The very simple reason the Fed feels more comfortable about raising interest rates

Next meeting! It could happen at the next meeting!

Next meeting! It could happen at the next meeting!

That was the message from the Federal Reserve in yesterday’s monetary policy statement.

Does that mean the Fed will raise rates in December? No. It doesn’t. If the jobs or inflation data come in hugely disappointing over the next few weeks, the US central bank could still delay, in what I’ve characterized as the greatest monetary policy experiment of all time.

So why does the Fed seem to feel so confident about the outlook? After all China remains soft, with all the related problems that’s causing in emerging markets. The dollar remains strong hampering US exports. What’s changed for the better?

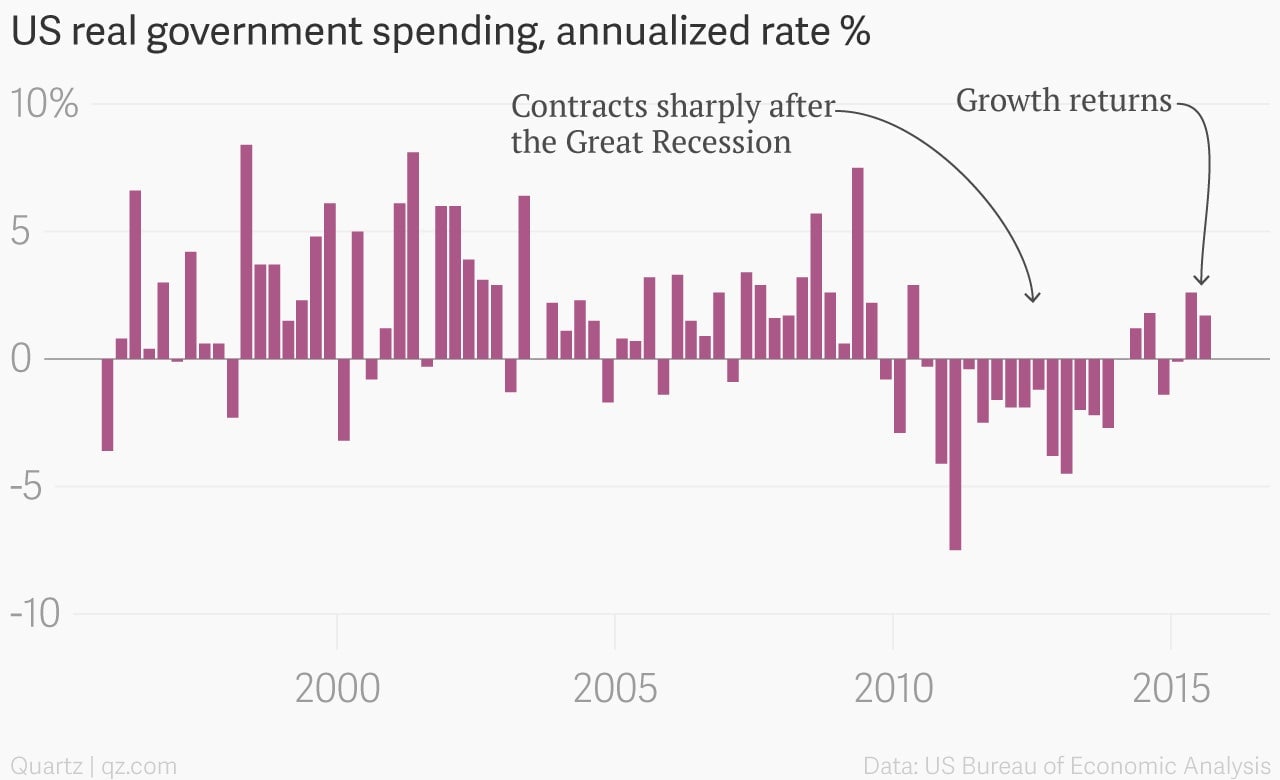

Well, after a long period of contraction in the aftermath of the Great Recession, spending by federal, state, and local governments in the US is once again rising, really. The first look at third-quarter US GDP growth, which was released this morning, shows government spending rising at a 1.7% annual pace in the third quarter, the second consecutive quarter of growth.

While government spending is often vilified by the political right, the simple fact is that government activity is a large, important part of the US economy, and in fact, of all large advanced economies. (Total government spending was about 32% of GDP in the US in 2014.)

If that large a chunk of your economy is shrinking, it’s a major headwind to growth. And it’s exactly the opposite of the expansive government spending John Maynard Keynes prescribed as a way to smooth out the recurrent busts of the business cycle. In other words, it explains, at least a bit, why growth has been so sluggish in the aftermath of the Great Recession. And if government spending is able to shoulder some of the burden of keeping the economy going, monetary policy can back off a little bit, and the Fed can perhaps start to lift rates.