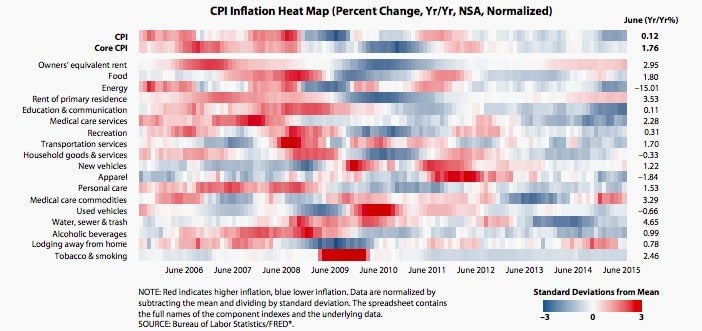

This heat map shows why the Fed’s vice chairman thinks it should chill on raising interest rates

Everyone’s getting ready for a highly-anticipated rise in US interest rates, which could come as soon as next month—the first change since 2008 and the first increase since 2006. Banks are throwing lots of money (paywall) at their rate traders to keep them from seeking greener pastures, and the pretty solid jobs report on Friday did little to dissuade that general consensus.

Everyone’s getting ready for a highly-anticipated rise in US interest rates, which could come as soon as next month—the first change since 2008 and the first increase since 2006. Banks are throwing lots of money (paywall) at their rate traders to keep them from seeking greener pastures, and the pretty solid jobs report on Friday did little to dissuade that general consensus.

But then Stanley Fischer, the Federal Reserve’s vice chairman, went on Bloomberg TV this morning (Aug. 10) to say that there would be no such rate hikes until inflation returned to “normal times.” That’s all good and fine, but personal-consumption expenditure—the Fed’s preferred gauge of inflation—has been running below the Fed’s 2% year-over-year target for more than three years and was at 0.3% in June. Consumer-price inflation (CPI), a more widely-cited measure, has breached that barrier only a couple times in that span and was at 0.2% in June.

Inflation is so low mostly because of cheap oil, but that’s far from the only reason. Last month, researchers at the St. Louis branch of the Fed put together a heat map (pdf) that tracks how far the underlying CPI components are straying from their long-run averages. It’s pretty clear that inflation is relatively low across the board.

A Bloomberg story accompanying the Fischer interview noted that the market thinks there’s about a 50/50 chance of a September rate hike. We’ll find out whether inflation is high enough for them to be right soon enough.