European companies might be loaded, but they’re not spending. And that’s terrible for the EU economy

Uncertain about the region’s weak growth prospects, European companies are sitting on a lot of cash these days. The 265 European firms in the StoxxEurope 600 Index, excluding banks and insurers, were holding $475 billion in cash at the end of 2012, according to data compiled by Bloomberg.

Uncertain about the region’s weak growth prospects, European companies are sitting on a lot of cash these days. The 265 European firms in the StoxxEurope 600 Index, excluding banks and insurers, were holding $475 billion in cash at the end of 2012, according to data compiled by Bloomberg.

That’s three times more than in 2002, said Bloomberg.

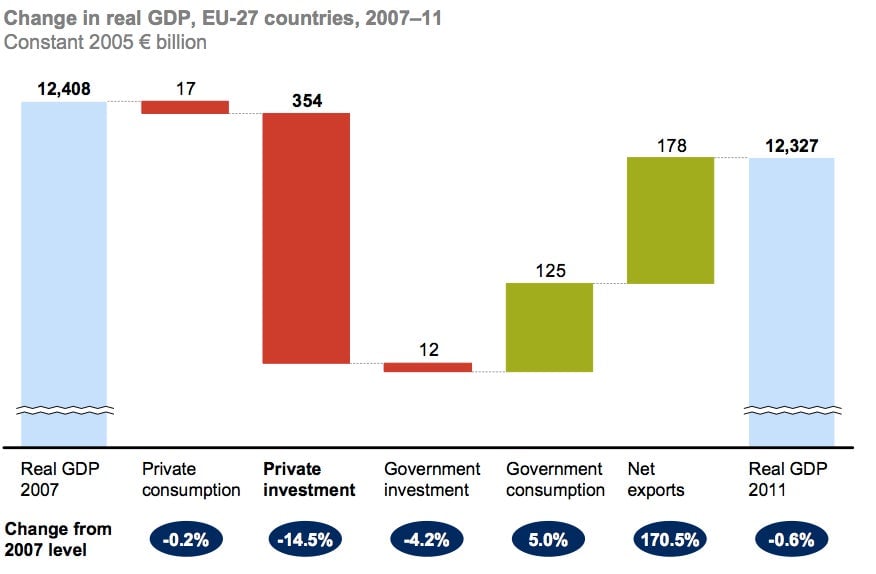

On the flip-side, European private investment has plummeted. As of the end of 2011, private investment in 26 of the 27 EU member countries had not recovered to 2007 levels, and private investment in the bloc was roughly 15% lower than 2007 levels, the consultancy firm McKinsey said in a December report.

This matters because private investment typically generates about one-third of GDP growth in the first two years of a recovery, the firm noted. In 41 cases where real GDP fell and private investment declined by at least 10%, said McKinsey, private investment typically recovered only five years after the year GDP peaked. On that basis, a recovery in private investment in EU economies is behind schedule.

Of course, the more European companies decline to invest in the region, the harder it will be for the euro area’s economy to recover. European officials expect the euro zone to shrink 0.3% this year, with domestic consumption and government spending remaining low.

However, the lack of intra-European investment doesn’t mean that Europe is entirely without shoppers. Indeed, as we discussed earlier, Chinese foreign direct investment in the EU climbed from €1 billion a year between 2004 and 2008 to €7.8 billion in 2012, according to US consultancy Rhodium Group. Meanwhile, earlier this month, US cable company Liberty Global announced it would buy Britain’s Virgin Media for $16 billion.

There has been a lot of talk about a potential boom in M&A in 2013, in part because of the mountain of cash European companies are sitting atop. But the real issue here is sentiment, not cash. An October 2012 survey by Citi found that about 66% of European firms said they planned to cut spending in the next six months, with the majority blaming the euro zone crisis for canceling or delaying projects. And, unfortunately, there hasn’t been much in the news lately to prompt a change of heart.