The Fed says it’s worried about low inflation, but it isn’t worried enough

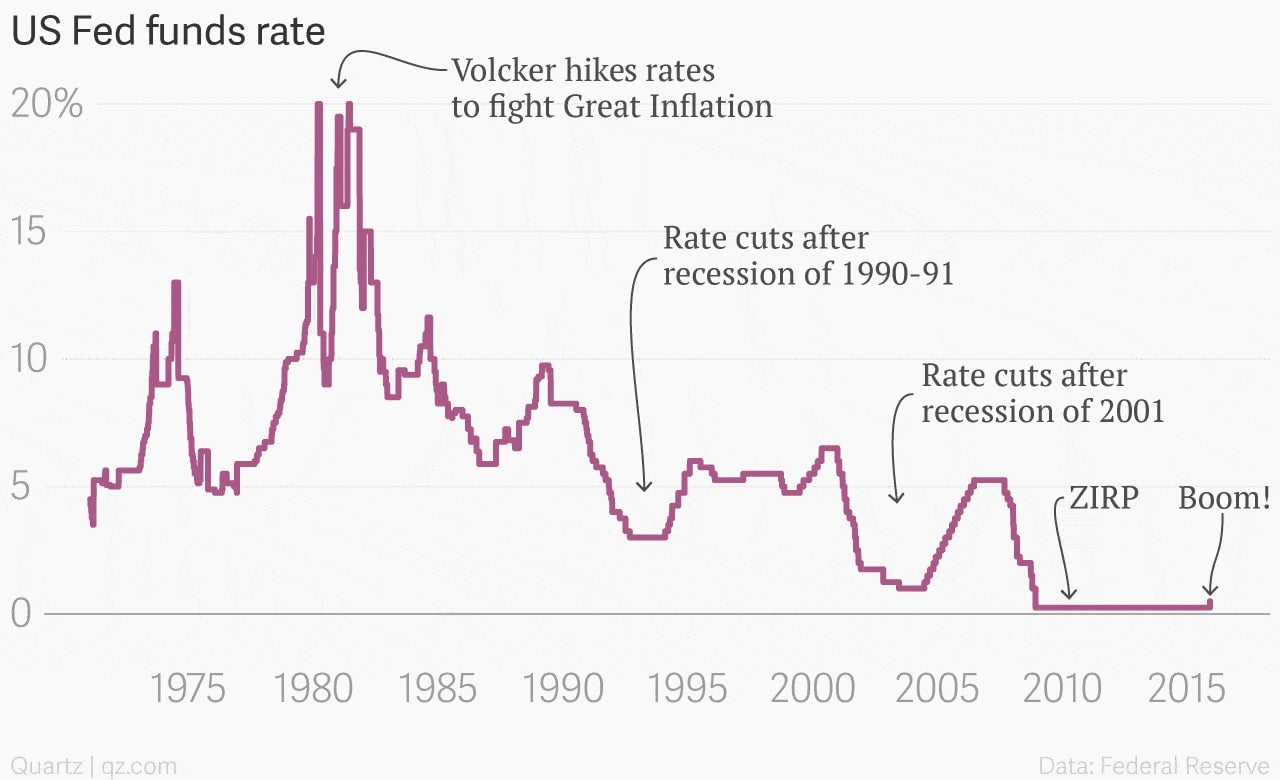

The minutes from the Federal Reserve’s December meeting of its policy-setting committee are out. You’ll remember that after that meeting, the Fed announced an increase to its target short-term interest rate for the first time in nearly a decade. It was a big moment. (So big, we made t-shirts.)

The minutes from the Federal Reserve’s December meeting of its policy-setting committee are out. You’ll remember that after that meeting, the Fed announced an increase to its target short-term interest rate for the first time in nearly a decade. It was a big moment. (So big, we made t-shirts.)

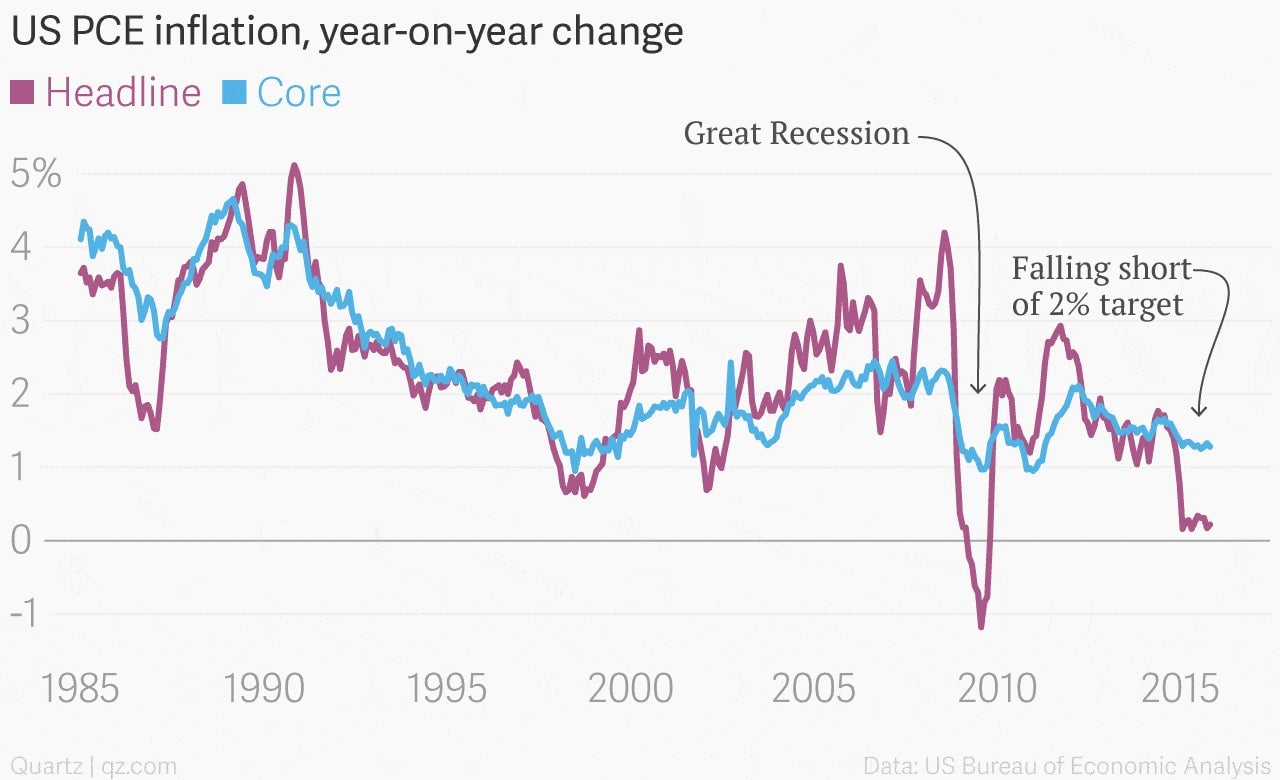

The move wasn’t without controversy. While the US job market has improved quite a bit since the worst of the Great Recession, there are still indications that more people would get back to work if the economy generated jobs for them. What’s more, the Fed also has a target for a 2% annual increase in inflation. And it continues to fall short of hitting that goal, as measured by the Fed’s preferred inflation gauge.

In its minutes released today, members of the Fed committee in question—the Federal Open Market Committee—expressed concern about the ongoing low levels of inflation, which can serve as something of a weight on economic growth. Low inflation rates raise real, or inflation-adjusted, interest rates. (That’s a disincentive to borrow and invest.)

Inflation also offers a cushion to the economy keeping it from slipping into deflation—a widespread decline in prices—if it runs into a economic shock. Low inflation makes that cushion skimpier and raises the risk that the economy could fall into deflation, which would be a major problem for economic growth.

So while, low rates of inflation may seem like a good thing for shoppers, they can be a risky thing for the economy as a whole.

That’s why even as the Fed moved to raise short-term interest rates at its last meeting—a move that, all else being equal, should slow price increases—committee members also wanted to tell the markets that it was worried about missing its inflation goal. The minutes say:

“Because of their significant concern about still-low readings on actual inflation and the uncertainty and risks present in the inflation outlook, they agreed to indicate that the Committee would carefully monitor actual and expected progress toward its inflation goal.”

That’s a nice gesture. But it’s important to keep in mind that we are in the midst of a global trend of low, low inflation. China, Japan, the US, and Europe are all contending with weak inflation numbers.

Now, quite a bit of this is due to the collapse of oil prices over the last year-and-a-half. But even the outside risk that the US could be sucked into a global deflationary vortex should be the Fed’s main concern right now. Given its decision to raise rates, the US central bank is a lot less worried than it ought to be.