing yuan appreciation is in China’s interest, given that the country has a stated goal of taming inflationary pressures and tilting its economy towards more domestic consumption. (All else being equal, a stronger currency would help on both fronts.)

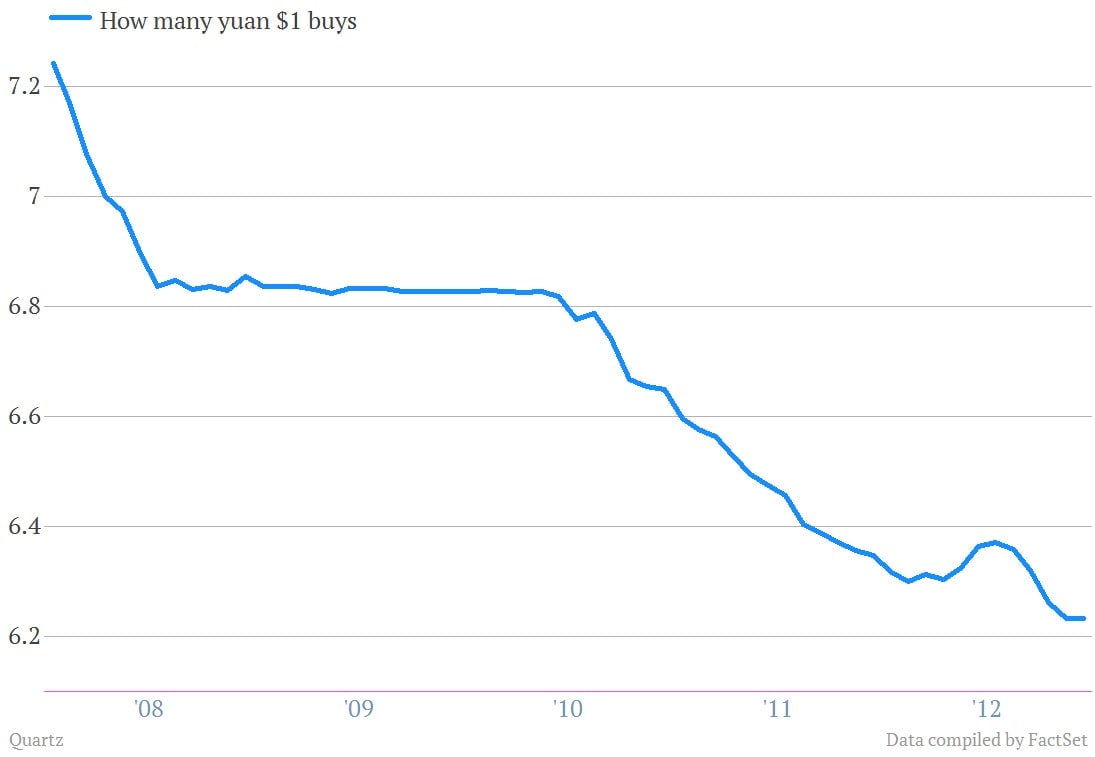

Over the last few years, signs have emerged that China is starting to agree that the time for a peppier yuan is indeed ripe. As this chart shows, Chinese authorities have resumed the strengthening of the yuan against the dollar.

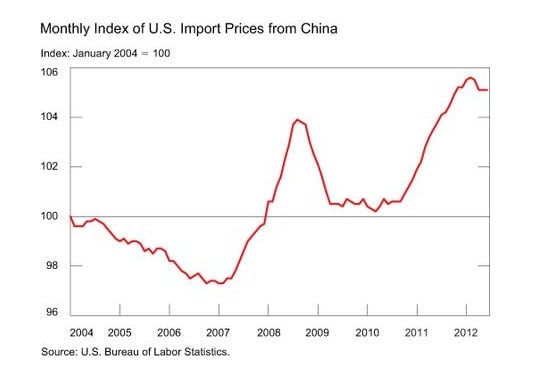

As we noted last week, the US has been hoping for a stronger yuan for a while because it should help US manufacturers. There’s a catch, though: just as yuan appreciation helps shift China’s economy towards consumption and away from exporting, it does the opposite for the US. One of the ways it does that is through higher prices for Chinese-made goods that the US imports. And there are a lot of them. According to researchers at the Federal Reserve Bank of New York, China is the single-largest supplier of US imports, accounting for almost one-third of consumer goods and more than 20% of non-oil imports. The prices of those have been moving higher as the Chinese yuan has appreciated.

Of course, this trend would in theory help the competitiveness of US manufacturers of these goods… if there were any. America’s manufacturing sector has long since ceded production of many cheap goods to foreign producers. That means US consumers will mostly likely still end up buying a lot of goods from China. And as they struggle with the tax increase from the payroll tax break’s sunset—which was agreed to as part of the New Year’s Eve fiscal cliff deal—the stronger yuan could deal another blow to consumers’ spending power.

Meanwhile, those dynamics could also feed through to retailers. Companies like Wal-Mart and Target, as well as low-cost competitors such as Dollar General and Family Dollar, specialize in rock-bottom pricing on merchandise—much of which is sourced in China.