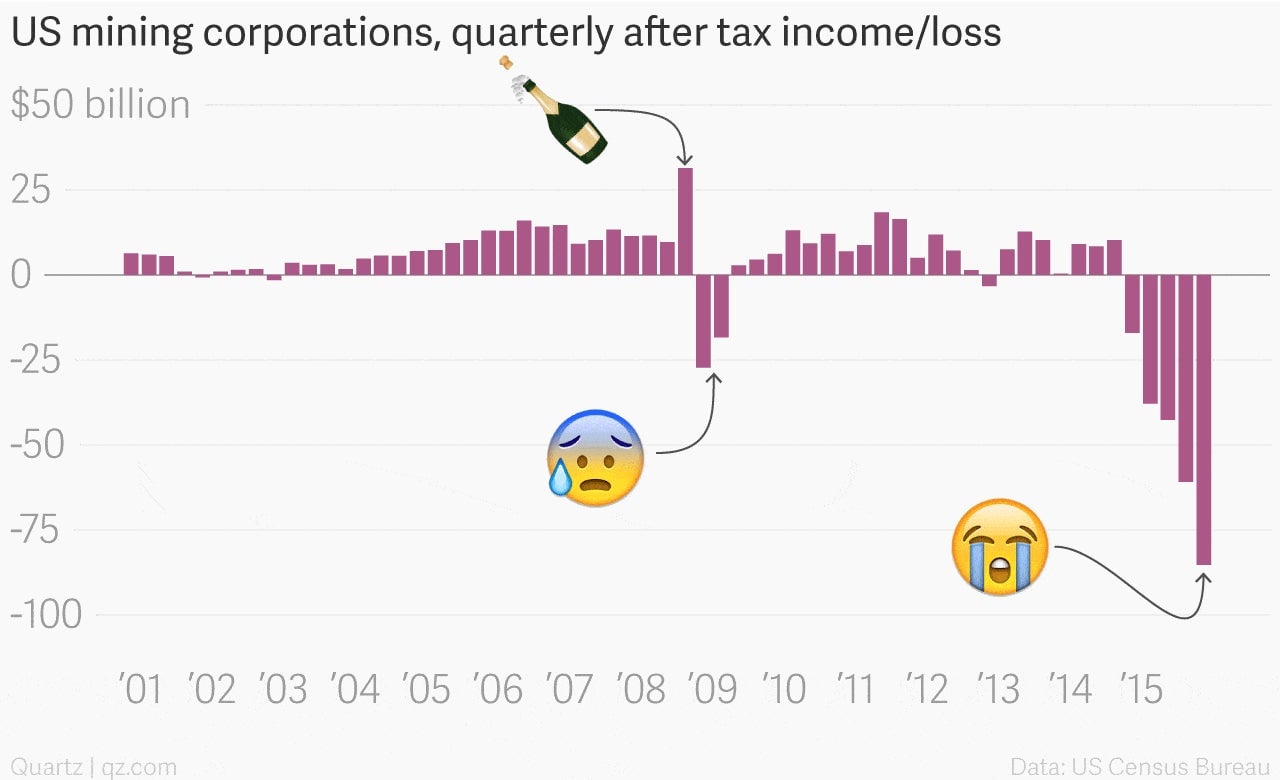

Only emojis can show you just how painful the commodities bust has been

This is what a bust looks like.

This is what a bust looks like.

If you’re in the business of digging old carbon or minerals out of the ground, these are not good times.

After-tax losses for large US mining companies ballooned to more than $85 billion in the fourth quarter of 2015, even worse than the more than $17 billion in losses during the same period of 2014, according to new data from the US Census Bureau. (The mining sector includes companies that mine, coal, crude oil and natural gas, as well as related processing industries.)

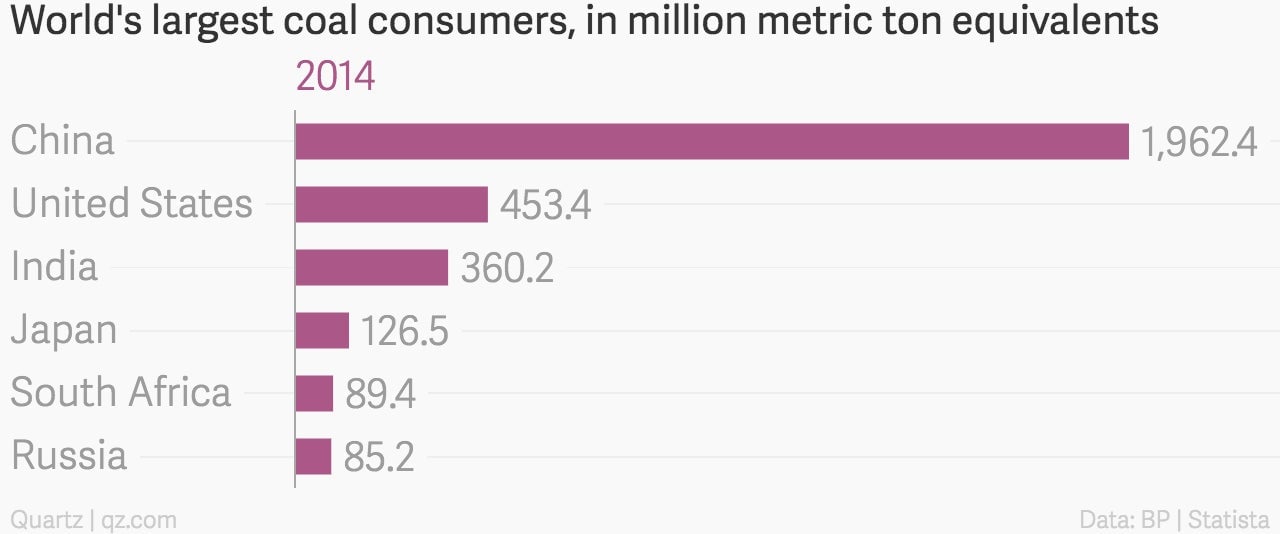

The historic collapse of oil prices isn’t the only story. Coal companies are also in dire straights. Last week Peabody, the world’s largest private coal miner, disclosed that it might have to seek bankruptcy protections. Moreover this is a global story deeply tied to the economic downturn in the world’s biggest coal addict, China.