The market expects, and pretty much demands, another giant Chinese government spending spree

Global markets expect the Chinese government to dig into its deep pockets once again for another round of stimulus spending.

Global markets expect the Chinese government to dig into its deep pockets once again for another round of stimulus spending.

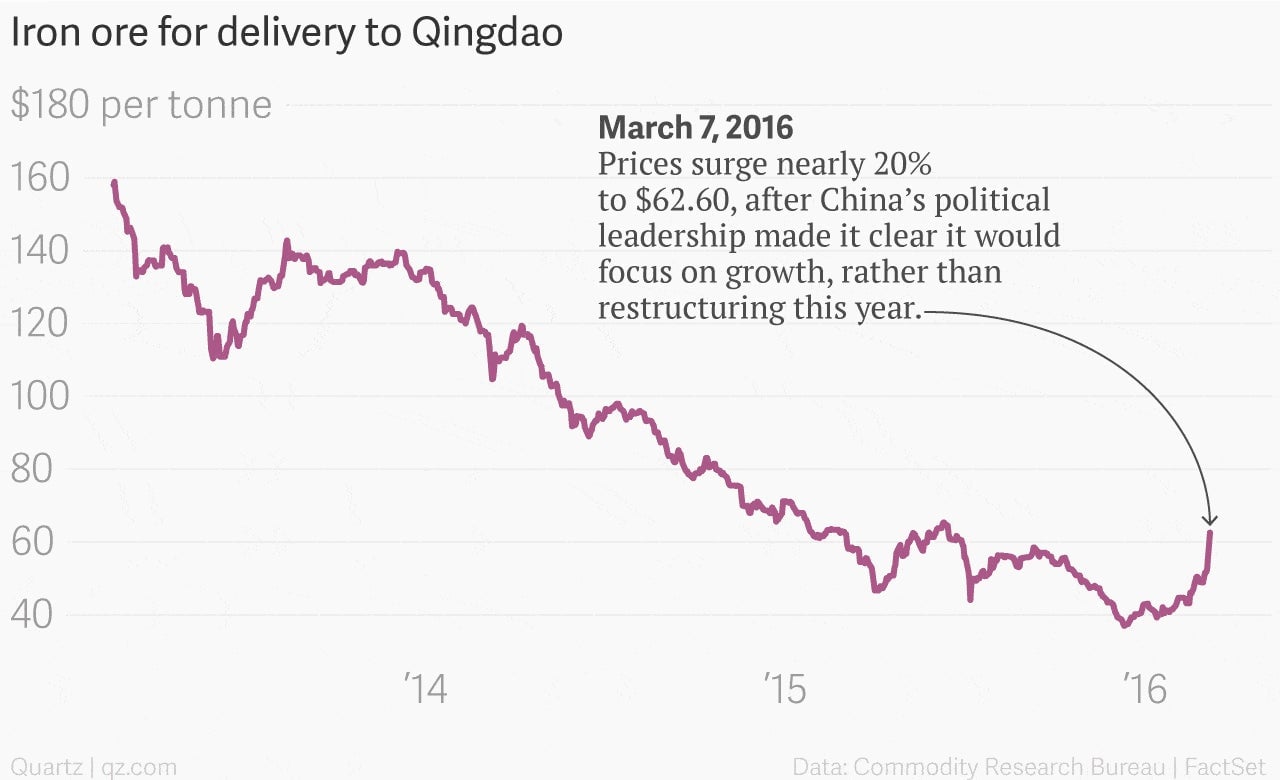

That’s one way to interpret the 19.5% surge in the price of iron ore set for delivery to the northeastern port city of Qingdao today.

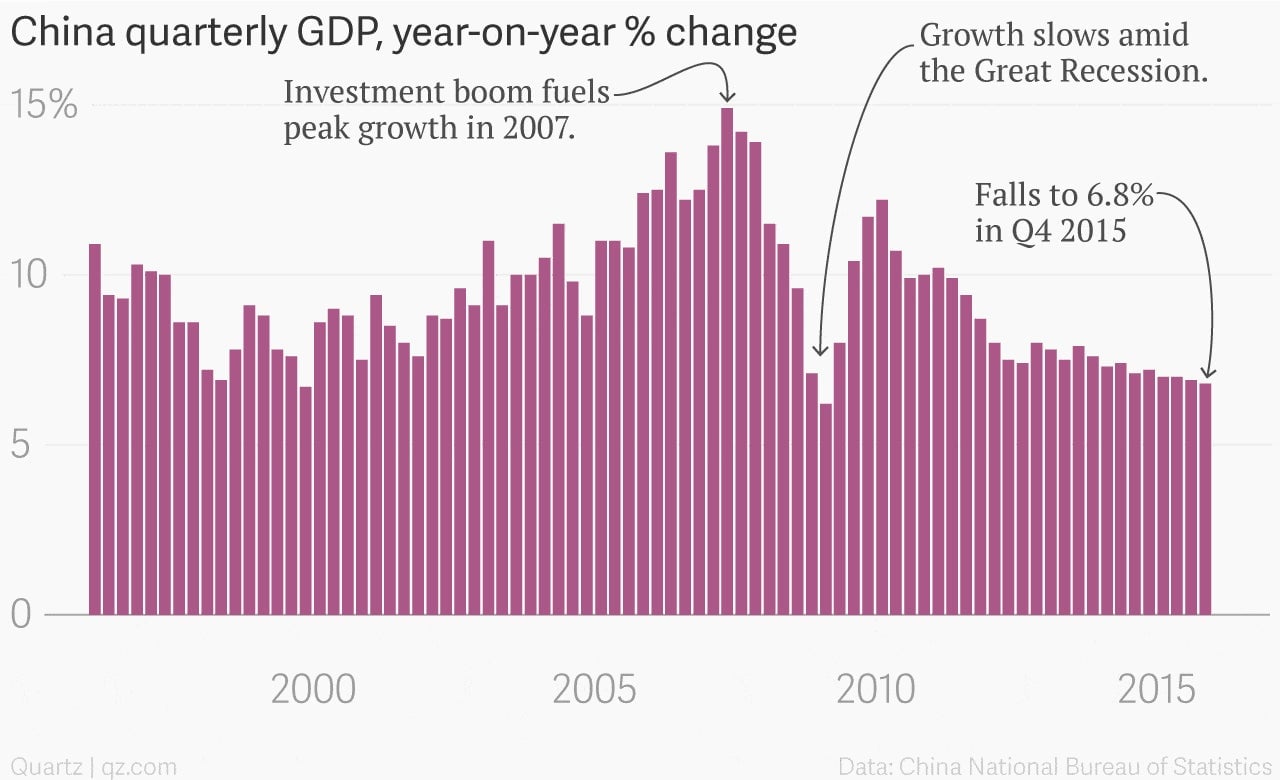

The price rise followed pronouncements at the start of China’s National People’s Congress this weekend that China’s leadership would keep trying to thread the needle by balancing slowing economic growth, rising debt loads, a weakening industrial sector and expectations that China can continue to raise living standards.

Maybe.

The surge in the price of iron—a key ingredient for steel—suggests markets expect a more-of-the-same government spending spree on heavy industry similar to the one that helped Chinese growth rates recover quickly from the Great Recession. In other words, the tough restructuring of China’s heavy industry may wait.