Your gold is worth less and less lately—here’s why

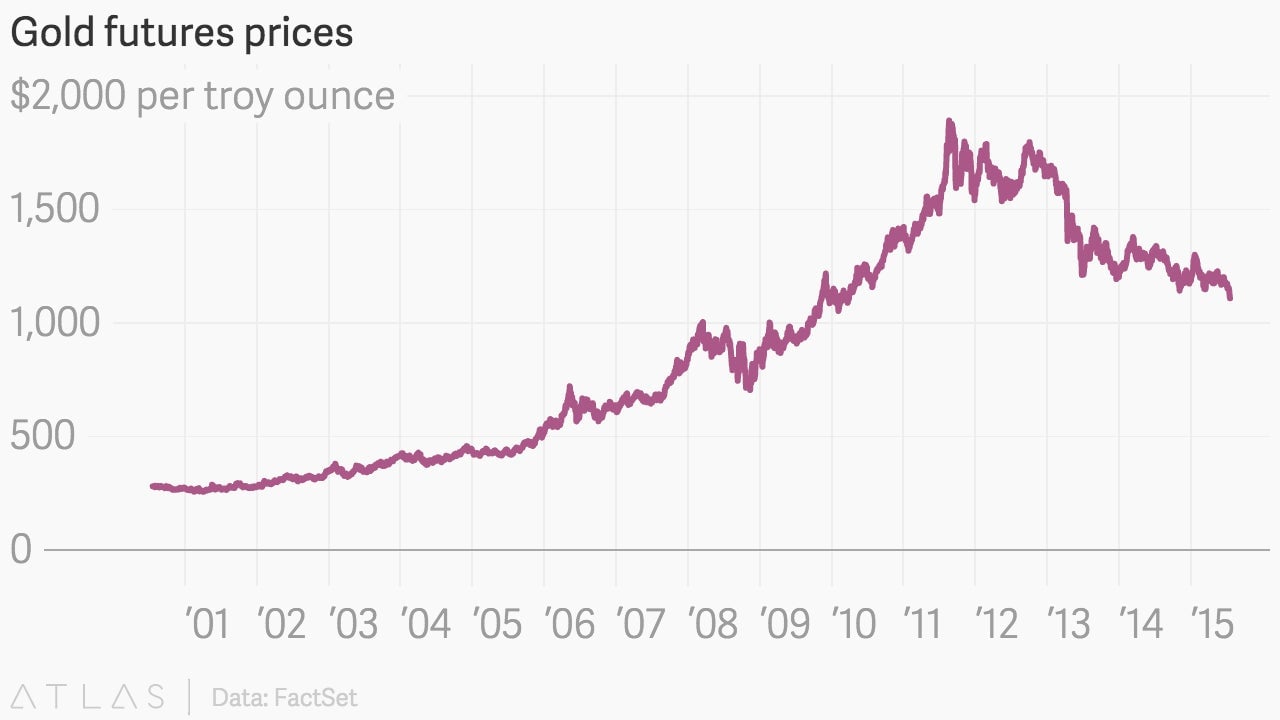

Gold prices are in retreat again Monday (July 20), after falling to a five-year low in overnight trading.

Gold prices are in retreat again Monday (July 20), after falling to a five-year low in overnight trading.

Why? China—in part. A fresh update on reserves from the People’s Bank of China late last week showed a lower-than-expected build in the bank’s bullion reserves. Demand from China has been seen as a cornerstone of prices for the precious metal in recent years.

Also, the renewed strength of the US dollar is weighing on gold prices. The greenback, as measured by the ICE US dollar index, is up roughly 8.5% this year, amid a selloff in the euro and expectations that a Fed rate hike might happen before the end of the year.

The prospect of the Fed stepping away—even slightly—from the extraordinary monetary policy put in place in the aftermath of the financial crisis and Great Recession underscores a simple fact. The oft-cited reason for owning gold—as a hedge against activist central bank policies that will lead to inflation—has never materialized. In reality, inflation in the US remains far too low, despite oodles of new money created and pumped into the banking system through the Fed’s quantitative easing programs over the last few years.

To be sure, gold bugs had a good run in the immediate aftermath of the recession. But since gold prices peaked above $1,890 in 2011, they’re down more than 40%. In fact, over the last five years, you would have been better off owning the US 10-year Treasury note, which delivered a loss of 6% compared to a loss of 7% on gold during that period.

On the other hand, long-term believers in the power of gold are still ahead of the game: The metal is up about 150% over the last 10 years, compared to a gain of about 72% for the stock market over the same period.