Why “unicorn” is the wrong model for media startups

Unicorns base their valuations on hopes of never-ending growth. It might work for Uber or Airbnb, but it’s not a valid model for digital media whose growth relies on a structure of third party distribution and tiny ARPUs.

Unicorns base their valuations on hopes of never-ending growth. It might work for Uber or Airbnb, but it’s not a valid model for digital media whose growth relies on a structure of third party distribution and tiny ARPUs.

After a week in New York and Washington, meeting with representatives of both old and new media economy, I found myself on the receiving end of torrents of explanations regarding the virtues of distributed contents. To many modern media companies—regardless of their core products—spreading editorial contents through ecosystems controlled by Facebook, Apple, or Google is not just a good idea, it’s a matter of survival. Even the most reluctant join the fray. According to a publisher: “Saying that distributed content is threatening the brand is like saying that going digital killed print.”

The trending strategic certainty says that playing offense requires aggressive distribution on social platforms. “The web is dead, audiences are flat,” says a prominent New York VC. “If you already have one [web site], then fine, keep it, but do not expect any growth from it.” According to him, the potential for growth of direct digital distribution—on the web or through apps—has reached a plateau, and the future lies in content massively spread on others platforms: Facebook, Twitter, Snapchat, What’s App, Pinterest, etc. Some media have deals with two dozens such outlets, counting “content views” (the metric du jour) in billions. They radiate impressive figures, double-digit monthly growth, and unbelievable reach.

But please, do not question the value of these content views, nor the prospect of monetization—not in polite company.

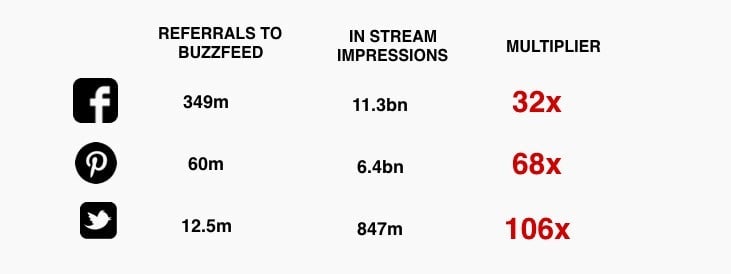

Most media unicorns (or near-unicorns) are built on their ability to accumulate massive audiences, hoping their numbers will outweigh their infinitesimal per-unit monetization. Take Buzzfeed: Its valuation hovers at $1.5 billion after six funding rounds totaling $296 million. The company is an undeniable success, with about $400 million in revenue, according to two people involved, with cash-flow reinvested in growth and expansion. Buzzfeed propagates its content—and its advertisers’—on social platforms on a massive scale. What is its distribution structure? Here is the split based on monthly figures provided last year by Buzzfeed founder Jonah Peretti:

It means that for each click sent back to Buzzfeed, 44 views, on average, are made on social. To their investors, such ability justifies the billion-plus valuation. Similar metrics also apply to Vox and others who have not reached the unicorn status.

What’s wrong with this picture? Three things.

First: the risk stemming from this heavy reliance on third-party distributors over which the publisher has no control. When a content provider makes 44 times more traffic outside its own premises, it becomes highly vulnerable to changes the third party might make to its distribution mechanism. As long as publishers’ and distributors’ interests are aligned, everything’s fine. But who can guarantee such harmony will last?

Second: most players who currently enjoy social leverage live in the hope that Facebook will come up with some direct monetization model. While Buzzfeed and its ilk are making it big by producing and spreading social content on behalf of clients, many others expect that Facebook will come up—soon—with models that will favor sponsorship, as an example. They are building large audiences on Facebook with that goal in mind.

The third risk is the level of sensitivity to economic conditions. If, because of a recession, ad markets go south, it is doubtful that a car maker or a beverage company will continue to divert top dollars for bespoke productions aimed at the social sphere. Right or wrong, flight-to-quality will set in, with advertisers taking refuge in more chartered territories of communication, drying up social dollars in the process.

In the wealthy corral of 173 unicorns valued at $585 billion combined, all are not equals. One common denominator, though, is the astounding growth the species requires. But some appear stronger than others.

For example, Uber (valued at $62 billion) got $10 billion from its VCs. This gives it oxygen to deal with enormous losses that far outpaces the Amazon model, itself once seen as overly aggressive. See what Bloomberg said about it:

Over the first three quarters of 2015, Uber lost $1.7 billion on $1.2 billion in revenue. For perspective, during Amazon.com’s worst-ever four quarters, in 2000, it lost $1.4 billion on $2.8 billion in revenue. CEO Jeff Bezos responded by firing more than 15 percent of his workforce.

[The tech site The Information recently provided great insights about Uber economics.]

But Uber’s continuous funding seems to obey its own logic. A few weeks ago, at the World Economic Forum at Davos, I spoke with its founder and CEO Travis Kalanick. When I asked him about the possibility of a bubble, he shot back: “…Look, I’m obliged to raise money because my competitors raise money. That’s it. Now, if it comes to a stop, fine. I won’t have to do that shit anymore…” Uber raised about $10 billion, while its main competitor Lyft raised $1 billion.

Despite its mammoth losses, Uber is addressing a tangible global market of $310 billion a year (when combining all sectors Kalanick says he wants to go after), according to Aswath Damodaran, a finance professor at NYU’s Stern School of Business. Even a small chunk of such a huge market could justify Uber’s current valuation, especially since Uber directly addresses its pool of customers, whether they live in New York or Beijing.

A similar argument could apply to Airbnb, currently valued at $25 billion; the lodging platform taps into the vast global market of travelers without relying on intermediaries and with a high level of replicability.

In passing, both companies might be relatively recession-proof: if Uber is able to make the ownership of a car completely irrelevant in some cities (as it is already the case in San Francisco, New York, London, or Paris), it could become a staple product on its own. As for Airbnb, it provides additional revenue to thousands of young and older households and, to many, a great way to travel for less, which make it less vulnerable to adverse economic conditions.

Unfortunately, none of this applies to actual or aspiring media unicorns because they exist on much smaller markets that need to be addressed in a bespoke manner. Uber or Airbnb platforms work the same everywhere, but Buzzfeed, Vox, and similar ones need to be heavily customized for each audience, and they need powerful intermediaries to funnel page views, each generating a minuscule ARPU. Some horns will break, and it will hurt.

This post originally appeared at Monday Note.