Turns out low-fee funds from the biggest fund shops tend to beat the market

U.S. large-cap stocks sit at the core of many investors’ portfolios, thanks to a history of positive long-term performance. But if you look at the mutual fund industry as a whole, you might think that finding funds that match or beat the performance of the broad market has been a challenge, particularly in the parts of the market that are regarded as the most efficient, including U.S. large-cap stock funds. However, new Fidelity research suggests that doing better than average may not be as hard as some believe.

U.S. large-cap stocks sit at the core of many investors’ portfolios, thanks to a history of positive long-term performance. But if you look at the mutual fund industry as a whole, you might think that finding funds that match or beat the performance of the broad market has been a challenge, particularly in the parts of the market that are regarded as the most efficient, including U.S. large-cap stock funds. However, new Fidelity research suggests that doing better than average may not be as hard as some believe.

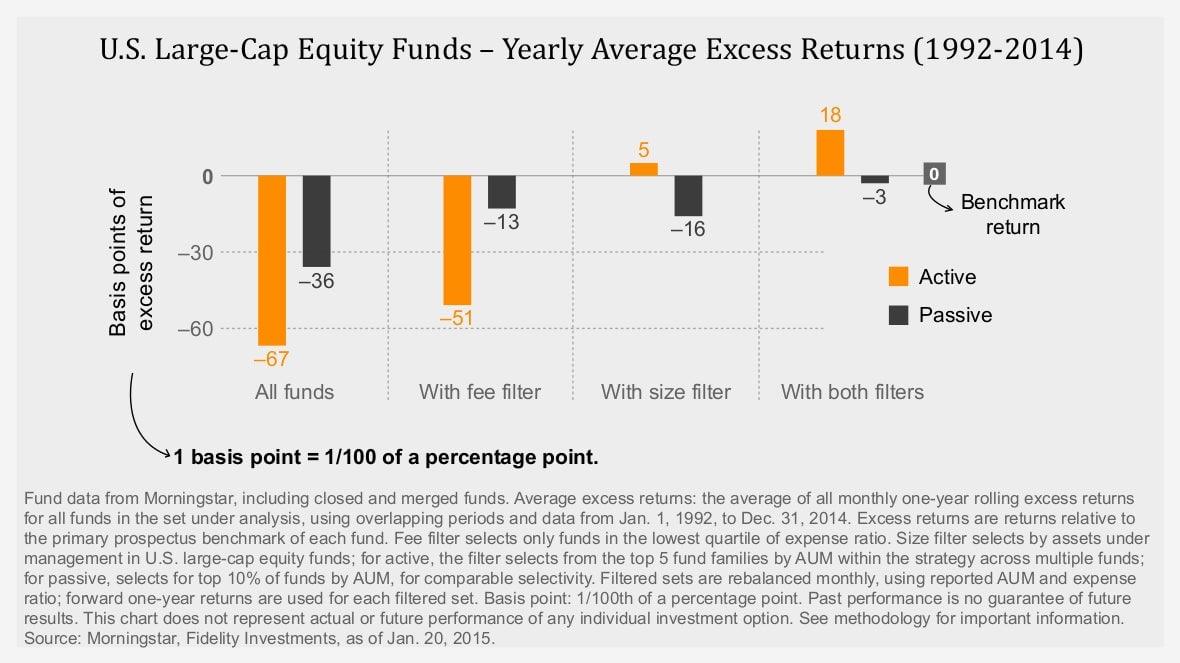

Fidelity’s research shows that “filtering” for funds with lower fees that are also run by the largest fund companies produced a subset of funds with better-than-average performance, for both active and passive funds. In fact, actively managed funds beat both passive funds and the market index on average, even after fees, according to the analysis, which focused on large-cap U.S. funds from 1992 to 2014. In a recent paper, Fidelity’s Timothy Cohen, chief investment officer, equities, Darby Nielson, managing director of quantitative research, and their team describe the results they saw. Below are some highlights of that research.

Behind the screens

The researchers chose the fee and size filters because they believe these filters are intuitive and straightforward. Had other filters been used, results may have been different. Why do these filters work? Like shopping for anything else, looking at mutual funds may include thinking about price, but may also involve considering what you get for your money.

High fees can eat into returns, making it more difficult for a fund to match or beat the performance of a benchmark. So the research team began by screening for funds in the lowest 25% of reported expense ratios for their fund type (active or passive). They selected this subset of funds each month over more than 20 years and then averaged the one-year returns.

Next, the researchers filtered for size. For active funds, they looked for the mutual fund companies with the most assets. In the fund industry, differences in size can be quite large. As of the end of 2014, the median amount of assets for all fund families was less than $300 million, while the median for the top five fund families was more than $184 billion—more than 600 times bigger.

The assumption was that larger fund companies could use size to their advantage, by committing more resources to research and trading, and the benefits of those resources would be shared across all the companies’ different funds.

As shown in the chart above, the filters worked. Simply filtering for lower expense ratios improved the average performance of the funds selected, but both sets of funds still underperformed the market. Selecting funds from the group of the largest fund families improved the average performance as well, and, here, the actively managed funds outperformed the market, while the passive index funds still lagged.

When both filters were combined, the average performance of the selected actively managed funds outperformed the market by 0.18 percentage points (18 basis points). The average performance of the passive index funds also improved, though it still lagged the market slightly (as one would expect from passive funds). It may not be possible to invest in the portfolio of better-performing funds, but the impact of these simple filters may surprise investors who believe that finding active funds that can outperform their benchmarks is too difficult.

Implications for investors

The next time you are looking for a fund, you may want to consider expenses and resources. But remember, these filters are only a starting point, and some outperforming funds might not fit the pattern. Be sure to consider any investment within an asset mix that makes sense for your situation, and then consider the funds’ objectives, risks, and expenses, and other details.

What’s more, average results never tell the whole story. Not all funds with lower expenses or those that are from the biggest shops will outperform, and some higher-cost or lower-resource funds may, particularly over short time horizons. But the results of our filters suggest that some informed research may be able to identify above-average funds for your portfolio, whether you prefer the index-tracking approach of passive funds or the potential outperformance offered by active management.

This article was written by Fidelity and not by the Quartz editorial staff.