Why the 26% drop in car sales is a bad sign for India’s economy

Car sales in India tanked last month, falling 26%—the most in 12 years. That’s a grim reading on the health of the country’s consumer demand and crystallizes the reversal of fortunes for what was once one of India’s most promising industries.

Car sales in India tanked last month, falling 26%—the most in 12 years. That’s a grim reading on the health of the country’s consumer demand and crystallizes the reversal of fortunes for what was once one of India’s most promising industries.

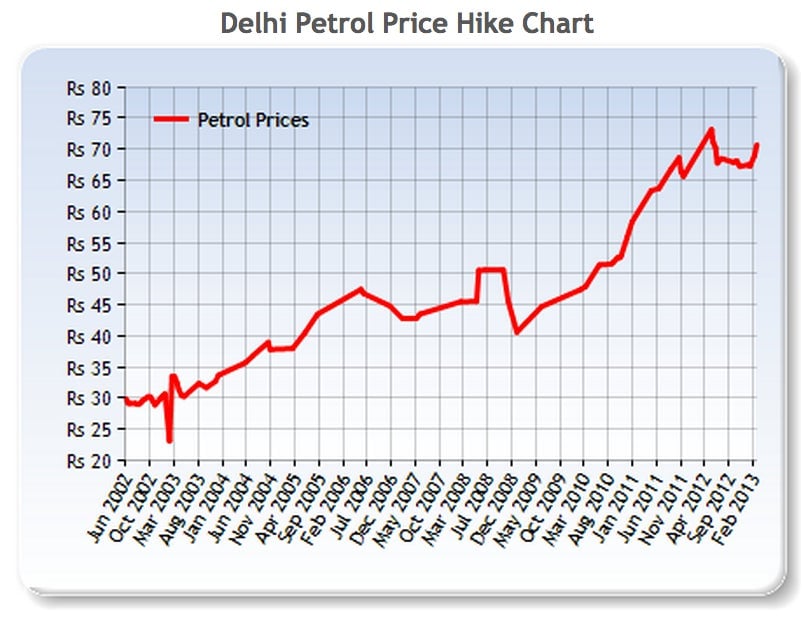

The big culprits behind the year-on-year drop? In addition to India’s general economic slowdown, high interest rates, rising fuel costs and a September increase in subsidized diesel prices that drove up carmakers’ freight costs top the list.

Some 65% of India’s GDP comes from domestic consumption (by comparison, China’s contributes more like one-third). But as we’ve pointed out in the past, the Indian government has forged a dilemma: its subsidy of food prices has spurred inflation, prompting it to raise interest rates. But tightening has almost halved the country’s growth, say some, and has weighed particularly hard on India’s private sector.

And its consumers, it turns out. Even as central bank interests rates came down in late January, a trend of “negative sentiment” that the president of the Society of Indian Automobile Manufacturers called out in January continued unchecked. Here’s a look at how fuel prices in Delhi have trended, via MyPetrolPrice.com:

As the Wall Street Journal reports (paywall), the government budget unveiled a week and a half ago failed to include supportive measures that India’s carmakers had hoped for, instead raising taxes on SUVs and imported vehicles.

That makes today’s data merely more glum news for international carmakers like Nissan and General Motors that sunk big investments into the sector, encouraged by the boom years in 2010 and 2011.

But while this news bodes ill for India’s car industry, the news is also not entirely surprising, given the months of downturn that the industry has faced. As for the economy as a whole, the ratings agency Moody’s recently predicted a gradual upturn this year, projecting 6.2% GDP growth, up from 5.1% in 2012—based largely on the government’s budget and its potential to tame inflation.