As most banks pull back, Standard Chartered is winning the global banking game

Most multinational banks in the US, UK, and European Union have been cutting back on their global operations, trimming costs and reducing activities that they don’t consider as “core” businesses. Even Citigroup—which prides itself on its global presence—has axed some of its consumer-banking operations abroad already and may cut even more, after they took a toll on its profit.

Most multinational banks in the US, UK, and European Union have been cutting back on their global operations, trimming costs and reducing activities that they don’t consider as “core” businesses. Even Citigroup—which prides itself on its global presence—has axed some of its consumer-banking operations abroad already and may cut even more, after they took a toll on its profit.

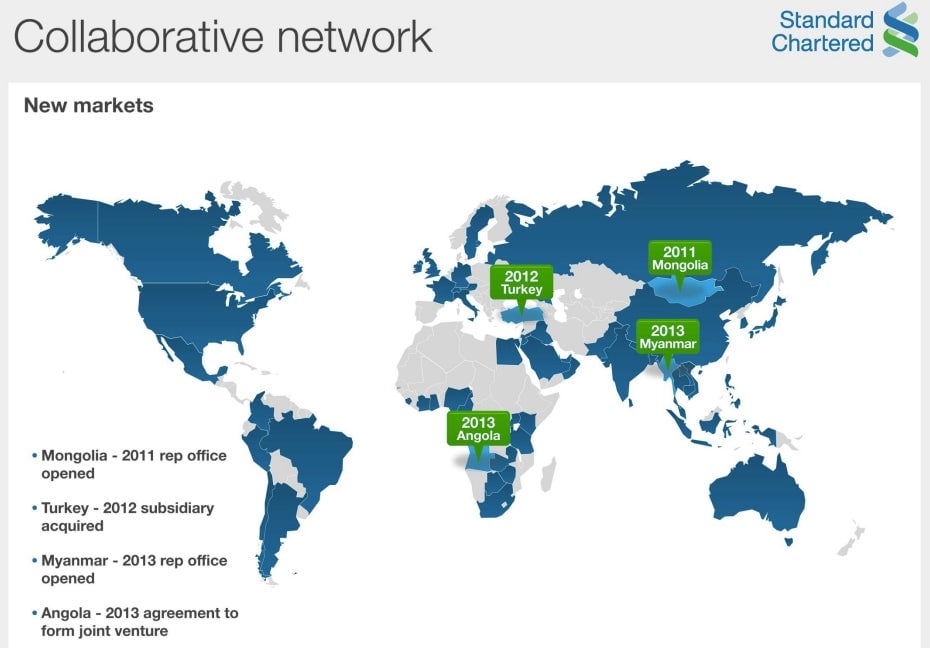

Standard Chartered, however, is doing the exact opposite. In 2011, the UK-based bank opened an office in Mongolia. In November 2012, it purchased Crédit Agricole’s operations in Turkey and expanded those operations to form a full-fledged subsidiary. It is the only international bank with a presence in all 10 members of the Association of Southeast Asian Nations (ASEAN), after reopening operations in Myanmar last month. It is also one of the few banks making strong incursions into inland China, away from the coastal cities where both foreign and domestic banks have strong footholds.

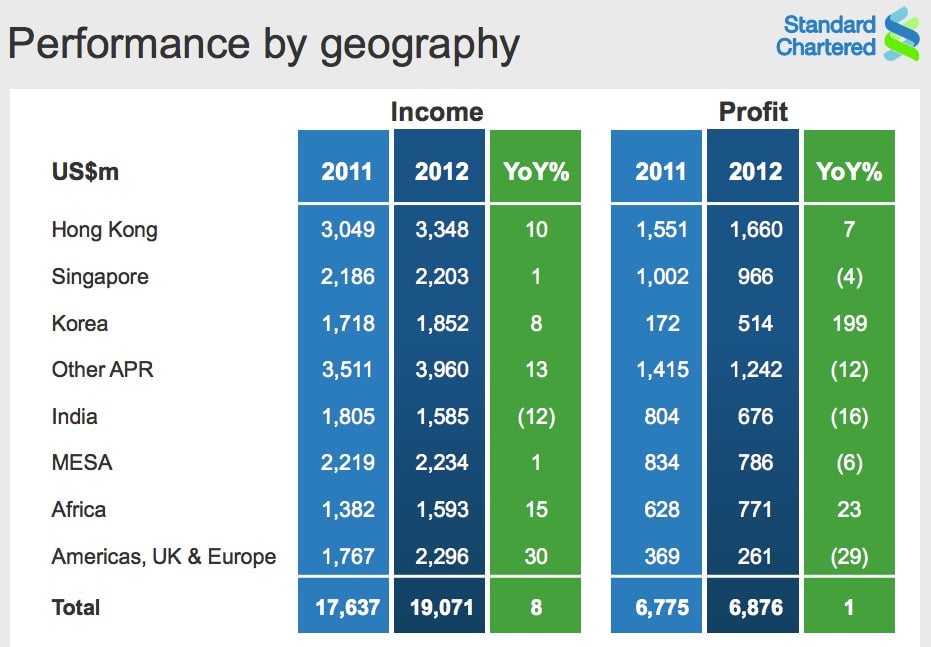

Believe it or not, Standard Chartered’s decision to get in the game while everyone else is getting out is making it oodles of money. Hong Kong generates 18% of the bank’s income, well ahead of the Americas, the UK and Europe combined. Together those Western markets accounted for 30% of the bank’s income growth in 2012, but its greatest profit growth came from emerging markets. Profits in South Korea, for instance, grew by 199% year-over-year, and operating income increased in every market except India.

This global expansion is predicated on the belief that growth in the next few years is coming from the East and South, not the stagnating West. “Our markets in Asia, Africa, and the Middle East are not immune. Slower growth or shocks in the West will undoubtedly affect them. But there continues to be a clear gap between the growth in our markets and growth in the West,” said CEO Peter Sands in a conference call. “The underlying drivers for growth in the emerging world, industrialization, urbanization, demographics, remain extraordinarily powerful. We’re seeing strong growth in interregional trade and investment across our markets.”

Standard Chartered may or may not be hit by new regulations that could make it more difficult to do business overseas. Regulators in Washington, London, and Brussels have been working on new rules that would allow a systemically important financial institution to fail without collapsing the global financial system. They will make doing business more expensive—particularly in those countries—but it’s not clear that regulators in emerging markets would adopt similar standards.

If they don’t, Standard Chartered could get around any particularly stringent rules in rich countries by relocating its headquarters, although Sands says it is “too early to draw conclusions on what action we would take as we don’t know what we are dealing with.”

Regardless, the bank looks poised to dominate a piece of the banking business that no one else is laying claim to, and is doing really well at it. “Solid, reliable, predictable. A 10th consecutive record year, the traders love it!” gushed Marc Kimsey, a senior trader at London-based Accendo Markets. “Standard Chartered should be the cornerstone of any long term portfolio.”