If the Fed wasn’t already thinking of holding rates steady, it certainly ought to now

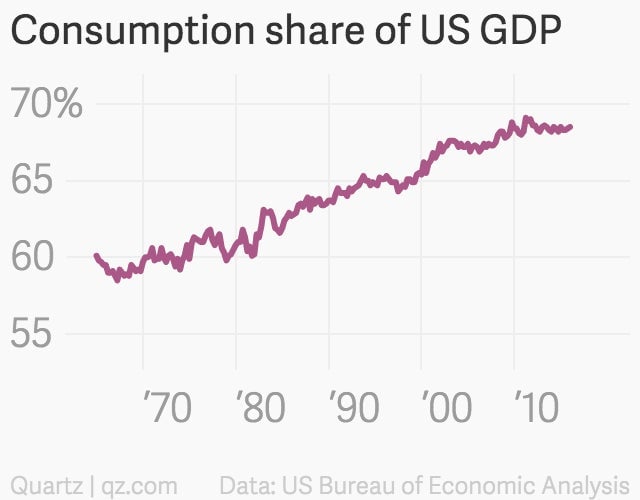

As a share of GDP, US personal consumption accounts for roughly 70%.

As a share of GDP, US personal consumption accounts for roughly 70%.

So if consumers aren’t consuming, you’ve got a problem.

Which brings us to today’s update on US retail sales. The headline number was flat, driven by a large decline in sales of gasoline (due to lower prices) and a slowdown in auto purchases.

In theory, lower gas prices should be a good thing, freeing up cash to be spent elsewhere. But even so-called “core retail sales,” which excludes gas, autos, building materials, and food services, was completely flat on the month. What’s more, the statistical eraser came out and revised down a previously peppy January core reading of 0.6% growth to a skimpier 0.2% month-on-month gain.

This isn’t a disaster. And to some extent it should be expected as the wobble of the stock market seemed to give consumers jitters in the opening moments of 2016.

But it’s still worth thinking about as the Fed begins its two-day monetary policy meeting today (March 15), with a decision due tomorrow afternoon. Hardly anyone now expects an interest rate increase at this meeting, although it wasn’t too long ago that many Fed watchers thought the US central bank would raise rates regularly throughout 2016 after getting the ball rolling on rate increases at the end of 2015.

As things have settled down in financial markets, expectations are again growing that the Fed will return to the rate-hike routine later this year, perhaps in June. The Fed should go very slowly here, though, not only because of the market gyrations that followed its first rate hike, but because there are some real signs that the Fed’s years-long effort help the labor markets are starting to take root in a meaningful way—and it would be a pity to jeopardize this.

For instance, labor force participation has shown a surprising uptick in recent months as people are being drawn back to work.

These gains could be a blip. Or they could be the start of a very good thing. And the Fed should see how much further it can go in order to pull people back to work.

After all, if the economy depends on consumers to consume, it probably wouldn’t hurt if a few more of them had jobs.