To stop gold imports crippling its economy, India needs to greatly increase access to banking

India’s central bank is desperate to wean people off of gold. As we recently discussed, India’s gold imports are so high they have ballooned the nation’s current account deficit. The nation cannot produce enough goods to export to balance out its gold-mania.

India’s central bank is desperate to wean people off of gold. As we recently discussed, India’s gold imports are so high they have ballooned the nation’s current account deficit. The nation cannot produce enough goods to export to balance out its gold-mania.

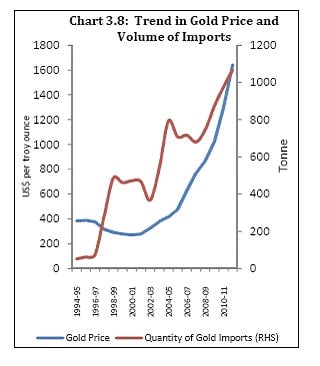

The challenge the central bank faces is a big one. India’s gold imports have soared as the economy has expanded, with demand constant whatever is happening to the gold price.

The Reserve Bank of India is now trying desperately to think of solutions. It recently suggested mopping up gold demand with alternative, gold-linked products to be sold though financial institutions.

But the central bank is ignoring the main reason Indians hoard gold in the first place: not enough Indians have bank accounts. It is well known that the yellow metal is a traditional wedding dowry, and the country’s wealthiest love it enough to order $250,000 gold shirts. What really drives gold imports, though, is that banking coverage across the country is scant. It is estimated that only 35% of Indians have formal bank accounts, and access to banking is a major problem outside big cities. So for many rural Indians, gold is the only savings vehicle they can get their hands on.

The shambling state of rural banking is why the RBI’s plans to quash gold imports will probably not work. Most of its recommended schemes require access to a bank account and, in some cases, an understanding of fairly sophisticated products like annuities and derivatives.

An RBI working paper (pdf, paragraph 13.1) sketches out some of these quick fixes. The “gold accumulation plan,” for instance, would involve convincing people to put cash into a bank savings account for a fixed term. They could cash in their savings in the form of physical gold at the end of the term. But as Nick Trevethan, ANZ senior commodities strategist, points out, such accounts do not solve the problem of high gold imports. “A savings plan where gold delivery is deferred just stores imports up for the future,” he tells Quartz.

The RBI also likes the idea of what its calls “gold-linked accounts.” These would be offshore savings accounts that do not give depositors ownership of physical gold, but instead work like an exchange traded fund (derivatives based on the performance of the gold price). This would not involve any gold being imported into India. But it would also not offer the physical security of owning gold. And it may take a while to educate unbanked Indians who have never balanced a chequebook about derivatives.

Then there’s the RBI’s plan to persuade Indians to take their gold out of their homes and put it in the bank. Financial institutions could trade the gold customers have placed with them in the domestic market. So Indians buying new gold could buy it from local banks rather than importing it. That is a good idea, which falls flat because it requires easy access to a bank account in the first place.

The central bank’s paper also canvasses the idea of a “gold pension product”. This would see Indians surrendering their gold to a fund manager in return for a regular annuity during retirement. “This also has potential to bring gold back into the system,” says ANZ’s Trevethan. The pension manager could sell gold it receives from customers into the domestic market, which would dampen the need for imports.

But this idea may not fly, Trevethan cautions, as “many people have a close personal attachment to their gold” and surrendering gold bars to an outside fund manager “creates counterparty risk.” In other words, some unlucky Indians could find themselves giving their precious metal to a pension manager that sells it, and then later goes bust.