Teva’s deal with Allergan continues a massive year for pharma M&A

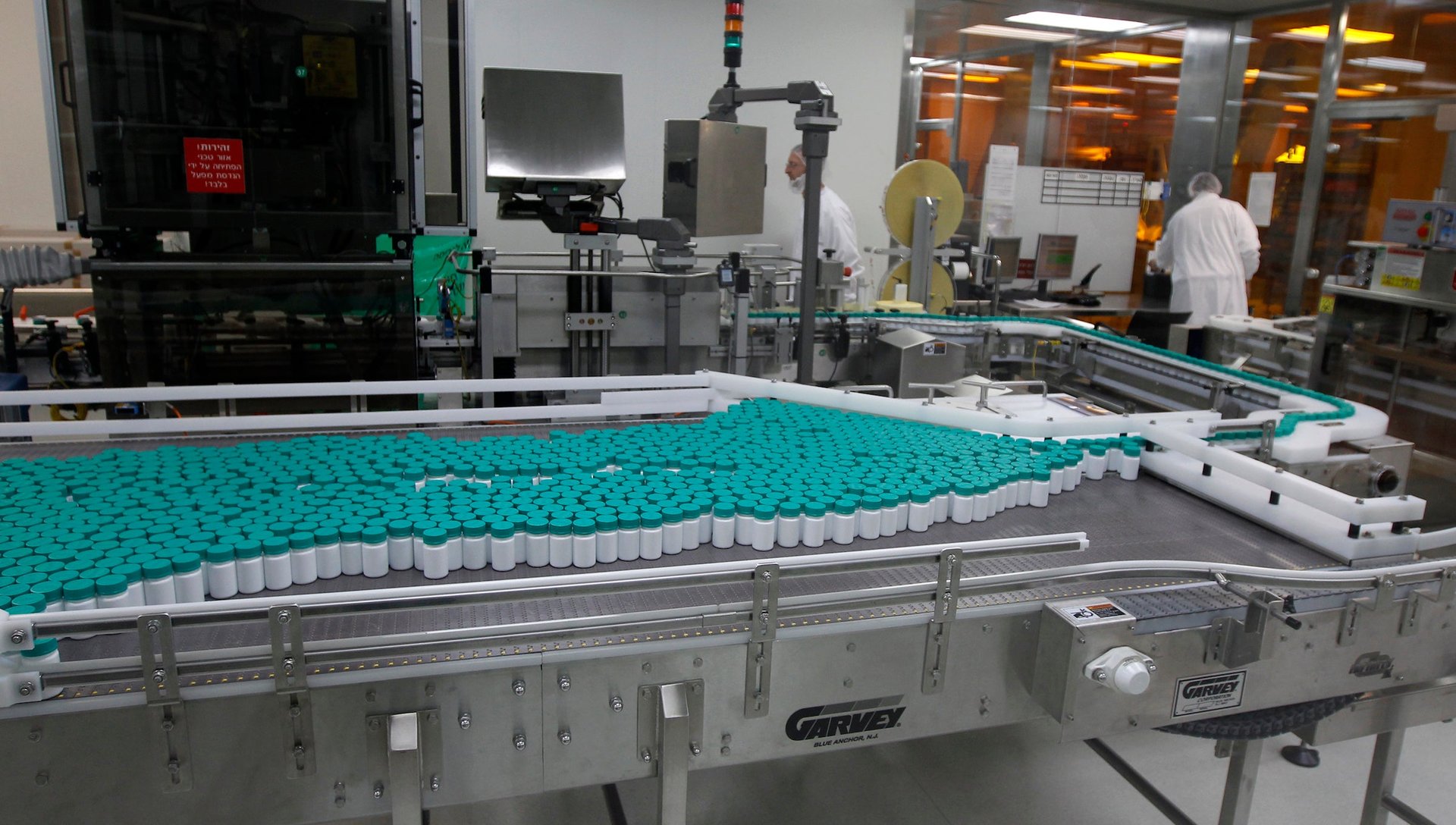

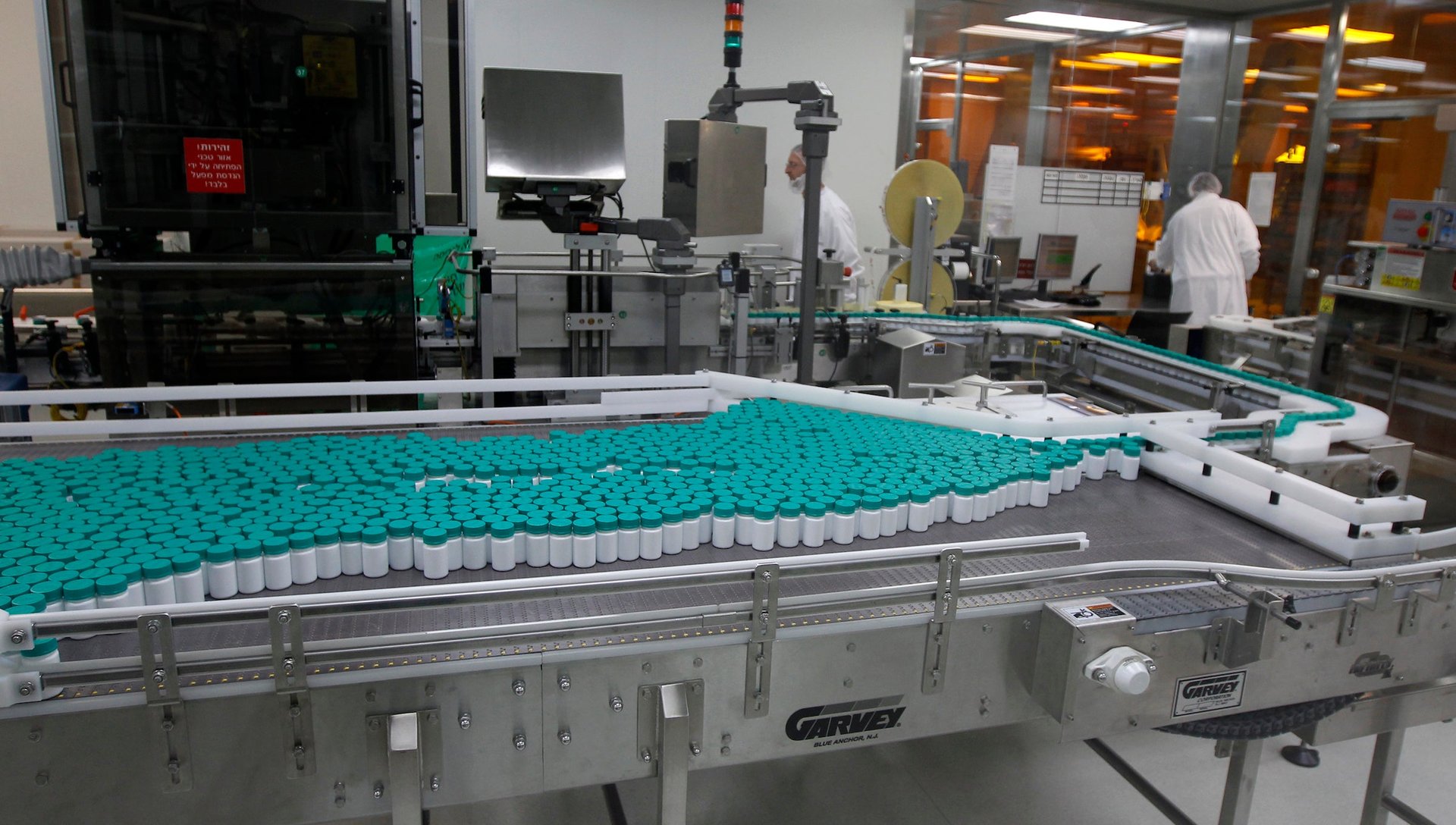

Allergan announced today that it would sell its generic drugs business to Israeli off-brand giant Teva in a $40.5 billion megadeal. It’s the 10th biggest pharmaceutical transaction on record, according to Dealogic, and already makes 2015 one of the biggest years ever for dealmaking in the industry.

Allergan announced today that it would sell its generic drugs business to Israeli off-brand giant Teva in a $40.5 billion megadeal. It’s the 10th biggest pharmaceutical transaction on record, according to Dealogic, and already makes 2015 one of the biggest years ever for dealmaking in the industry.

This deal has a bit of a backstory that underscores how manic the M&A scene is in pharma. Allergan used to be Actavis until a month ago, when the company assumed the name of its $70 billion acquisition. That buyout came at the tail end of a yearlong saga in which a Bill Ackman-backed Valeant failed to acquire Allergan.

Teva only moved on to this deal after its previous generic target, Mylan, resorted to scorched earth tactics to avoid being bought out(the most scathing corporate letter of recent memory, and a Dutch takeover defense trust called a stitching).

So far this year, more than $240 billion worth of transactions have been announced, more than any other year through July by a pretty wide margin, according to Dealogic:

Just seven months in, 2015 is already one of the biggest years on record when compared to full year totals. Catching last year will take some doing, but it’s worth noting that last year’s biggest deal, Actavis’s buyout of Allergan, didn’t happen until November:

This wave of consolidation has been brought on by a long term and worrying decline in research productivity by big pharma companies. Biotechs, flush with cash from a few blockbuster drugs, have also joined in as acquirers.

Firms that managed to switch to lower corporate tax areas before a federal crackdown on so-called tax inversions have been aggressive buyers. And yield-hungry investors have eagerly provided financing.

The overall health care field is seeing a merger boom. Driven by changes in large part stemming from the Affordable Care Act, four of America’s five largest health insurers have announced plans to merge (last week, Anthem said it was buying Cigna; earlier in the month, Aetna agreed to terms with Humana).

Next up may be hospital groups, which might band together to better negotiate with larger insurers.