Larry Summers: Don’t expect sequester to generate a Clinton-style surplus

It now looks likely that the sequester—the package of deep, automatic spending cuts worth about $85 billion this year and then $1.2 trillion over the next decade—will hit the US economy. But ex-Treasury Secretary Larry Summers tells readers of the FT not to expect a Clintonesque budget surplus anytime soon:

It now looks likely that the sequester—the package of deep, automatic spending cuts worth about $85 billion this year and then $1.2 trillion over the next decade—will hit the US economy. But ex-Treasury Secretary Larry Summers tells readers of the FT not to expect a Clintonesque budget surplus anytime soon:

Yes, medium-term fiscal restraint is necessary to contain financial risks. But it is not sufficient. Unlike the 1990s, when reduced deficits stimulated investment by bringing down capital costs, fiscal restraint cannot be relied on to provide stimulus now when long-term US Treasuries yield below 2 per cent.

So what does that mean? Basically, Summers is arguing that by cutting the budget in the 1990s the US was also able to cut the borrowing needed to finance the budget, so it reduced the supply of Treasury bonds available for investors to buy. Smaller demand + stable supply = higher prices. And in the world of bonds—where yields and prices always move in opposite direction—higher prices equal lower yields on US government debt. Yields on US government debt are essentially the foundation for all other interest rates, so this lowered US borrowing costs for consumers and corporations.

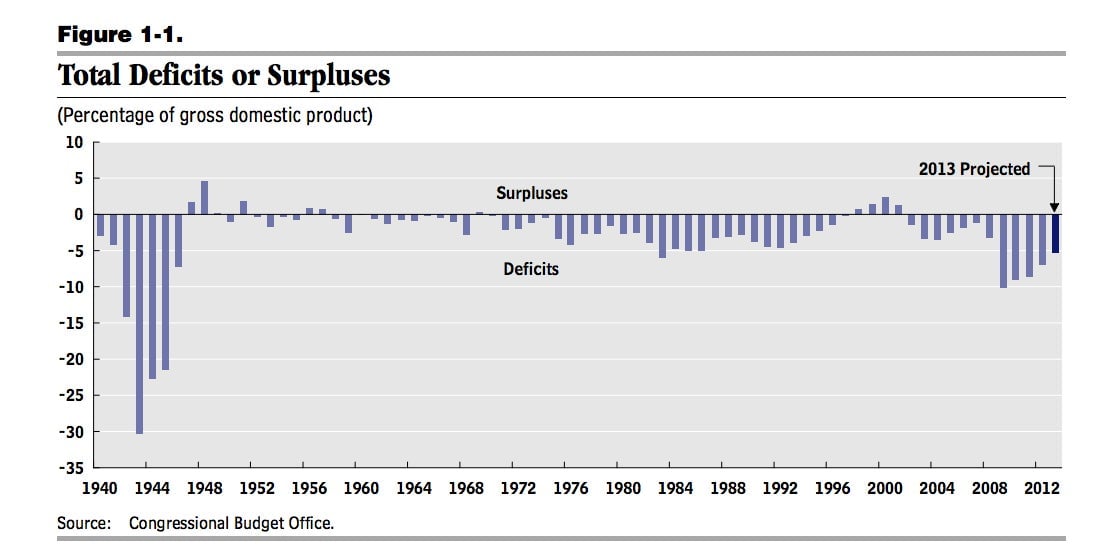

Implicitly, Summers is arguing that those low interest rates helped generate at least part of the economic boom of the 1990s in the US. And that surge in economic activity juiced tax revenues that helped pull the US budget into surplus for a brief moment in the late 1990s.

But right now, interest rates are already at rock bottom thanks to the premium global investors are putting on safety, as well as the heroic bond-buying of the Federal Reserve. As a result, Summers is saying, don’t expect budget cutting to do anything good for growth anytime soon. Basically, Summers’ remarks fit snugly into the recent debate on something called “fiscal multipliers,” a bit of jargon that describes how much or little government efforts to cut or raise taxes and spending effects the economy. Check out this Econbrowser post for a nice round of recent thinking on the subject.