The best part of the RBS Libor scandal: The emoticons

Sprinkled throughout the US Commodity Futures Trading Commission’s settlement notice against RBS(PDF) for rigging the London Interbank Offered Rate (Libor) are the instant message conversations between bank employees showing the impropriety. These chats show the informality typical of the medium, rife with spelling mistakes and, at times, interspersed with emoticons.

Sprinkled throughout the US Commodity Futures Trading Commission’s settlement notice against RBS(PDF) for rigging the London Interbank Offered Rate (Libor) are the instant message conversations between bank employees showing the impropriety. These chats show the informality typical of the medium, rife with spelling mistakes and, at times, interspersed with emoticons.

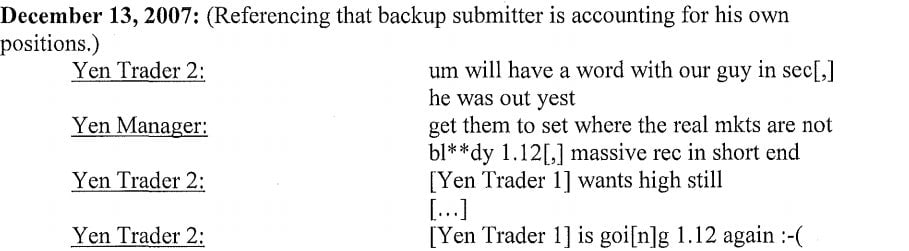

For instance, when one Yen trader–known in the document as “Yen Trader 2″– was trying to explain to an unhappy Manager about where the bank was going to submit their rate Yen Trader 2 expressed his displeasure with an emoticon:

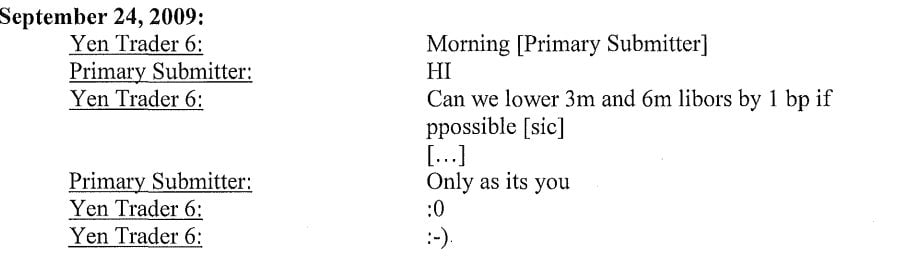

When “Yen Trader 6” wanted to thank the Libor submitter for their acquiescence to the scheme, he made sure it was with something good: two emoticons.

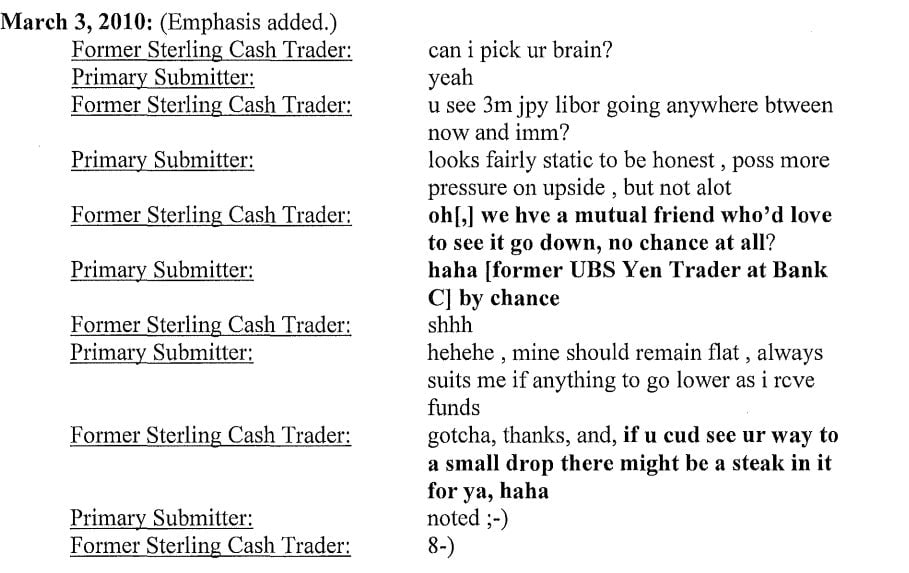

A former RBS employee didn’t think emoticons were enough to manipulate the markets, so he paired it with the prospect of a steak dinner. The winkey face helps lighten the gravitas of accepting a quid pro quo. The former employee responds in form.

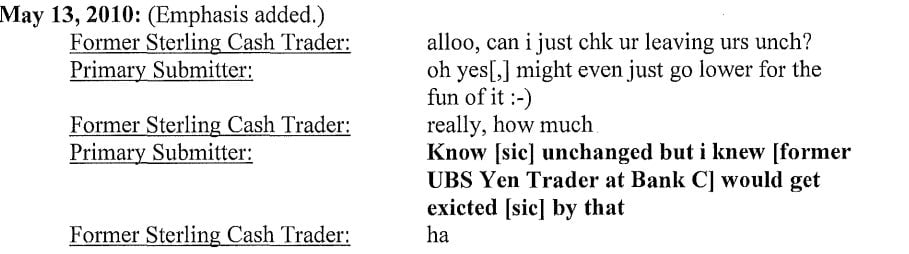

Later that year the primary submitter had this to say about the rate he was submitting:

RBS has agreed to pay a fine of $325 million to the CFTC for these and other infractions, $1 million for each occurrence of fixing–$54 million for each emoticon.