When Mario Draghi speaks, investors listen. And while you could say the same for most central bank chiefs, few central bankers move markets with words alone the way the president of the European Central Bank can.

He was at it again this week. As with many monetary-policy meetings before it, the ECB left interest rates unchanged after its latest gathering. But the combination of persistently weak economic growth, low inflation, and turmoil in emerging markets is clearly spooking Draghi and his ECB colleagues.

To this end, the president dropped several hints that at the central bank’s next scheduled meeting, it might expand its program of bond purchases—currently running at €60 billion ($67 billion) per month—or even cut rates further into negative territory. (The overnight deposit rate now stands at -0.2%.)

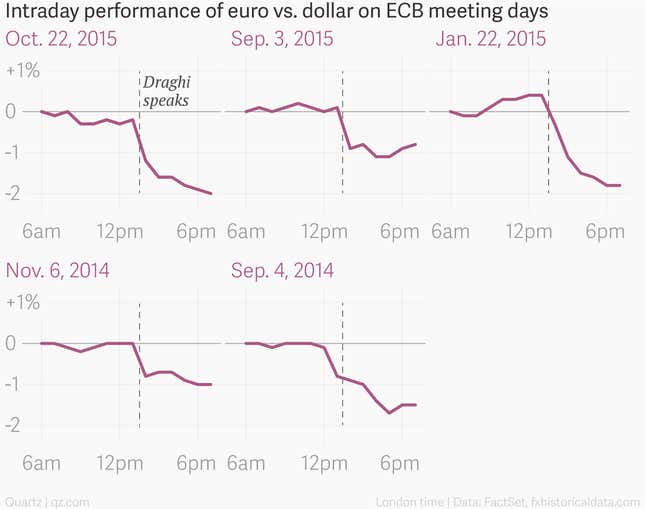

More stimulus would push down the value of the euro, helping to boost inflation and making things easier on exporters based in the euro zone. Draghi’s pledge yesterday (Oct. 22) to remain “vigilant” in avoiding a renewed recession had the intended effect—the euro plunged against the dollar almost as soon as he opened his mouth during his press conference.

It’s no wonder that traders hang on Draghi’s his every word, given how little help the ECB is getting from the austerity-minded governments that hold sway over euro-zone economic policy. Given his own difficulty trying to get the euro’s 19 member states to agree on anything ambitious, Draghi’s most powerful monetary-policy tool indeed is his language. Remember that he kept the euro zone from imploding in 2012 simply by promising to do “whatever it takes” to save it.

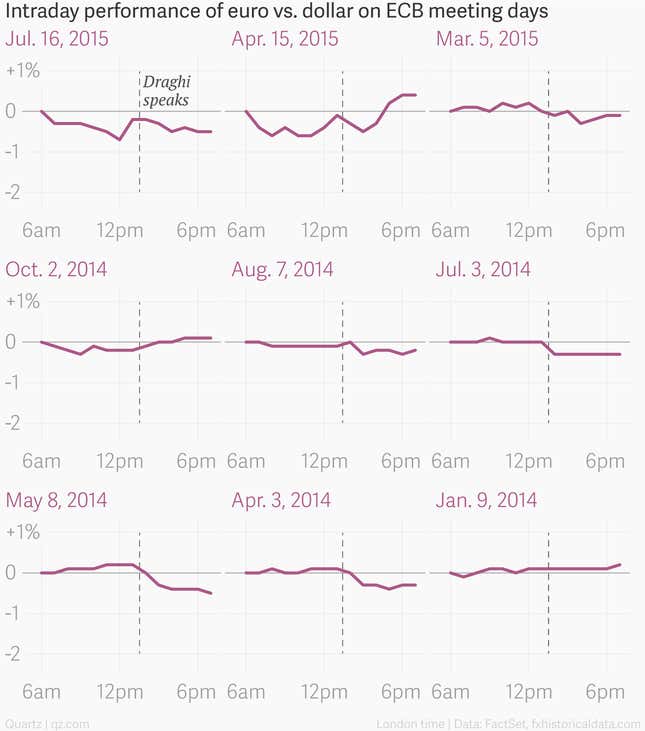

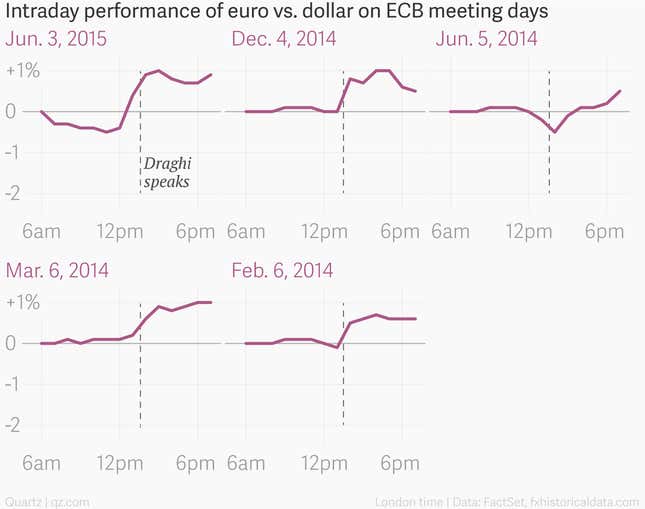

On the days the ECB’s rate-setting committee meets, the euro often swings violently up or down depending on the vibe Draghi gives off at the accompanying press conference, which always starts at 1:30pm London time. The latest moves prompted Quartz to examine the euro’s intraday performance on ECB meeting days for the past two years. Behold the mighty power of “Super Mario”…

Sell!

Buy!

Meh.