New York is now a better place to start your tech company than San Francisco

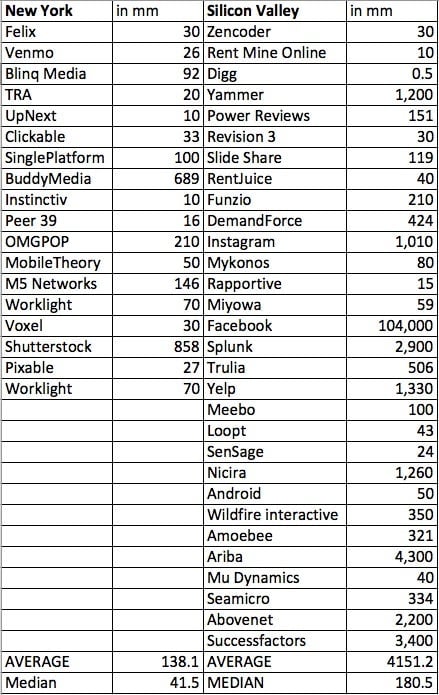

Why would anyone ever start a company in New York City when talent, capital, and network all favor Silicon Valley? This argument has persisted for a long time but let’s look at this from a pure financial and economic perspective for the first-time entrepreneur. If you achieve an exit you can expect a value nearly 40 times greater in the Valley than if you started your company in New York. Take all of the 2012 exits with reported numbers listed in CrunchBase (excludes the biotechnology and pharmaceutical industries):

Why would anyone ever start a company in New York City when talent, capital, and network all favor Silicon Valley? This argument has persisted for a long time but let’s look at this from a pure financial and economic perspective for the first-time entrepreneur. If you achieve an exit you can expect a value nearly 40 times greater in the Valley than if you started your company in New York. Take all of the 2012 exits with reported numbers listed in CrunchBase (excludes the biotechnology and pharmaceutical industries):

However, there is something to be said for the sense of urgency that you can only get in New York. Just by waking up in the morning you’ve spent at least $60. Even the milk expires sooner here. This urgency translates into what the Startup Genome blog calls the need for “NYC companies to monetize earlier, with a higher ratio of paying customers. Even though that may mitigate risk, it may also limit the startup’s ability to be highly disruptive.”

The Startup Genome Report, which Tech Crunch writer Rip Empson cites to compare startups in Silicon Valley to San Francisco, further illustrates the differences: “Compared to New York entrepreneurs Silicon Valley entrepreneurs are 2x more likely to build games, 50% less likely to build marketplaces, 23% more likely to build social networks, 3.5x more likely to build infrastructure and 2.5x less likely to build financial tools. New York entrepreneurs have the highest proportion of companies trying to resegment existing markets with niche products.”

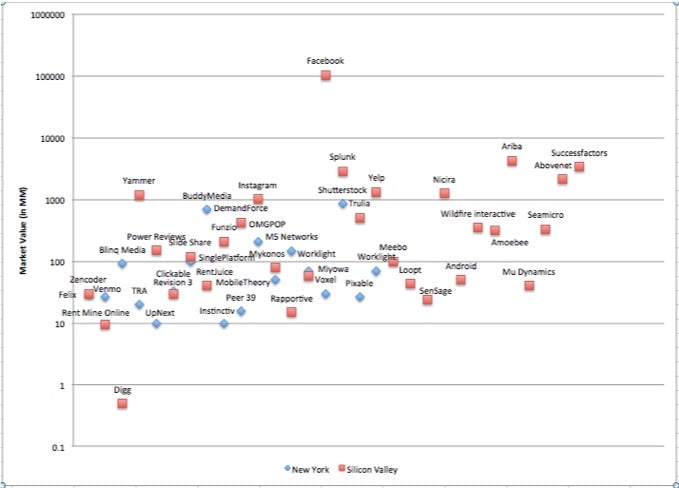

According to Statistic Brain, the least risky industries are finance, education, agriculture, services, wholesale, and retail. The riskiest industry by far is information.

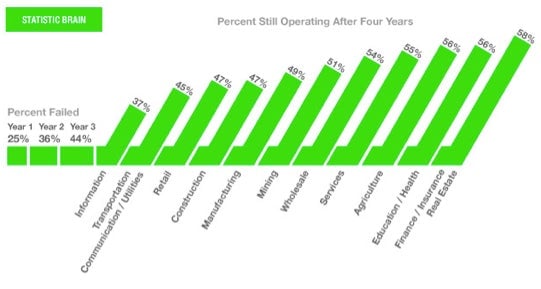

Let’s look at the most popular companies in either ecosystem: (The term “popular” is subjective. Silicon Valley popularity includes those most searched for on Crunchbase and the New York companies were taken from the New Tech City report.)

Silicon Valley has a larger number of more risky information businesses. With the exceptions of Foursquare and Tumblr, the overall composition of New York companies is less risky, mirroring the industries in its proximity: the financial industry on Wall Street, the healthcare industry in Northern New Jersey, the retailers and wholesalers on Fashion Avenue.

The Startup Genome Report also finds:

Entrepreneurs in Silicon Valley are much more ‘ambitious’ than entrepreneurs in New York City. Silicon Valley entrepreneurs are 22% more likely to estimate their market size as greater than 10 billion compared to New York City entrepreneurs. They are also almost 2x less likely to estimate their market size to be less than 100 million.

Translation: The Valley takes more risk than New Yorkers. They engage in the riskiest industries and the businesses that are successful there reap the biggest rewards. New Yorkers engage in slightly less risky behavior, which yields lower financial rewards. (I do mean slightly; if you are an entrepreneur you have to be crazy.)

This data further back the notion that Silicon Valley startups really are looking to rewrite the rules; therefore, as a whole, we see new pure technology being developed in Silicon Valley, whether it’s the Apple “App” ecosystem, the Facebook platform, or the Google paid search industry. We see these new applications being applied to companies in New York. Successful New York companies include: Buddy Media, built on Facebook’s infrastructure; Bitly, built on the Twitter link-shortening phenomena; Clickable, since acquired by Syncapse, built on the paid search platform.

So what does this mean from a financial perspective? Let’s look at some more data.

Seedtable 2012

San Francisco Angel Investments: 70 | Venture Capital Investments: 146

New York Angel Investments: 82 | Venture Capital Investments: 95

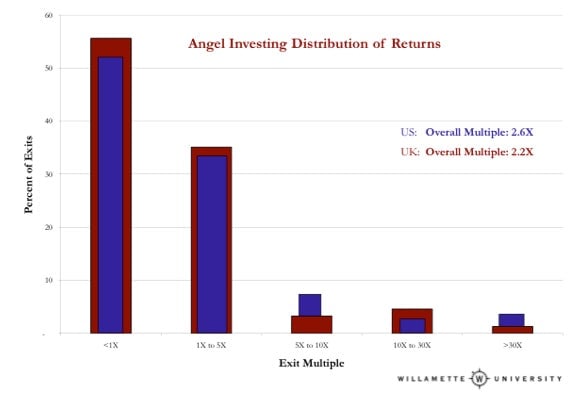

According to SeedTable, there were more angel investments in New York versus later stage, larger venture capital investments in Silicon Valley in proportion to the number of startups in 2012. This makes sense given the type of investing that goes on in venture capital. These investments need to return 10 to 20 times the initial investment to cover all of the losses that they will incur in the life of their fund. For every 10 zeros in the fund, there will be (hopefully) one investment that is that large. On the other hand, US Angel Investors typically make 2.6 times the initial investment (chart below). (Jacob Brody from Mesa+ points out that angels are willing to take lower returns because they “don’t pay a management fee or carried interest so they’re getting 100% of the upside not 20%.”)

So why would someone start a company in New York over Silicon Valley? Let’s think about it in terms of the lottery. In last November’s record Powerball jackpot of $588 million the odds, as listed on Powerball.com, were 1 in about 175 million that you’d win (1:175,223,510). Business Insider already did the math and figured out that you should have bought more tickets. Each ticket you purchased was expected to net you $1.21 (this number should be a bit higher since they calculated the expected value based on $500 million and not $588 million).

Through the lens of a startup founder: would you rather have a 25% chance of selling your business for $5 million or a 0.25% chance of a $500 million exit? Either way you look at it, the expected value is $1,250,000. Are these bets equivalent? To exaggerate this point: an 100% chance of $5 million or a 0.001% chance at $5 trillion; both result in $5 million. A sure thing versus a moonshot. (Of course, this is an exaggeration because nothing in the startup world is guaranteed.)

Roman Fichman, a New York based startup lawyer notes “that in a smaller, quicker exit founders end up getting per year about the same; they get paid sooner and have an exit to take credit for. At the same time, the acquisition market is much more active because many more companies can afford the smaller price tag.”

If you are a first timer, a “small win” can give you another chance for the “big win” while “no win” takes you out of the game and back to the “day job.” Brody says: “It’s all about your risk profile.”

Financially and statistically, because of the myriad of opportunities given to a company that has raised less money coupled with the industries that New York companies choose, there’s a higher probability of more, smaller winners in New York than one big winner like in Silicon Valley.

More winners in New York sounds great, but what does that mean for the future of technology? Technology is the end game in Silicon Valley but it is a means to an end in New York. Technology is the main driver of business in the Valley and thus its businesses are compensated accordingly. In New York, technology is an enabler, which allows these companies to change the dynamics of existing industries.

But will New York ever see a technology revolution and truly rival Silicon Valley? All signs do point to “yes,” with the inflow of seed stage capital, education hubs, and more mentors and prior entrepreneurs (since there will theoretically be more that have won the entrepreneur game than in Silicon Valley). Yet this shift will take time. In the near future, New York will be taken seriously as a game changer, but until then there are a lot of other business-related problems to solve here: the rent is still too high and the milk has already spoiled.