Is there a Great Rotation? It all depends on whether you want there to be one

There’s been plenty of chatter recently about indications that “the Great Rotation” is upon us.

There’s been plenty of chatter recently about indications that “the Great Rotation” is upon us.

While it may sound like one, this is not a doomsday-prepper type scenario; it’s actually the long-awaited return of retail investors to stocks, from the bond market where they’ve been pouring their cash since the financial crisis hit.

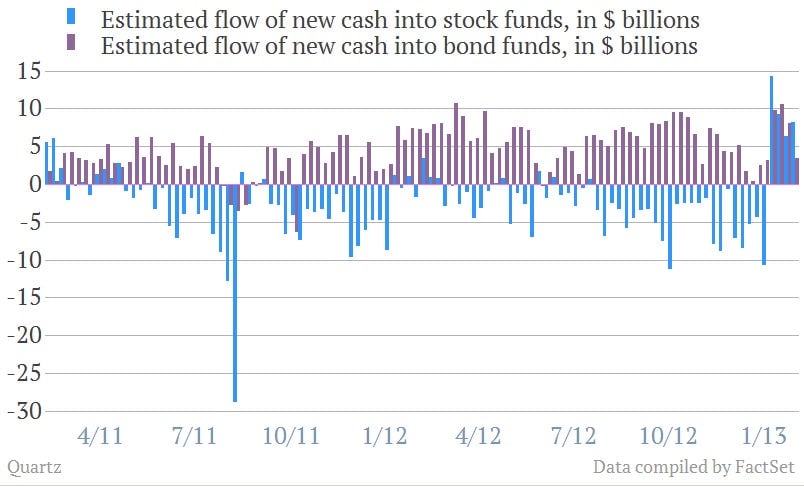

And there are signs that something is afoot. For one thing, data on mutual fund flows do indeed show retail investors returning to stocks in early 2013, although inflows into bond funds have stayed steady too.

The evidence is at the right-hand end of the chart below, with data from the Investment Company Institute, a US mutual fund trade group. Each bar represents a week. The blue bars showed steady outflows of stocks since the financial crisis hit. (That big drop in the summer of 2011 was the debt ceiling crisis.) But early in 2013, the blue has swung into positive territory. But you’ll notice from this chart that money is still going into bonds too. Why?

Well, first, it’s worth noting that money has been shifting from supersafe government bond funds, to riskier stuff like emerging-market and junk—oh, excuse me, high yield—funds. So the “great rotation” is a bit of a misnomer so far: it’s more of a great tide, with money washing into both stock and bond markets.

And some argue that this can go on for quite a while. After all, that tide is being generated by the world’s central banks, which are creating oceans of liquidity through their various versions of money-printing and bond-buying. (That’s “quantitative easing,” in polite circles.)

But could the recent dynamic turn into a genuine rotation, with investors definitively choosing stocks over bonds?

Perhaps unsurprisingly, there’s a plethora of opinions on Wall Street. But succinctly summed up, if analysts focus on the bond market they tend to pooh-pooh the prospects for a big selloff in bonds:

Morgan Stanley government bond analysts:

One risk to the Treasury market that does not concern us is what pundits refer to as the “Great Rotation.” The idea is that money will flow out of bond funds and into equity funds. The premise of the argument is that either (1) money flowed out of equities as the “risk off” environment festered, and now will flow back into equities – and out of bonds – as “risk on” regains traction, (2) money that would otherwise have been invested in equities sought safe-harbor in bonds temporarily, but now has become risk-seeking, or (3) a combination of the two. In our view, these premises are false.

We think such concerns are overdone. For one, many of these same investors will have also been burned by equities over the past decade, and may not be so quick to abandon fixed income for equities. Second, even if this ‘great rotation’ does materialize, we think credit should suffer less than pure rates exposure or, for that matter, money market funds and bank deposits. Third, we think institutional investors would welcome such an exit and exploit the opportunity to add risk at better levels.

Analysts who write notes aimed at selling stocks, on the other hand, tend to like the “great rotation” story very much:

Deutsche Bank stock market analysts, in a note entitled “Stop Waiting for the Great Rotation”:

Waiting for higher interest rates has caused many investors to miss a huge rally … In the last 18 months the S&P 500 has delivered a total return of about 35%, yet many individual investors sat this rally out. Why? They were probably waiting for a sustained upturn in treasury yields or a clear sign in flows of a rotation from bonds to stocks. We think it’s time that the investment community retires the advice to wait for the signal of higher treasury bond yields.

And someone who has no skin in either game is suitably clear-eyed about the whole thing:

Mohamed El-Erian, co-CEO of giant bond fund shop Pimco:

We’re not seeing it. What I think we are all seeing the equity funds, the fixed income funds, the commodity funds is a rotation out of money market funds and out of bank accounts that no longer have complete FDIC insurance. So what we are seeing is cash is being pushed into both the equity and the fixed income markets. And we’re not as yet seeing any “great rotation.”