American household net worth just hit another record high

If the US were one giant household, it would be an incredibly rich one.

If the US were one giant household, it would be an incredibly rich one.

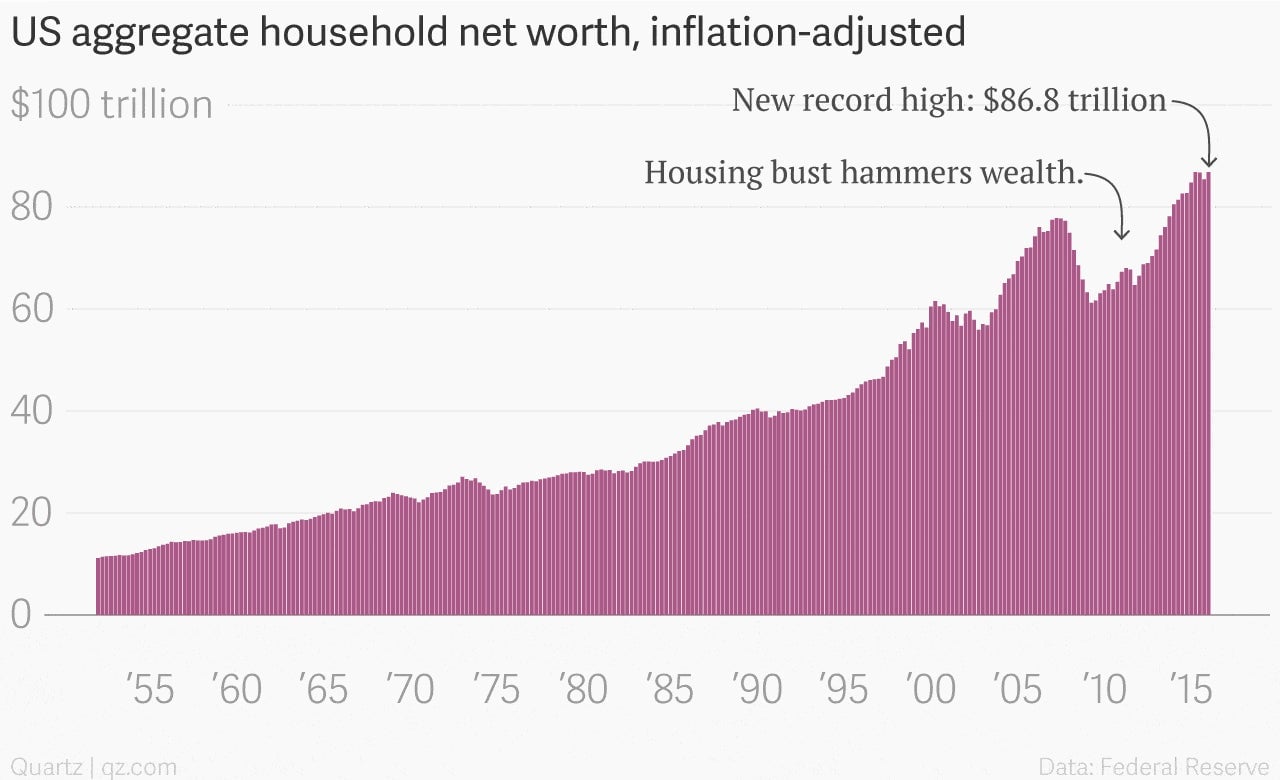

Aggregate net worth of US households and nonprofits—as reported in the Federal Reserve’s quarterly national accounts update—hit a new record high of $86.8 trillion during the fourth quarter of 2015.

Rising levels of homeowner equity and a stable stock market—remember, this is last year’s fourth quarter; the numbers don’t capture the market’s ugly start to 2016—drove wealth up to its new peak. On the whole, this is good news. It means that the deep damage done by the housing bust and the Great Recession are fading into history.

Of course, the US isn’t one happy household. In fact, at the end of 2015 there were roughly 118 million US households, and the Fed’s report doesn’t contain much information on how that $86.8 trillion in wealth is split up among them (nor non-profits, which also are included under the rubric of “household” in the Fed’s data).

What we do know is that ownership of financial assets—paper investments such as stocks and bonds—tends to be heavily concentrated among the wealthiest sliver of Americans. And for what it’s worth, French economist Thomas Piketty’s work suggests that the richest 1% of Americans owned about one-third of the country’s wealth in 2010. If that proportion held, that would be equal to about $29 trillion in wealth in 2015.