No surprises from Bank of America’s lousy Q4, but bullish 2013 outlook might underestimate lingering legal issues

Bank of America’s adjustments for crummy mortgage bonds left its Q4 net income hurting, as the US financial giant announced this morning. Profits amounted to a mere $700 million for Q4 2012, down 63% from $2.0 billion in the same period of 2011.

Bank of America’s adjustments for crummy mortgage bonds left its Q4 net income hurting, as the US financial giant announced this morning. Profits amounted to a mere $700 million for Q4 2012, down 63% from $2.0 billion in the same period of 2011.

No surprise there. That’s because, on January 7, BofA gave a preview of this morning’s $11 billion worth of charges related to bad mortgages sold to Fannie Mae in the run-up to the housing crisis (an example of tip-top shareholder expectations management of the sort that Rio Tinto’s departing CEO Tom Albanese evidently never mastered).

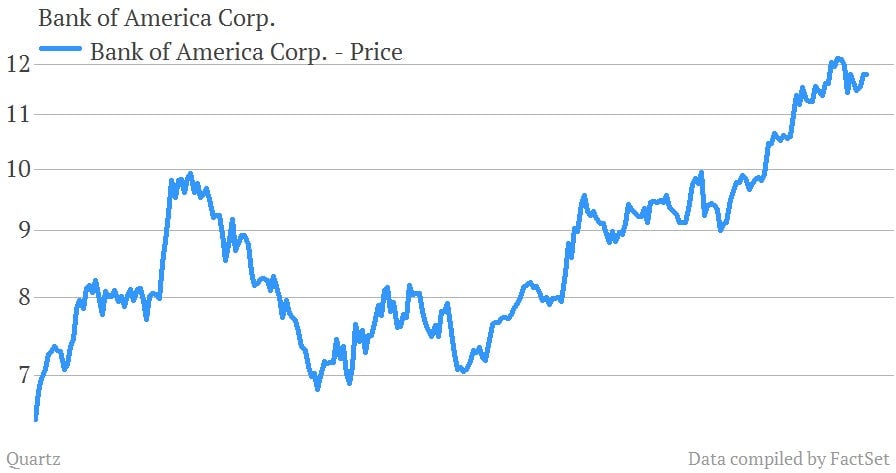

Profits for the year, however, came in at $4.2 billion, compared with $1.4 billion in 2011, signaling a return to health for the bank—something supported by rising bank deposits, which, at $28 billion, were up 28% from the previous quarter. The market has largely reflected this renaissance: for Bank of America shareholders, 2012 was a doozie of a year, with the stock up 107%.

Bank of America’s CEO Brian Moynihan pointed to the bank’s foray back into the mortgage business as basis for 2013 optimism, citing commercial lending and emerging market revenue as well. Plus, it’ll be nice to have those dodgy mortgages from 2008 behind it at last.

The bank’s bill of health might not be completely clean, though. A mortgage-related lawsuit filed by the Department of Justice and a possible suit from AIG could make the bank’s 2008 hangover flare up once again.