Japanese companies have swallowed up at least one foreign company a day, on average, for the last decade

For Japanese companies, there’s not much worth sticking around for at home these days. The country’s economy is struggling to grow and its aging population will eventually mean fewer customers. The solution is to get out and find new markets, and, often, the strategy Japanese companies have opted for is to buy existing companies overseas.

For Japanese companies, there’s not much worth sticking around for at home these days. The country’s economy is struggling to grow and its aging population will eventually mean fewer customers. The solution is to get out and find new markets, and, often, the strategy Japanese companies have opted for is to buy existing companies overseas.

According to Dealogic data, Japanese companies have bought or merged with over 5,000 international businesses since 2005. That’s an average of more than one merger or acquisition a day over the past 10 years:

Japanese companies have spent $60 billion merging with or acquiring foreign companies in 2015 so far (including Nikkei’s buyout of the Financial Times, announced yesterday), according to the Dealogic data. That compares with just $53.4 billion for all of last year.

Generally, the value of those deals is rising, and they spike during downturns in the economy:

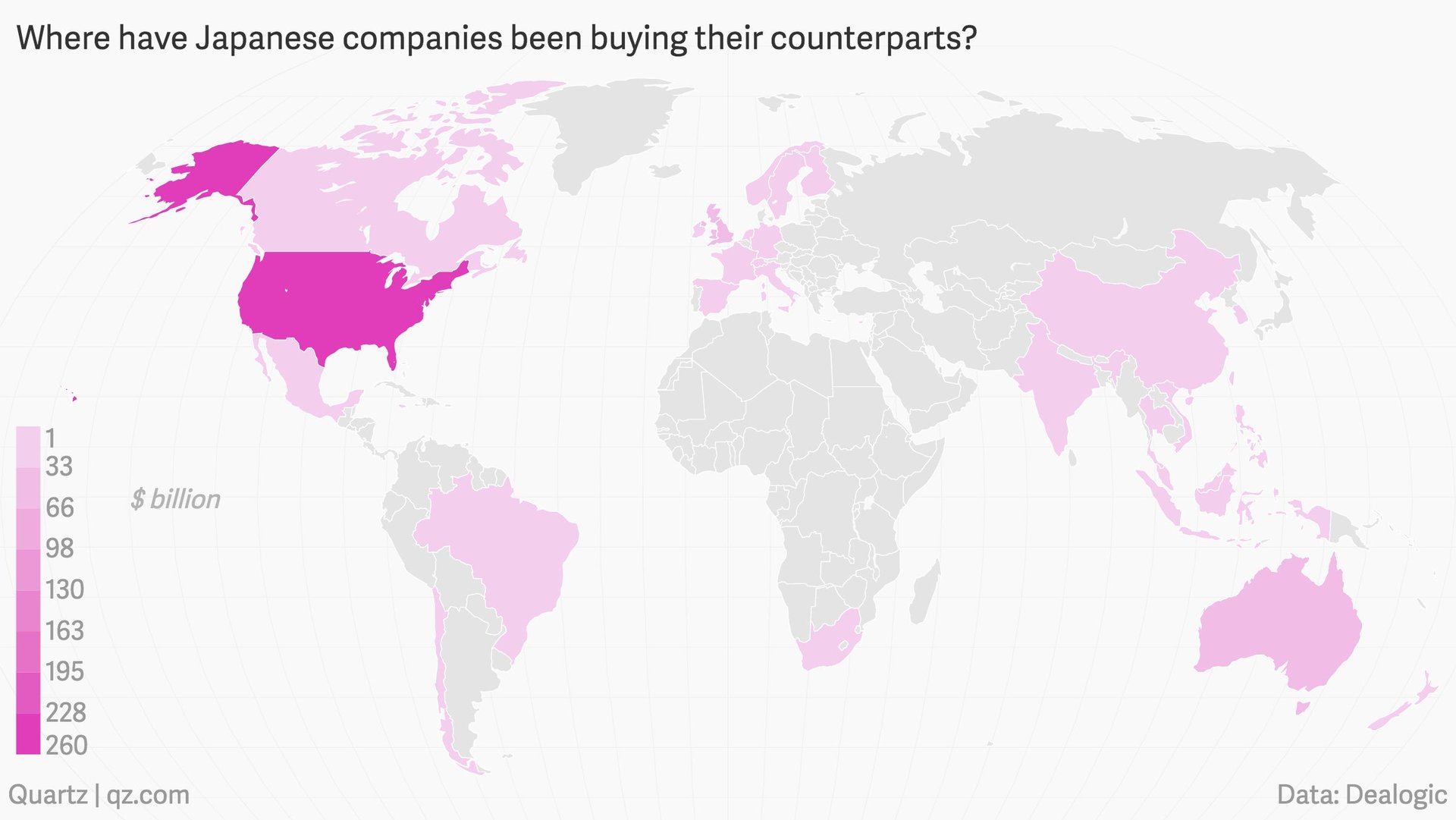

But among all the companies and markets to invest in, it is US-based companies that Japanese enterprises have their sights set on:

Japanese companies have been so eager to buy US companies, in fact, that in the past 10 years they have spent more money acquiring American targets than all of the rest of the companies in the next 19 biggest acquisition countries combined:

The trend doesn’t seem likely to change any time soon. Meanwhile, the Chinese are just getting started.