Stock exchanges are devouring each other because no one buys individual stocks anymore

Jack Bogle has won.

Jack Bogle has won.

It’s pretty clear that we’re living in the age of the retail index fund—the dirt-cheap investment product that aims to mirror market performance rather than beat it. (Bogle fathered the retail index fund as founder of the Vanguard Group.) Even the most brick-brained observer could spot the trend in the data:

The collapse of the stock market during the financial crisis and the Great Recession convinced US investors that actively managed funds, which aim to do better than broad market gauges such as the S&P 500, just weren’t worth the fees. (Research by finance professors had been saying so for decades.) It’s clear where things are going. PWC estimates (pdf) that money will continue to flow into index products, pushing the share of passively managed assets under management from 11% of global assets under management to 22% by 2020.

The rise of low-fee index funds has been a problem for the financial entities that have feasted on fees over the decades, for instance, stock exchanges. Today’s announcement that the London Stock Exchange Group and Deutsche Börse would very much like to get together and create a $30 billion entity reflects that fact.

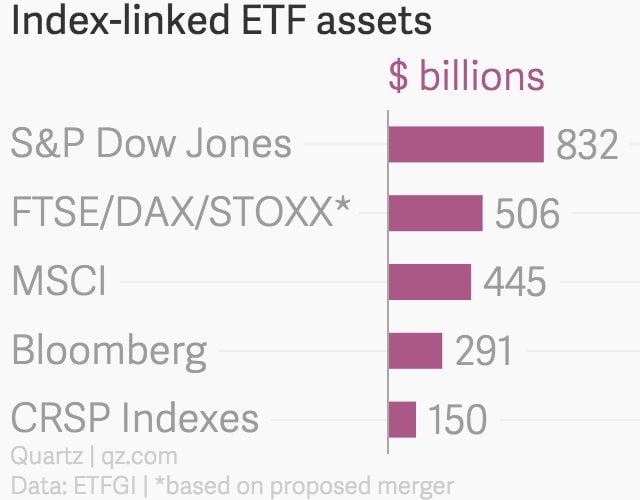

Because of the difficulty they’ve had generating top-line growth, exchanges have been increasingly forced to combine in an effort to cut costs and preserve profits. And in the low-fee index world, this is even more important. As Moody’s analysts noted when word of a possible deal between these two emerged back in February, the deal could help make the important index business more profitable. The “combining of [Deutsche Börse’s] STOXX index franchise with LSEG’s FTSE Russell Indexes business will create the second-largest global player in indexes, and duplicative management and support functions will likely be cut and consolidated.”

Oh, and if you’re interested in knowing more about Bogle, check out this Bloomberg interview with him.