Different retirement ages for different incomes? Here’s why that’s a bad idea

A popular solution to the problem of an aging population is to make people work longer. State pensions, in many developed countries, were conceived when a 30-year-old wasn’t expected to live to age 70. Now people live longer and retire earlier. Many members of the Organization for Economic Cooperation and Development have already increased the age when young people will be able to start their pension: the US (from 65 to 67), the UK (from 65 to 68), France (from 60 to 62), and Sweden (67 and there’s talk of raising it to 69).

A popular solution to the problem of an aging population is to make people work longer. State pensions, in many developed countries, were conceived when a 30-year-old wasn’t expected to live to age 70. Now people live longer and retire earlier. Many members of the Organization for Economic Cooperation and Development have already increased the age when young people will be able to start their pension: the US (from 65 to 67), the UK (from 65 to 68), France (from 60 to 62), and Sweden (67 and there’s talk of raising it to 69).

In some cases, that’s still not sufficient, and developed countries continue to face fiscal pressure from aging populations. It isn’t unreasonable to expect people to spend longer in retirement than a generation or two ago: As countries get richer, people consume more of most things, including leisure. But three decades of retirement is probably too much.Perhaps, then, it makes sense to increase the retirement age even further?

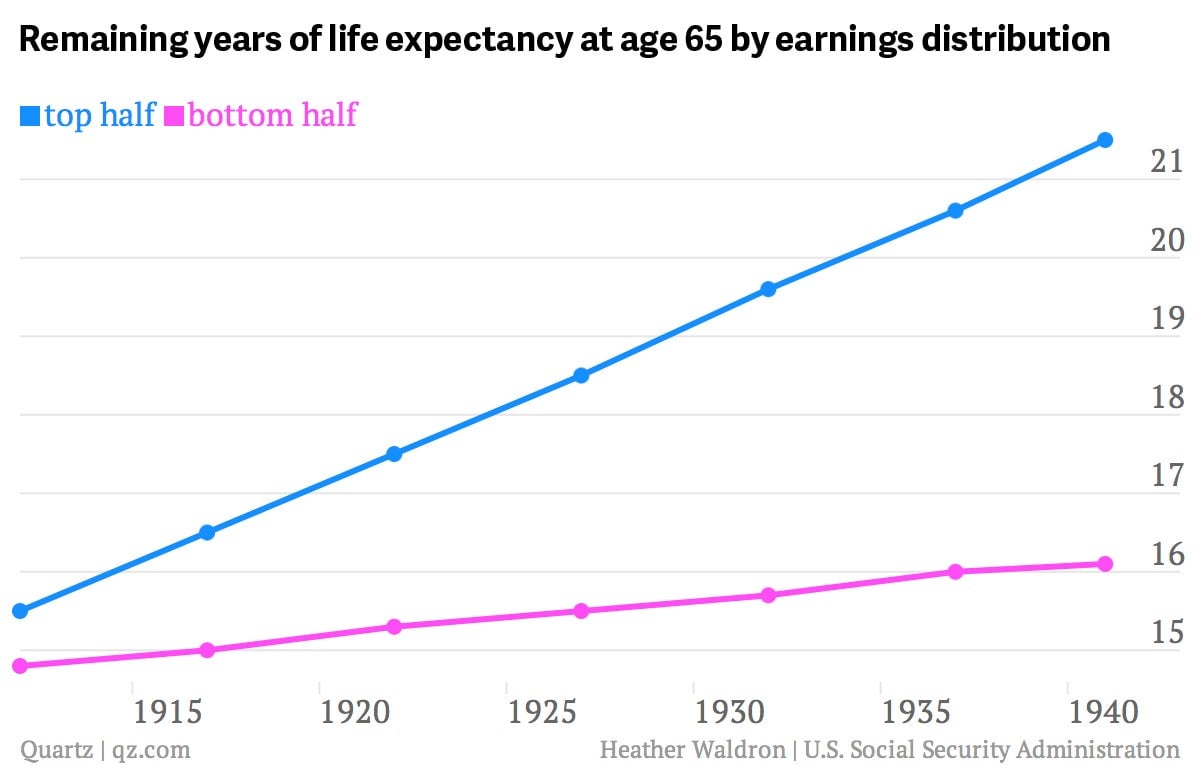

Some economists in America, like Paul Krugman and Gary Burtless, don’t think the retirement age should be increased at all because it’s only richer Americans who are living much longer than they used to:

This trend is not unique to America. An increase in “mortality inequality” also has occurred in many countries in Europe.

Life expectancy at retirement has increased for almost everyone, but why it’s gone up more for higher earners is a complicated question. In America the lack of access to health care is often blamed for the increased disparity; but that can’t explain Europe. One factor common across these countries is the lifestyle associated with being poor: higher rates of smoking and obesity. Lower income is also correlated with having a chronic condition or disability. Either of those conditions may have resulted from bad health habits, physically demanding work, or poor nutrition as a child.

What exactly causes the increase in mortality inequality is important, because it has implications for policy, including the right retirement age. Most state pensions serve the entire population, not just the poor—they also have progressive benefits relative to what you pay in (though the return on your tax dollar or euro is a function of how long you’ll be alive to collect benefits, so increasing the retirement age does undermine the progression). But thoughtful reform considers more than one part of the population. Poorer people’s retirement needs may be different to those of the better-off.

However, that doesn’t justify keeping the retirement age fixed for everyone else. Life expectancy has increased for most people, albeit at different rates depending on your income or other demographic factors such as gender or race. When everyone gets a state pension, it’s most sensible to set the retirement age based on the median person and target populations with special needs directly.

One solution that has been proposed is income-specific retirement ages. However, I recently explained why means-testing, or basing benefits on income, creates perverse incentives. It’s also a slippery slope. Men of African descent, even after controlling for income, have shorter life expectancies than men of European decent. So by the same logic, your race should determine when you can claim your pension. Yet basing retirement age on other demographic factors seems absurd; why is income any different?

Also, in many cases, lifestyle is what drives the difference in life expectancy. Does it make sense to subsidize behavior that leads to ill health? The disparity in life expectancy is a problem; we should do more to encourage healthier choices, rather than earlier retirement, to address it.

Still, you might say, what about people whose low-paid jobs are physically demanding? It’s not realistic for them to work longer, and their jobs might contribute to their earlier deaths. But again, this doesn’t justify tailoring policy, which affects everyone, to one segment of the population. It would be more effective, and cost-efficient, to help this population directly. That might include expanding disability and old-age poverty programs, so people who need to retire earlier can do so with the dignity they deserve.

For everyone else, working longer may not be the worst thing. Modern aging will probably include a new near-retirement phase of life which features less physical, more part-time work. Working longer enhances the quality of old age by keeping people in a social setting and helping keep their minds sharp. Though later retirement may be counter-productive when it comes to fiscal solvency, there’s evidence it increases life expectancy—across the income spectrum.