Investors look nearly fearless as market’s “fear gauge” falls to 2007 levels

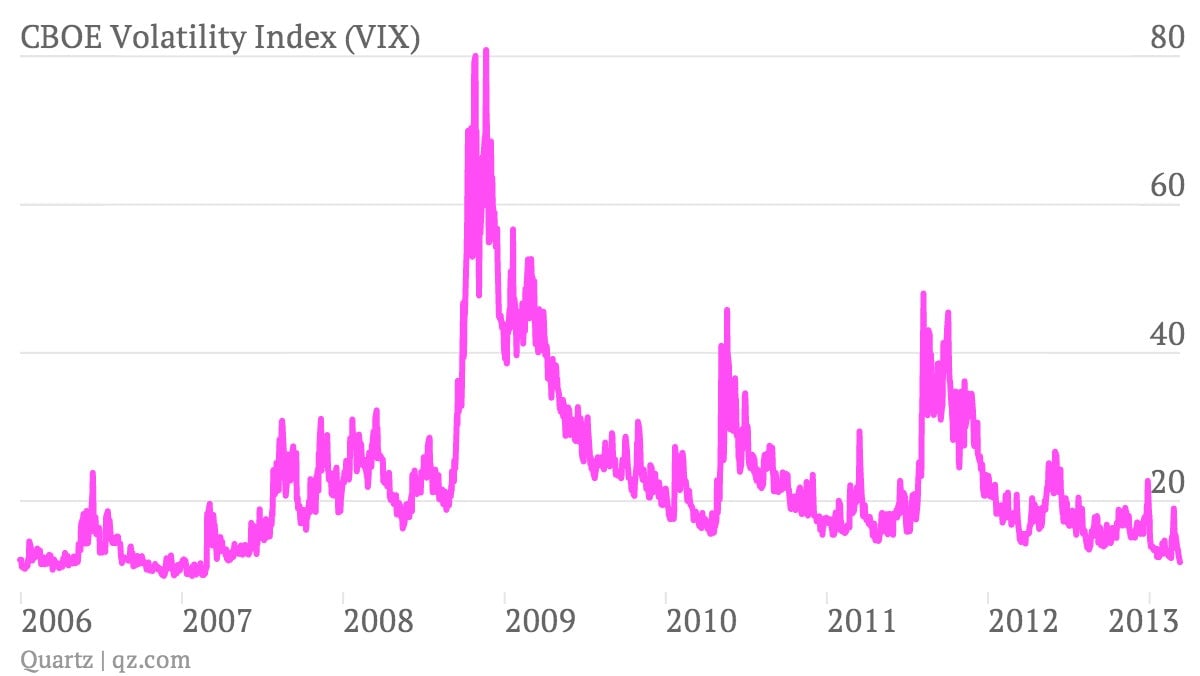

The CBOE Volatility Index—known in the markets as the VIX—hit low levels not seen since 2007 yesterday, as investors either gain increasing confidence in the durability of the US economic recovery or blithely tap dance along a cliff’s edge. The VIX is sometimes referenced as the stock market’s “fear gauge.” If that’s so, fear seems to be in increasingly short supply. Here’s a look at the VIX, going back before the great blowout of 2008.

The CBOE Volatility Index—known in the markets as the VIX—hit low levels not seen since 2007 yesterday, as investors either gain increasing confidence in the durability of the US economic recovery or blithely tap dance along a cliff’s edge. The VIX is sometimes referenced as the stock market’s “fear gauge.” If that’s so, fear seems to be in increasingly short supply. Here’s a look at the VIX, going back before the great blowout of 2008.

Somewhat counterintuitively, market prognosticators often get worried when the VIX falls to extremely low levels. These market seers suggest an especially low VIX could be a sign that investors are getting increasingly optimistic, and are more likely to be shocked by even a small bump in the road. It’s true that in recent years, that the VIX has had a propensity to surge after finding new lows. Both of those blow ups in 2010 and late 2011 were largely due to particularly nasty episodes of the European debt crisis. At any rate, with the Dow Industrials etching yet another record high yesterday, those incorrigible creatures known as “stock market timers” might want to tread carefully here.