The most important economic chart nobody is talking about right now

Yeah, yeah. We know. China is a mess.

Yeah, yeah. We know. China is a mess.

But here’s something you might not know: Europe is officially less of a mess than it used to be.

Thanks to the belated efforts of the European Central Bank, which joined the global currency printing party only recently, key indicators of European economic growth are finally—FINALLY!—moving in the right direction.

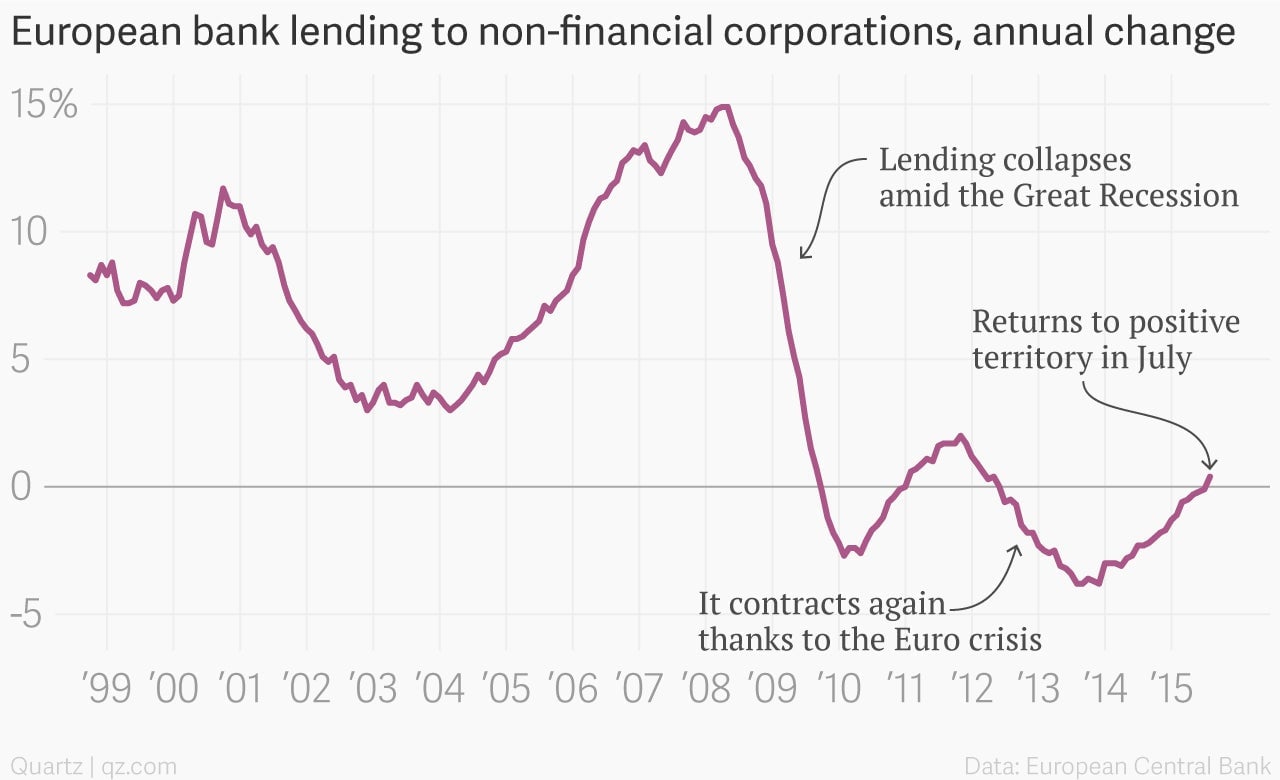

For my money—and Europe’s—this is one of the most important economic charts of the moment.

The chart shows lending by large European banks to non-financial businesses. Capitalism runs on debt. If corporate access to credit is choked off by a dysfunctional banking system—which Europe has had for the past few years—an economy simply will not grow. And bank lending is even more important in Europe than it is in the US, where companies have traditionally had more access to other ways of raising capital, such as selling debt in the bond markets.

So, to see annual bank lending to real European companies finally emerge from negative territory is a tremendously good sign that Europe is on the right track. Sure, Europe won’t deliver the kind of fast growth the global economy has come to count on from countries like China, where a slowdown is the source of global economic concern. But Europe is nothing to sneeze at either. In fact, the 28-nation European Union is the world’s largest economic entity and trading bloc.