Not too long ago, the notion of generating social good along with financial returns was considered a fringe idea by most investors. But recently the area of “social finance” has started to enter the mainstream and receive consideration from Wall Street giants and some of the world’s largest institutional investors.

Defined broadly, “social finance” describes a range of investments that generate financial return and include a social or environmental impact. The market comprises a massive, global asset pool worth roughly $22 trillion, according to global investment company BNY Mellon. It encompasses strategies including impact investing, development finance and microfinance, environmental finance and socially responsible investing (SRI).

The shift toward investing with a social purpose is coming not a moment too soon—the size and complexity of the 21st century’s environmental, social and economic development issues are daunting. By 2050, the world population is expected to rise by more than 30%, with the majority of growth taking place in developing world cities. Governments have historically been the key solver of such social problems, but the sheer amount of capital required far exceeds their spending abilities. The recent global recession exacerbated this fundamental problem. And philanthropy alone can’t make up the difference.

Filling the gap

There is an emerging belief that social finance can help fill that gap. Morgan Stanley’s “Sustainable Signals” survey of 800 individual investors conducted in November 2014 found that 71% expressed interest in sustainable investing. An investor survey by the Global Impact Investing Network (GIIN) and J.P. Morgan found that impact investors plan to increase their investments by 16% this year.

One approach, the social impact bond, is gaining traction and garnering attention in the mainstream media. Social impact bonds are akin to regular bonds but their payments are based on hitting a social goal, like whether a therapeutic program for jailed teenagers reduces recidivism, or an education project increases access to job training and English classes for adult immigrants.

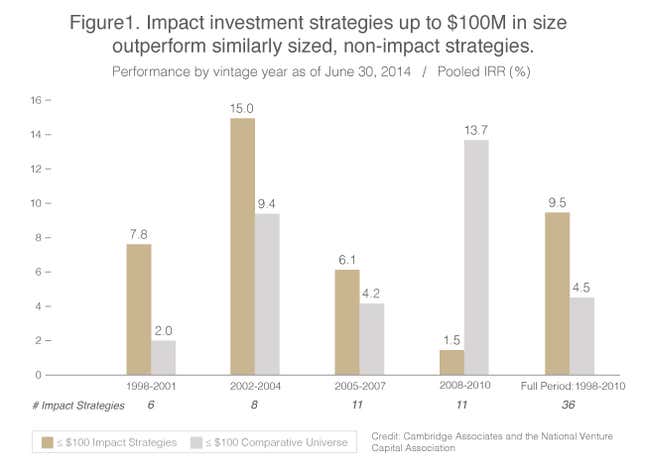

And while they have yet to establish themselves as consistent out-performers versus non-social finance investments, investors are increasingly noticing that social finance investments have the potential to generate comparable rates of return to similar conventional investments. For example, while large private investment funds continue to best impact investment strategies, impact investments at the smaller end of the spectrum are showing that they can offer the opportunity for competitive returns. According to recent benchmark data from Cambridge Associates and the GIIN, impact funds that raised up to $100 million returned a net 9.5% to investors, while similarly sized non-impact funds that invested in the same sectors and geographies returned an average of 4.5%.

This recognition of the positive financial impact of social investment is also changing how portfolio managers approach their investments. In an interview with The Financial Times, Omar Selim, chief executive of values-based Arabesque Asset Management remarked, “We find a remarkable correlation between diligent sustainability business practices and economic performances.” Recent research from Arabesque has found that companies with robust sustainability practices operate more efficiently and positively influence investment performance.

Scaling social finance

Despite rising interest in the sector, some investors say the social finance market’s development has been held back partly by a lack of suitable products to invest in, confusion surrounding the proliferation of industry terminology and questions of whether or not investments can be profitable given their limited track record. This has left many mainstream investors hesitant to dip their toe in the space.

To address these challenges, the social finance sector must come up with better ways to measure non-financial metrics, increase transparency of social and environmental impacts on financial performance and create a wider variety of investment products, according to a recent paper by BNY Mellon.

“Investors in particular have an important role in increasing participation in social finance,” said BNY Mellon’s head of corporate social responsibility, John Buckley. “Engaging policymakers, seeking technical expertise to use best practices, piloting new innovations and investing their capital are all levers at their disposal.”

Investment capital is plentiful in the world today. Social finance is in a great position to attract more of that capital as it addresses these key challenges. If investors and the financial industry continue to innovate and scale the social finance sector, there will be greater opportunity for investors to generate both financial returns and meaningful social and environmental impact.

Learn more about how BNY Mellon is enabling investor capital to advance social finance here.

This Sponsor Content Bulletin was not written or created by Quartz’s editorial team. This article was written by Quartz’s marketing staff and sponsored by BNY Mellon. The views expressed in this material are not those of BNY Mellon or any of its subsidiaries or affiliates. This material is intended for general information and reference purposes only and is not intended to provide or be construed as legal, tax, accounting, investment, financial or other professional advice on any matter.