Signs of loosening from Hungary’s new central bank chief drive forint into a nosedive

The Hungarian forint tumbled Monday, as the new head of the National Bank of Hungary—the nation’s central bank—made moves to centralize his power, something seen as auguring a move towards a much looser monetary policy.

The Hungarian forint tumbled Monday, as the new head of the National Bank of Hungary—the nation’s central bank—made moves to centralize his power, something seen as auguring a move towards a much looser monetary policy.

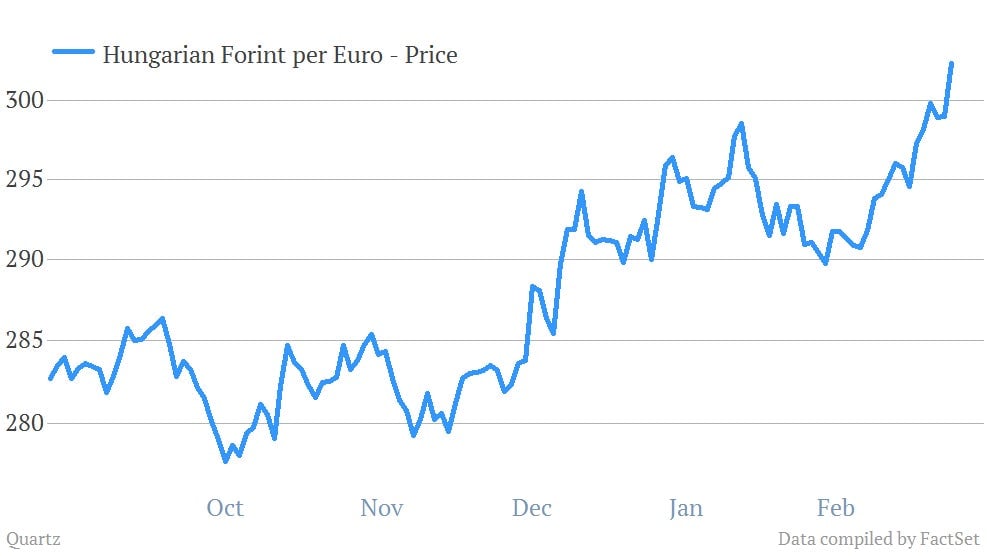

Falling more than 1% against the euro today, the forint is now down more than 2% in March alone, making it the worst performer of its 20-plus emerging-market peer currencies that Bloomberg tracks. Over the last six months, the forint has lost about 7% agains the euro. Here’s a look:

As a bit of background, the Hungarian economy is a mess at the moment. For one thing, the country is sinking deeper into recession, its second in four years. (Most of the country’s exports go to the euro zone, which is grappling with a recession of its own.) And Prime Minister Viktor Orban’s increasing dominance of the country’s institutions is making the foreign investors on which Hungary depends somewhat jittery.

It was actions by Gyorgy Matolcsy, Orban’s appointee as head of the NBH, that are apparently setting off concerns that Hungary could try to devalue or inflate its way out of its debt problems. (In 2008, Hungary became the first EU country to take a bailout led by the IMF in the form of a $26-billion aid package.)

But even that well-trod avenue for cutting emerging market debt is problematic for Hungary, as much of the consumer and corporate loans that Hungarians have borrowed are denominated in foreign currency. That means that a rapidly falling forint only makes it more and more difficult for them to repay, likely worsening its economic troubles.