Germany’s BASF has won effective domination of the US market for the world’s most promising lithium-ion battery

Electric cars currently occupy only a niche of the global automobile market, but some analysts think the category is on the verge of giant leap in global demand. If their forecasts are correct, demand for lithium-ion batteries will soar, too, which is the subtext of a more than year-long legal battle between German chemical giant BASF and a Belgian rival, Umicore.

Electric cars currently occupy only a niche of the global automobile market, but some analysts think the category is on the verge of giant leap in global demand. If their forecasts are correct, demand for lithium-ion batteries will soar, too, which is the subtext of a more than year-long legal battle between German chemical giant BASF and a Belgian rival, Umicore.

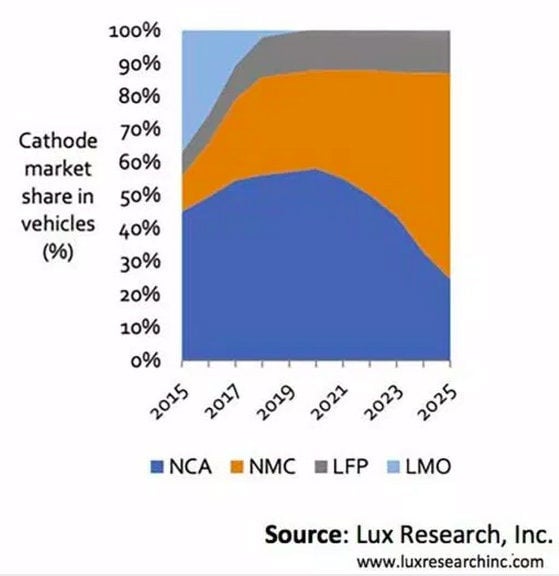

Both companies market a powerful lithium-ion chemistry that goes by the acronym NMC, for its component alloy—nickel, manganese, and cobalt. As of now, lithium-ion battery sales are dominated by another chemistry—NCA (nickel, cobalt, and aluminum), which is used in cars sold by Tesla Motors. But a growing number of analysts expect the market to shift to more energetic NMC in order to accommodate cheaper electric vehicles that can travel much farther than today’s electrics on a single charge.

In a February report, Bloomberg New Energy Finance forecast that NMC will come to own a full 95% of the global lithium-ion market in the 2020s. Even less-bullish reports foresee a fundamental shift to NMC. Lux Research, for instance, predicts that NMC will grow to about 60% of the market by 2025 (see chart).

With so much at stake, BASF last year filed complaints with the US International Trade Commission (ITC) in Washington and in US federal court, asserting that Umicore was infringing on US patents for NMC. The German company claimed that Umicore, while dominating NMC sales, with a third of the market, was effectively selling BASF’s product. (NMC is contained in the plug-in hybrid Chevy Volt, the BMW i3, and the Nissan Leaf, among other major models. It also will be used by the pure-electric Chevy Bolt, which is to reach the market in December.)

In an interim ruling last week, ITC judge Thomas Pender sided with BASF, finding that Umicore indirectly infringed on the patents for BASF’s NMC—a decision that, if upheld by the full panel of ITC judges, could bar Umicore’s product from the US, and throw much of the market to the German company. The final decision is expected in June.

In a statement, BASF said, “This dispute is aimed at protecting our investments and our patented technology position, and ensuring a level playing field. We were gratified that Judge Pender’s initial determination ruling supports that same view.”

Umicore continues to argue that it hasn’t violated the patents behind the BASF product, and vows to continue the fight. Tim Weekes, a Umicore spokesman, told Quartz that the company will petition the ITC to reconsider Pender’s ruling. He also said that Umicore is challenging the patents underlying BASF’s NMC in the US Patent Office.

At the heart of the dispute is the atomic-level behavior of the component metals. BASF argues that its NMC undergoes a two-phase transition: that it combines two different lithium-ion formulations, and then forms a third. Umicore asserts that there is no second phase. In its challenge, Umicore will rely in part on new research at Lawrence Berkeley Laboratory that suggests that NMC is in fact fundamentally a single-phase chemistry, Weekes said.

BASF declined to directly address Umicore’s claim regarding the chemistry.