Rich people increasingly prefer to get their financial advice from robots

More than 900,000 people became millionaires for the first time last year. Contrary to what some may believe, upon reaching this milestone, newly-minted millionaires rarely pile it high in a vault, don a swimming cap, and practice their backstroke among the bills. They, and nearly 15 million others lucky enough to have amassed seven-figure sums (at minimum), usually turn to professional wealth managers for advice on how to grow even bigger piles via shrewd investments.

More than 900,000 people became millionaires for the first time last year. Contrary to what some may believe, upon reaching this milestone, newly-minted millionaires rarely pile it high in a vault, don a swimming cap, and practice their backstroke among the bills. They, and nearly 15 million others lucky enough to have amassed seven-figure sums (at minimum), usually turn to professional wealth managers for advice on how to grow even bigger piles via shrewd investments.

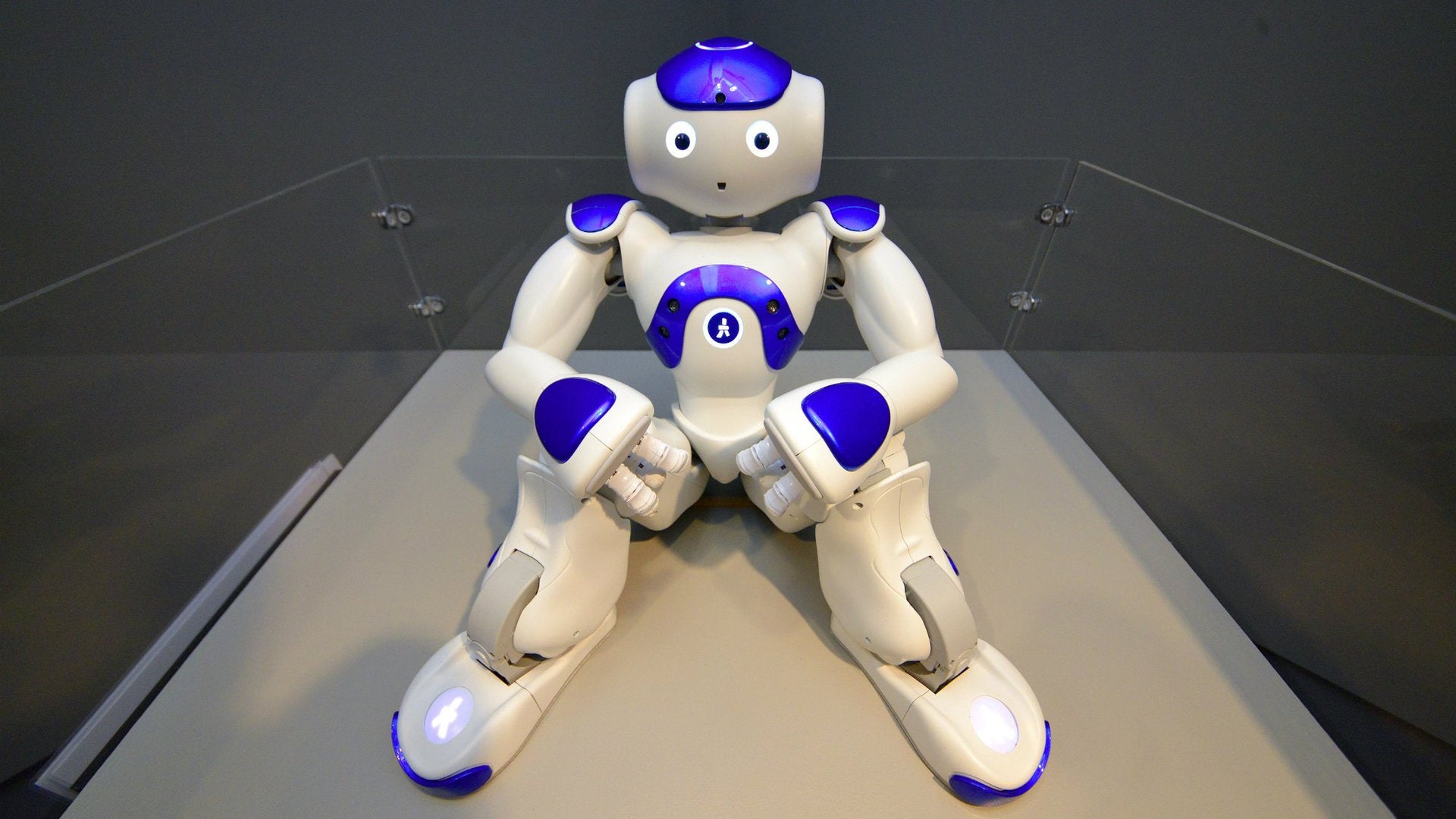

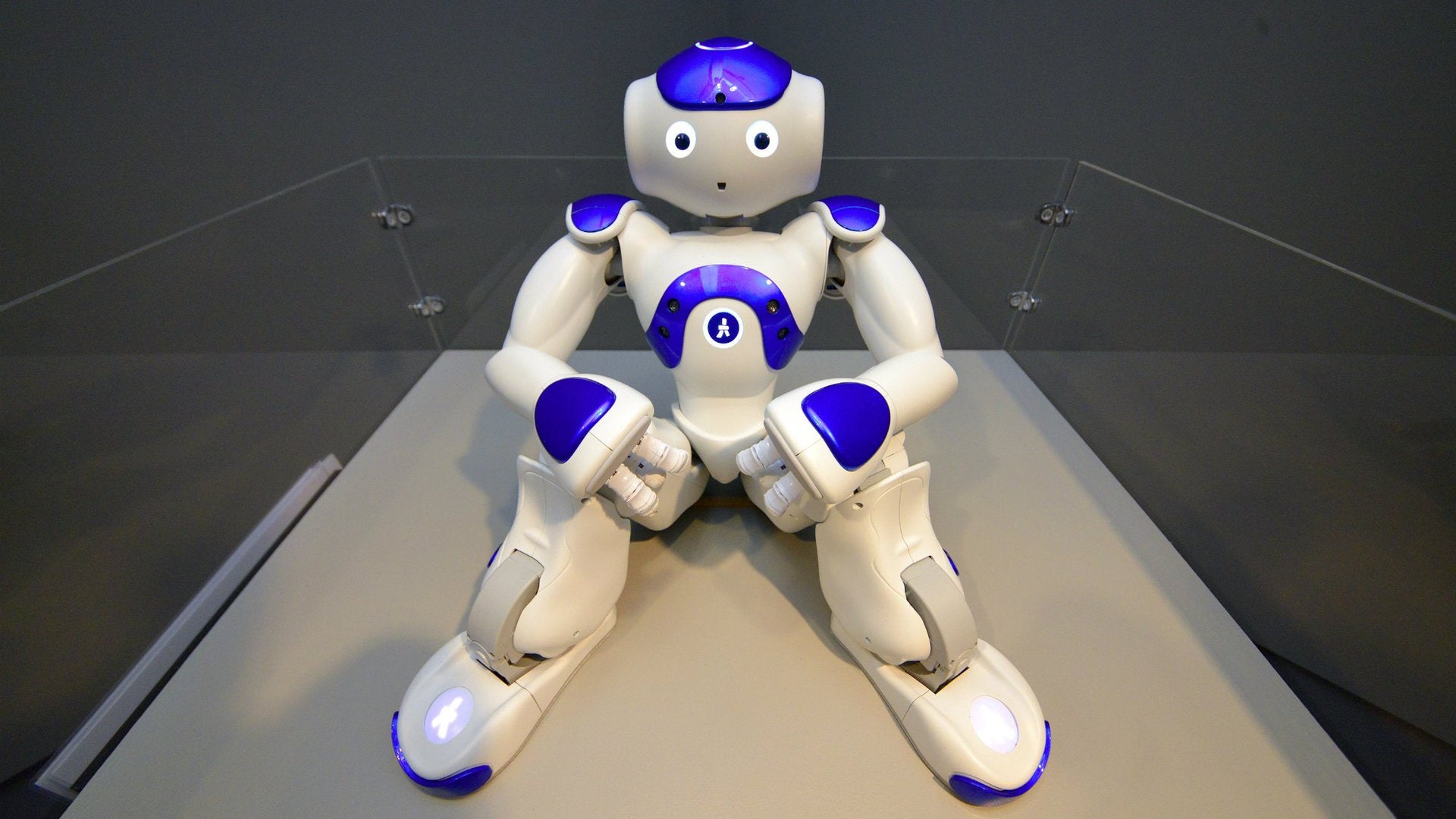

Increasingly, the uber-rich are also turning to so-called “robo-advisors” for money advice, engaging an algorithm to run their portfolio instead of a person. These automated online services often suggest low-cost funds and other inexpensive alternatives to the bespoke investment products offered by traditional private banks.

In a new report about the world of high-net-worth individuals, Capgemini and RBC asked millionaires (and billionaires) about whether they would consider using an automated advisory service. They also polled wealth managers on whether they thought their clients were interested in such services. The differences were stark:

Notably, the region where the ranks of the uber-rich are growing the fastest—Asia—is also where investors are the most open to robo-advisors. What’s more, two-thirds of high-net-worth individuals under the age of 45 are inclined to use automated advice, versus just over a third of older wealthy people.

For the traditional wealth-management firms that think robo-advisors aren’t of interest to the ultra-rich, this might make uncomfortable reading. And for those that took the “if you can’t beat them, buy them” approach, this will make them feel better about disrupting themselves. As an American wealth manager said in the survey, “In the future, every firm will need a robo-advisor.”