The latest adventures of Super Mario and the upside-down European bond market

One man is dominating the discussion among traders today: Mario Draghi. The president of the European Central Bank lit a rocket under stocks and bonds yesterday by hinting that the ECB is open to boosting its regular bond purchases—currently worth €60 billion ($66.7 billion) per month—and cutting one of its key interest rates even further below zero. The euro sank to the sounds of “Super Mario” revving up the printing presses.

One man is dominating the discussion among traders today: Mario Draghi. The president of the European Central Bank lit a rocket under stocks and bonds yesterday by hinting that the ECB is open to boosting its regular bond purchases—currently worth €60 billion ($66.7 billion) per month—and cutting one of its key interest rates even further below zero. The euro sank to the sounds of “Super Mario” revving up the printing presses.

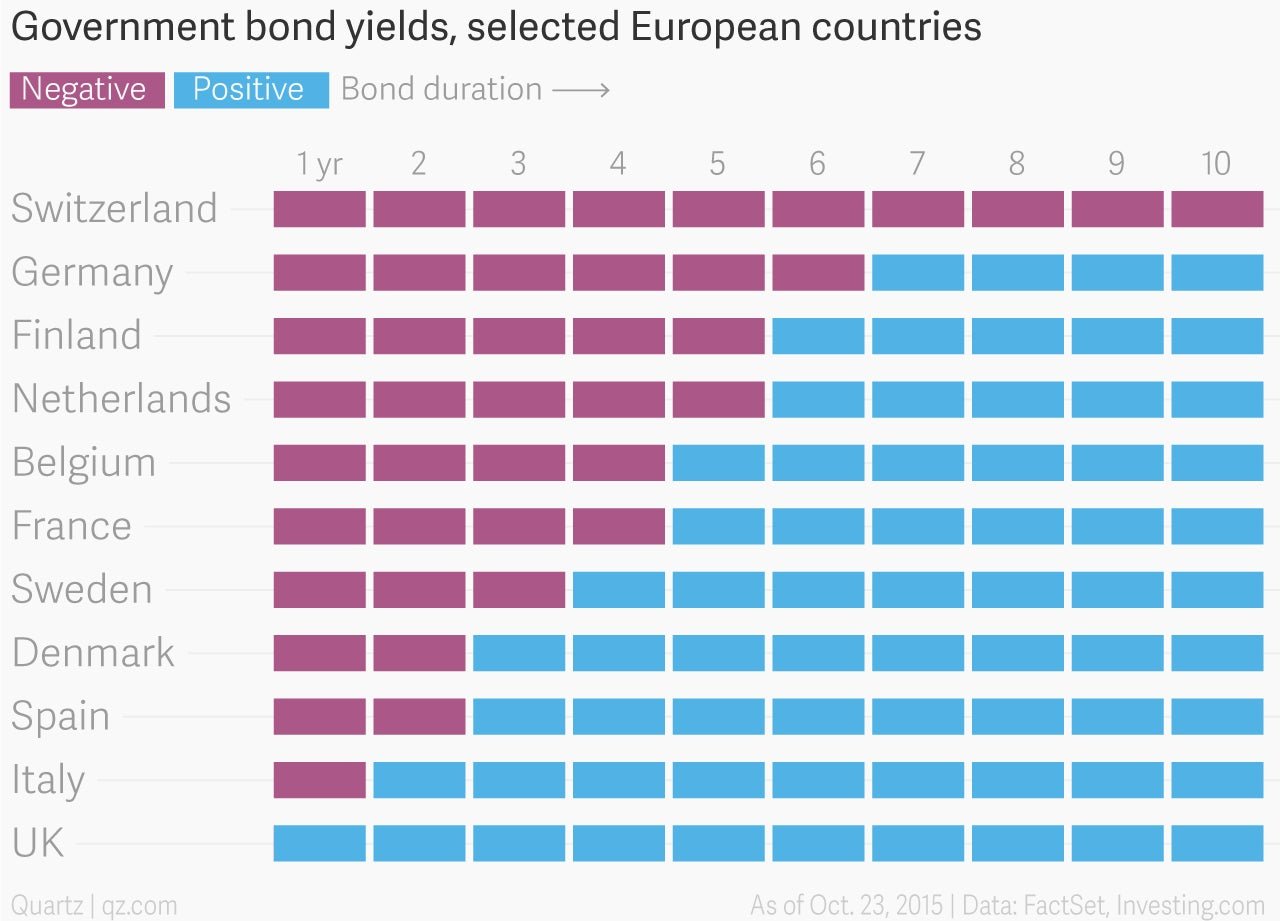

As a result, Europe’s upside-down bond markets remain as warped as ever, with a wide range of government debt trading at negative yields. That is, buyers are paying for the privilege to lend money to states.

Remember that bond yields move inversely to prices—the ECB’s massive, regular bond purchases are underpinning demand for debt issued by euro-zone governments. And with deflation still stalking several countries in Europe, even bonds with negative yields can give buyers positive inflation-adjusted returns.

Non-euro members such as Denmark, Sweden, and Switzerland that are major trading partners with the euro zone have slashed their own benchmarks rates below zero to keep pace with ECB and prevent their currencies from appreciating too much against the euro, dragging down yields for their government bonds in the process. Swiss government debt is trading at negative yields all the way out to 10 years.

More remarkable, perhaps, is what Draghi has done for “peripheral” euro-zone yields. Even some bonds issued by Italy and Spain, two of the weaker links in the euro zone, are now trading at negative rates.