It’s no secret that mobile money is the primary banking tool of choice for many Africans. This year alone, $33 billion is expected to change hands via mobile services on the continent. That’s almost much as the GDP of Ghana.

A recent survey done by SOKO Insight, a research firm, looked at mobile-money usage in Ghana and Kenya, where almost two-thirds of mobile owners now have mobile-money accounts.

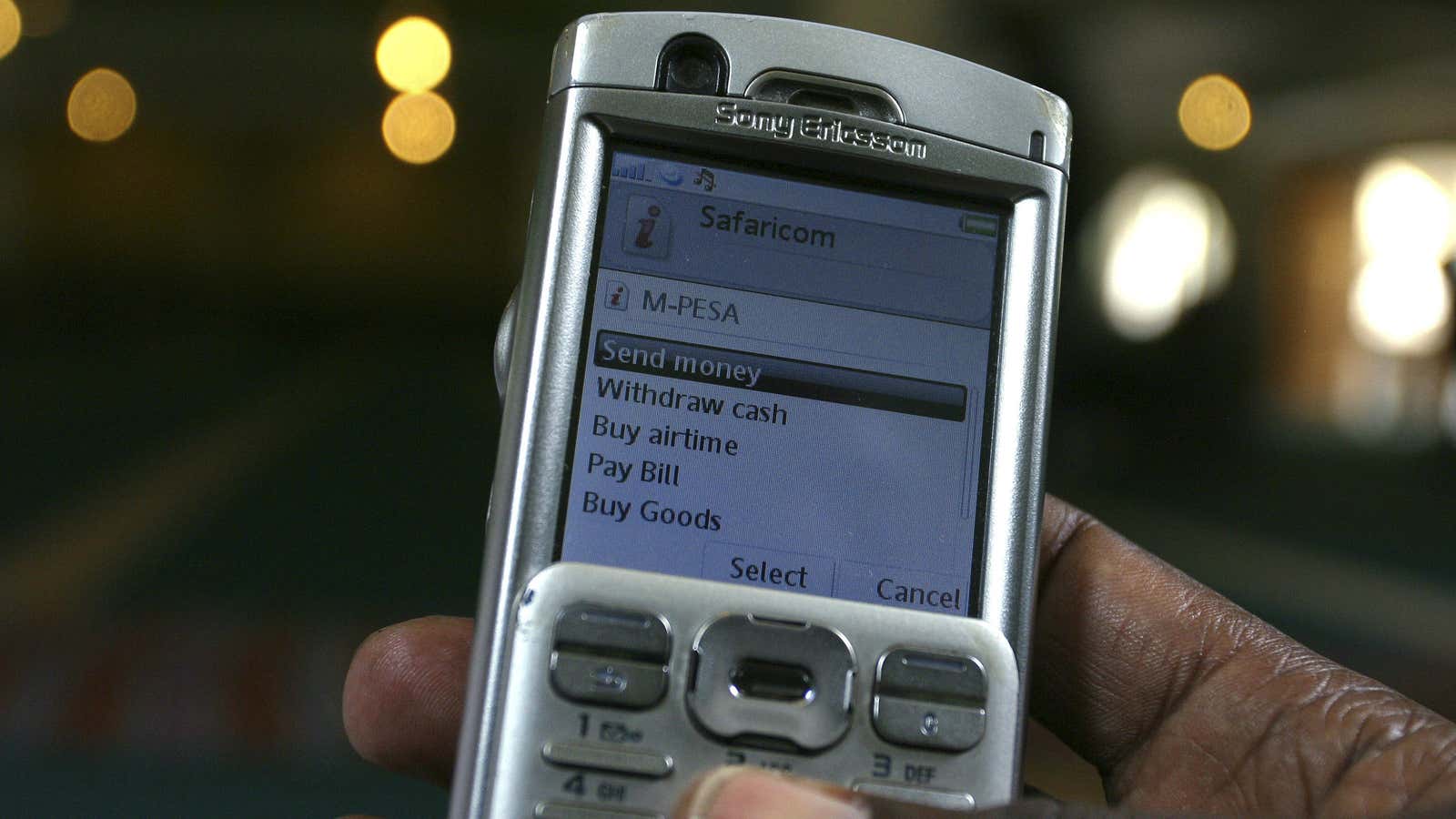

And where it was once mainly a tool to send and receive cash, mobile money has also become an increasingly common way for people to pay their bills, receive their wages, and even get loans:

The rise of mobile money in Africa has put traditional banks on the defensive, with mobile-phone companies doing double-duty as financial institutions. Still, banks remain the provider of choice for financial products, according to SOKO Insight’s survey:

But for how much longer? Users say mobile money is almost as easy to use as traditional financial services, and more affordable:

Banks have responded to the competition by coming up with their own mobile-money platforms, in some cases partnering with mobile carriers to do so (the classic “if you can’t beat ’em, join ’em” strategy). Kenya’s second-largest bank, Equity Bank, launched Equitel earlier this year in collaboration with Airtel. It gives a whole new meaning to the concept of a ”phone bank.”