Stocks and euro fall as Cyprus bank levy reignites fears of euro zone bank runs

This post has been corrected.

This post has been corrected.

European markets swooned today as the incredibly lousy deal for Cypriot depositors set off fears of bank runs in other euro zone countries, notably Italy and Spain. As Citi’s Steven Englander explained in a note (paywall), ”The issue is whether to believe that the Cyprus levy on depositors is one-off, but depositors and investors elsewhere could easily see this as another in a string of ‘one-offs’ and react badly.”

Markets across Europe tanked throughout the day: Euro Stoxx 50 was down 1.70%, as the FTSE 1000 fell 0.79%. The euro fell 0.98% against the dollar as of 7:44 am (EST), up somewhat from the 1.5% slide that marked the biggest drop in 14 months.

The gloom spread as US stock index futures dropped as well, with S&P 500 June contracts falling 0.9% as of 7:27% a.m. (EST). Patrick Spencer of London-based Robert W. Baird & Co. told Bloomberg that investors should expect “increased choppiness in the market and a bit of flight to quality today.”

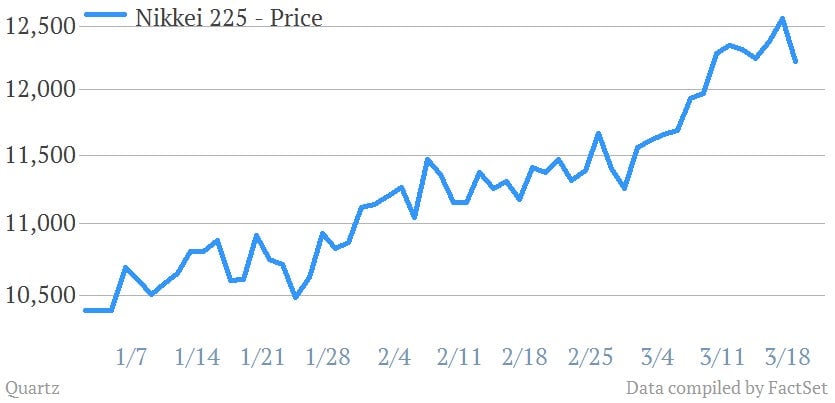

That trend already sent the yen up sharply against other major currencies today—it gained 0.33% against the dollar—likely due to its safe haven status (other conservative faves like US Treasurys, German bunds and gold also rose). Meanwhile, the Nikkei tumbled 2.7%, which was the biggest fall since May. Here’s a look at that drop in a larger context:

Correction 11:28am, March 18, 2013: This post was corrected to reflect that the earlier 1.5% drop, and not the 0.98% drop, was the biggest decline in 14 months.