Cyprus may spare small-time investors in the most worrisome piece of its bailout plan

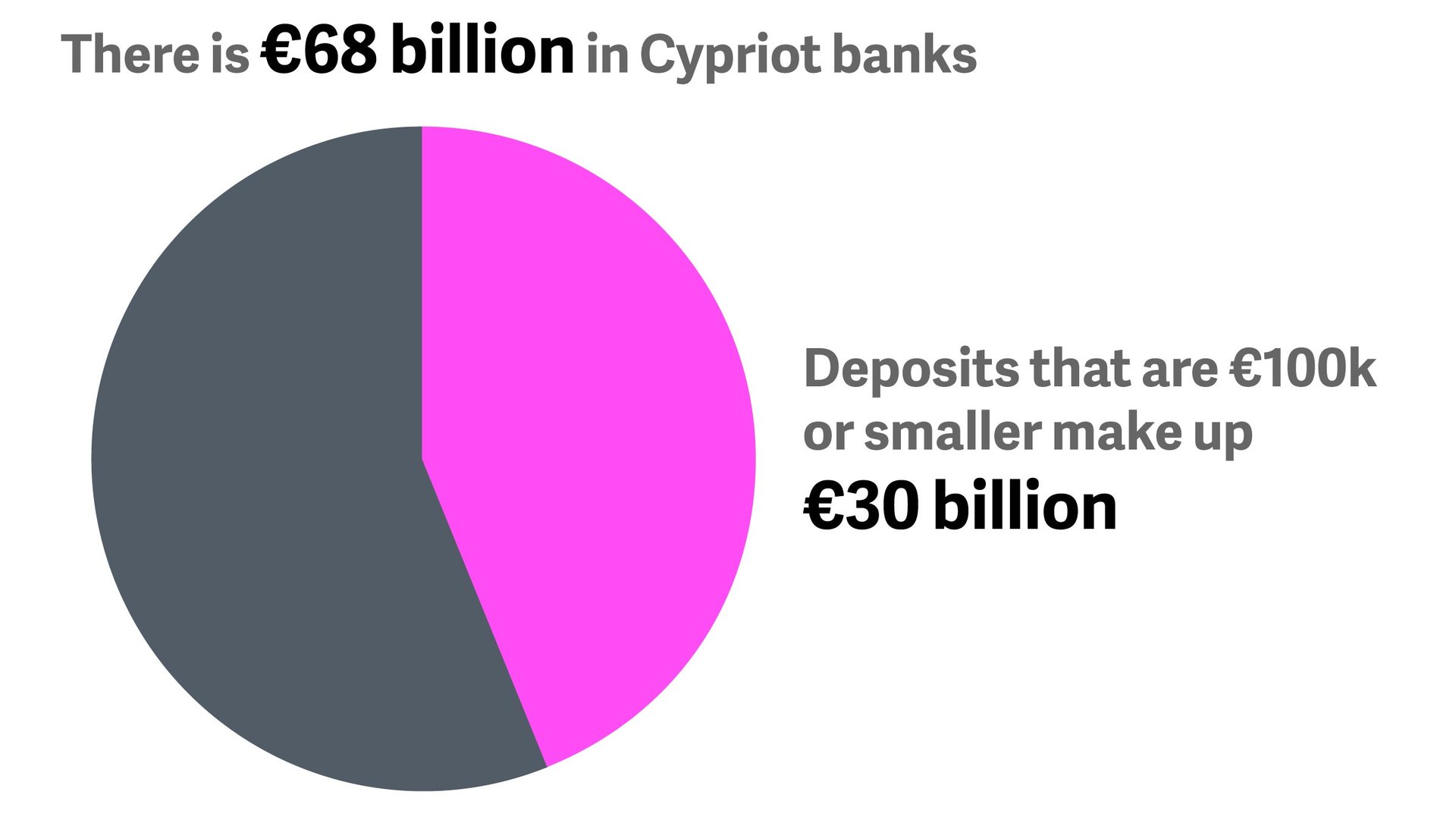

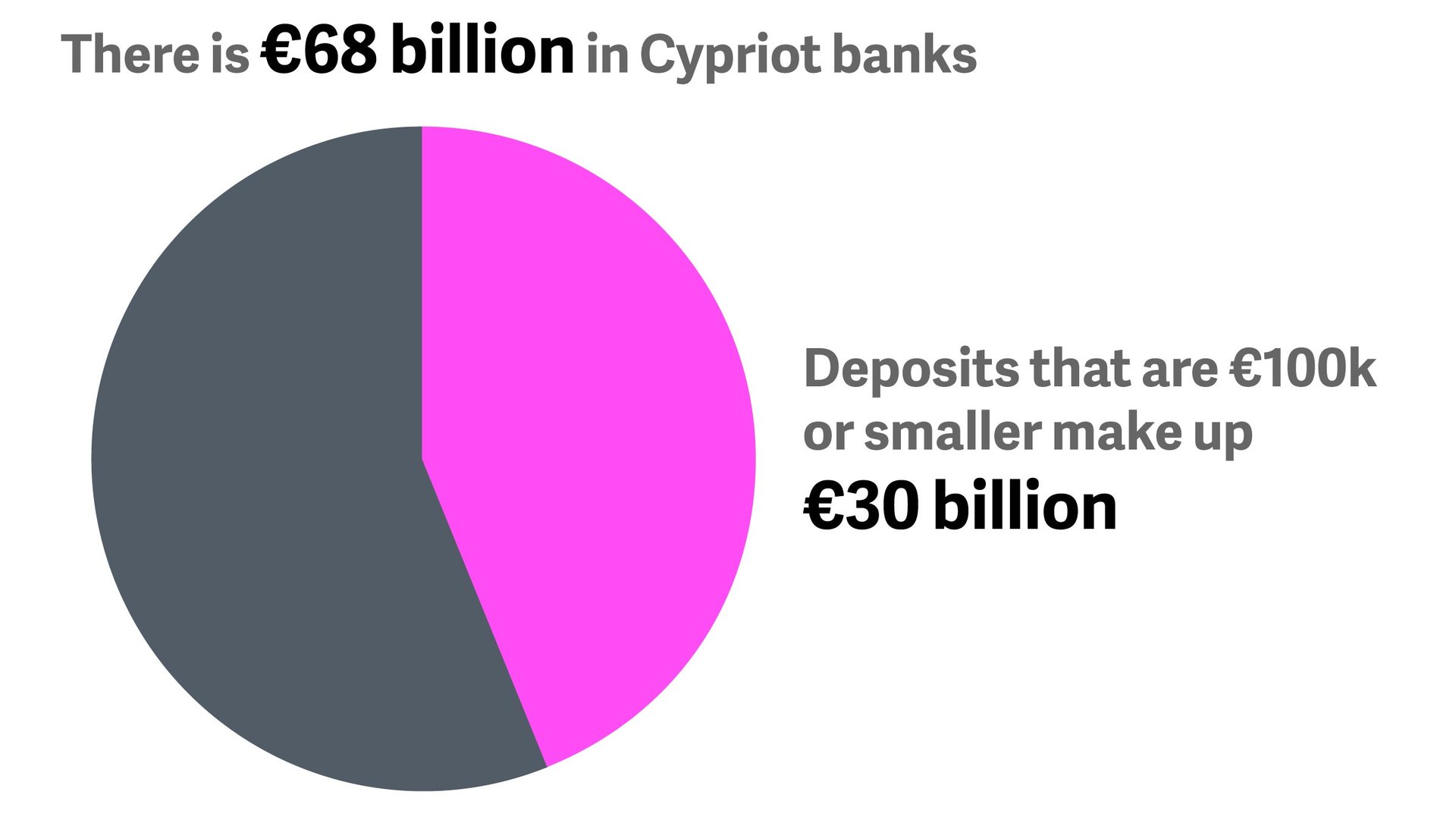

Cypriot pensioners can breathe a little easier. Jeroen Dijsselbloem, president of the Eurogroup (the euro zone finance ministers), announced in a teleconference late on Monday (March 18) that the troika will give Cyprus more leeway to determine the tax levied on depositors with less than €100,000 ($130,000) in the bank, paring back the most controversial piece of a bailout plan for the country that was announced on March 16. At that time, European leaders had decided that depositors would pay a 6.75% tax on their holdings up to €100,000, and then 9.9% on every euro thereafter. They hope this plan will raise €5.8 billion, alongside €10 billion of European financing, to help put the country’s failing banks on a more solid footing.

Cypriot pensioners can breathe a little easier. Jeroen Dijsselbloem, president of the Eurogroup (the euro zone finance ministers), announced in a teleconference late on Monday (March 18) that the troika will give Cyprus more leeway to determine the tax levied on depositors with less than €100,000 ($130,000) in the bank, paring back the most controversial piece of a bailout plan for the country that was announced on March 16. At that time, European leaders had decided that depositors would pay a 6.75% tax on their holdings up to €100,000, and then 9.9% on every euro thereafter. They hope this plan will raise €5.8 billion, alongside €10 billion of European financing, to help put the country’s failing banks on a more solid footing.

The plan immediately backfired, however. On the 16th, people ran to banks to withdraw their deposits, and European leaders were forced to declare a bank holiday through Wednesday (March 20). It’s likely that the plan in its current form won’t win approval in the Cypriot parliament, either.

So the Eurogroup is backtracking. Dijesselbloem is giving Cypriot politicians more leeway, though it’s unclear exactly how the final numbers will come out:

The Eurogroup continues to be of the view that small depositors should be treated differently from large depositors and reaffirms the importance of fully guaranteeing deposits below EUR 100.000. The Cypriot authorities will introduce more progressivity in the one-off levy compared to what was agreed on 16 March, provided that it continues yielding the targeted reduction of the financing envelope and, hence, not impact the overall amount of financial assistance up to EUR 10bn.

If authorities decided not to tax the first €100,000 of any deposit, then they would have to impose a 15.26% tax on every dollar over that, according to Reuters data. Other rumored proposals floating around include not taxing deposits below €20,000, or reducing the levy on deposits below €100,000 to 3%. As it stands, this would allow the country not to stand behind deposit guarantees on the first €100K invested in any account, which would set a dangerous precedent.