Not just the Dow: Here are four other US stock-market metrics topping previous peaks

After kicking past its all-time high yesterday, the Dow Jones Industrial Average continues to climb to fresh peaks. But of course, the Dow’s not a perfect index, if such a thing exists.

After kicking past its all-time high yesterday, the Dow Jones Industrial Average continues to climb to fresh peaks. But of course, the Dow’s not a perfect index, if such a thing exists.

The 30 large, blue-chip firms it’s comprised of can’t possibly reflect the breadth of the world’s largest economy. The S&P is considered a better bellwether by most professionals, and the S&P is lagging the Dow’s move higher, but is pushing in the same general direction. More importantly, there are a number of telling stock market measures that are telegraphing similar optimism on the US economy by rising over their previous high-water marks. We’ve rounded some of them up, below.

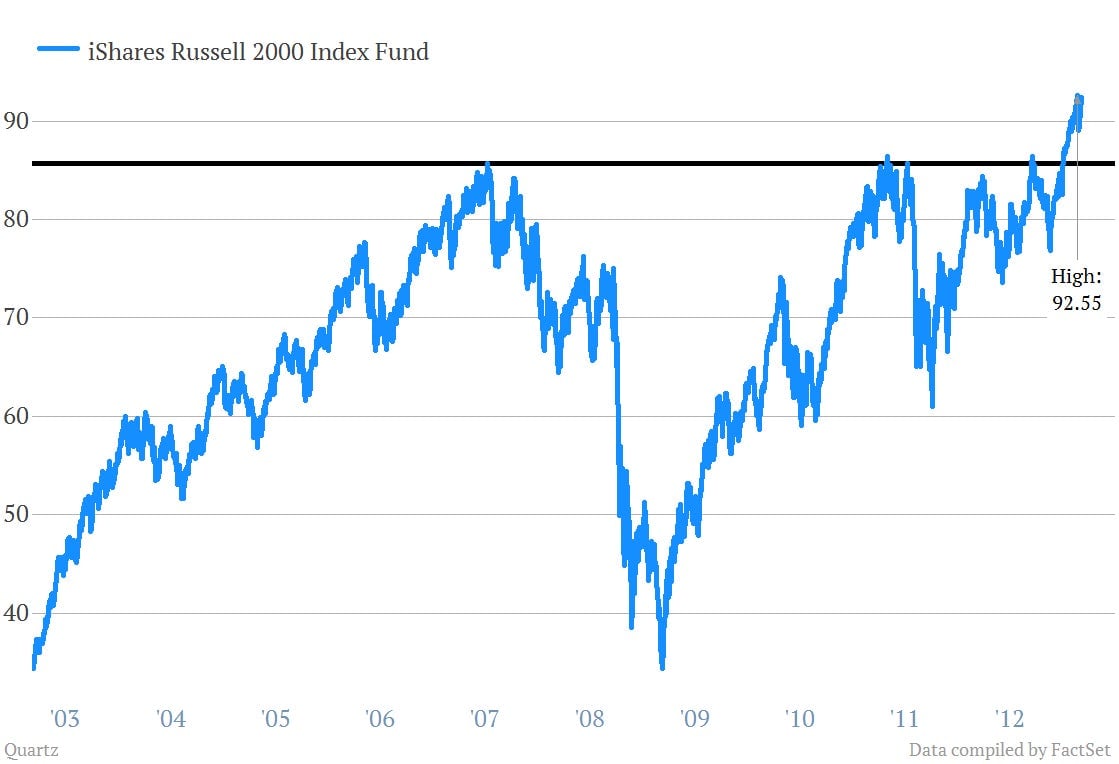

Small Caps

The Russell 2000 index of small-capitalization stocks has been leading the upwards march. It’s well beyond its pre-crisis peak, back in 2007. Small-cap stocks are usually thought to be a better barometer of the US domestic economy, as these smaller firms pull in more domestic sales than the global giants that dominate the Dow and S&P.

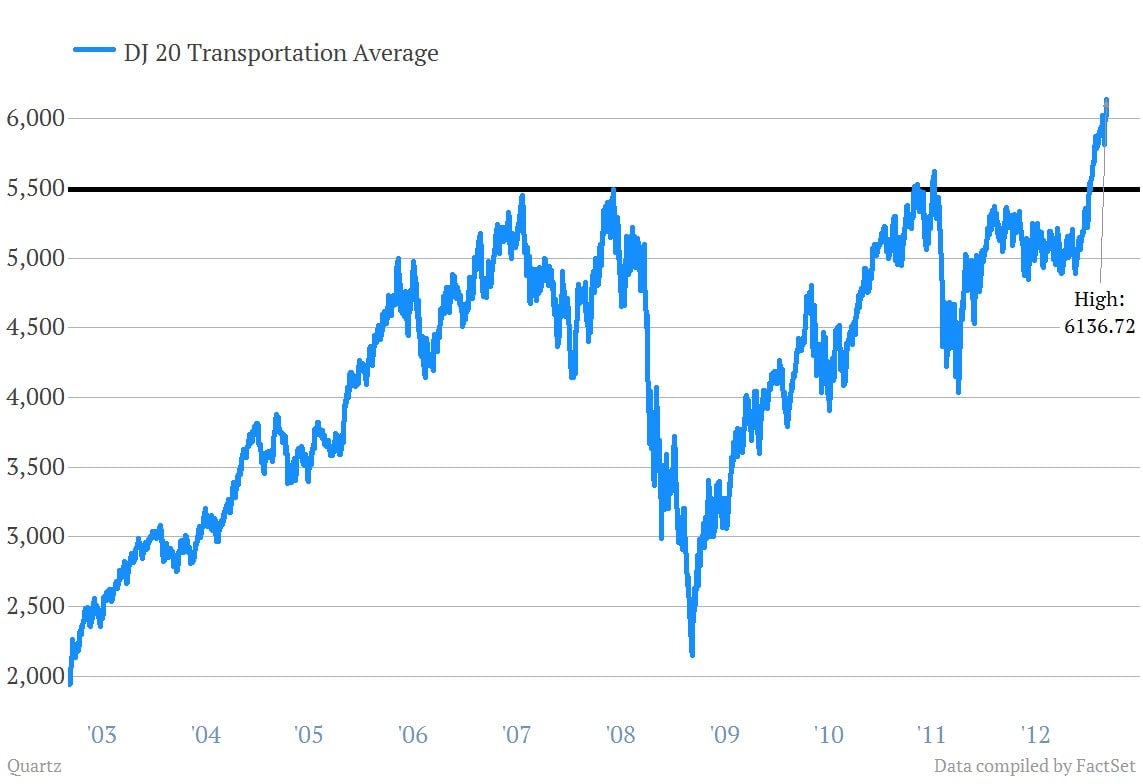

Trannies!

The Dow Jones Transportation index, which traders—seriously—like to call the “Trannies,” has been busting higher too. There’s an arcane stock market system known as “Dow Theory” that argues that market rallies aren’t significant unless there’s been a move higher in transport stocks. That doesn’t seem to be a problem here. Transport stocks have been soaring, which reflects optimism about the prospects for trucking and hauling more packages, lumber, coal and people around a country with a decent economic pulse. You can see here that the Trannies have already put their 2008 highs in the rear-view mirror.

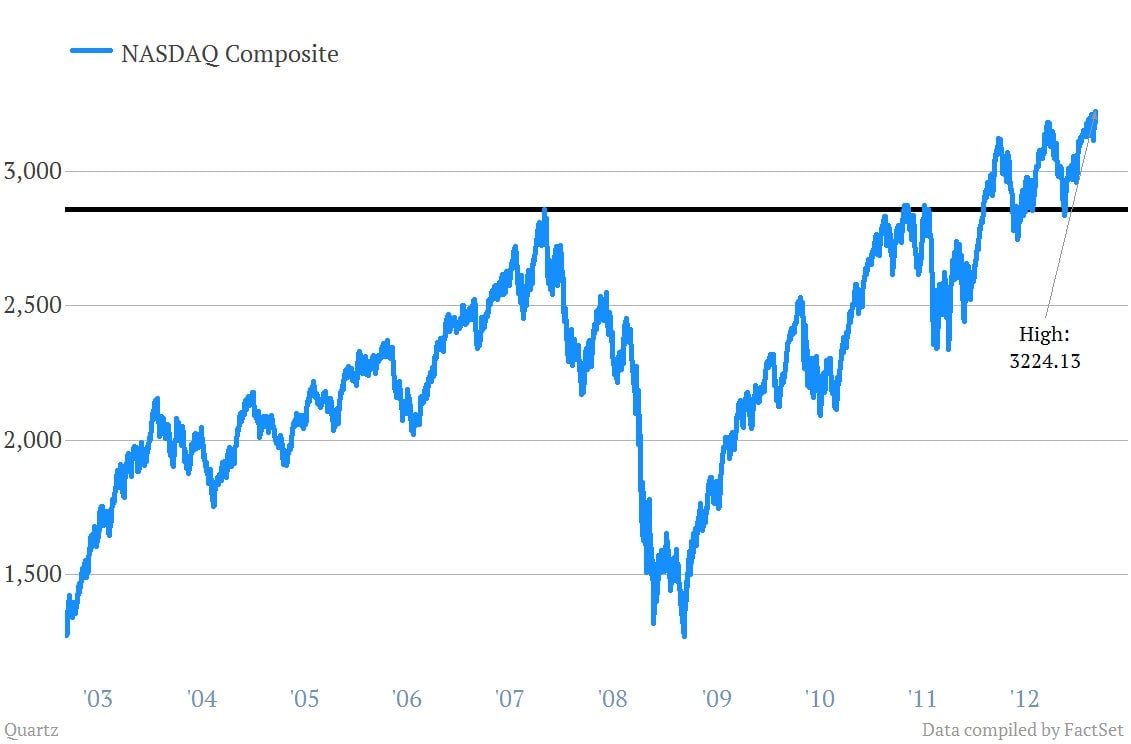

Like it’s 1999!

Remember the Nasdaq? Well, the tech-heavy measure has also reached for fresh peaks lately.

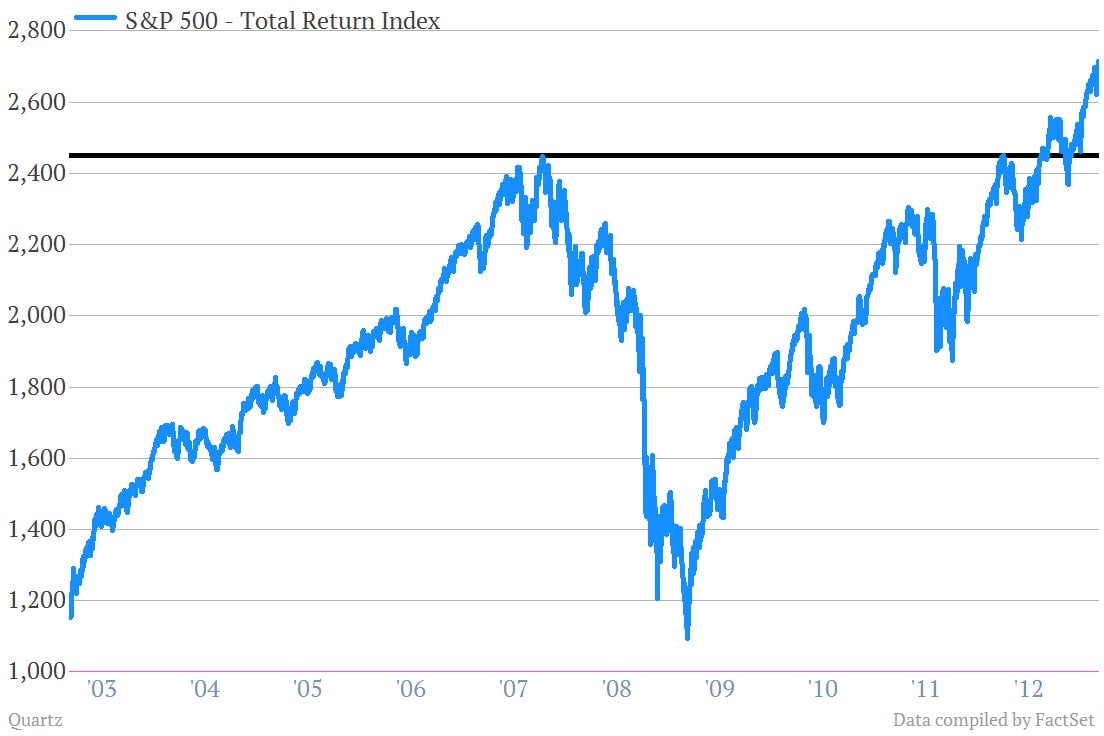

Dividends matter!

When we talk about the stock market, we often leave out one of the most important parts—dividends. While the prices of stocks swing up and down producing capital gains and losses, over time dividend payments produce a huge chunk of the total return on any investment. Case in point: the S&P 500 is still trying to muster its strength to surmount its all time high. But if you look at the S&P 500 Total Return index, which takes dividend payments into account, it’s already there.