Caterpillar’s slumping machinery sales could portend trouble in emerging markets

For a long time, global machinery giant Caterpillar has been viewed as a smart way to play the resource boom in emerging markets and Asia-Pacific nations such as Australia, where Caterpillar’s massive machines dig up the raw materials that are then stuffed on ships and floated to resource-hungry China.

For a long time, global machinery giant Caterpillar has been viewed as a smart way to play the resource boom in emerging markets and Asia-Pacific nations such as Australia, where Caterpillar’s massive machines dig up the raw materials that are then stuffed on ships and floated to resource-hungry China.

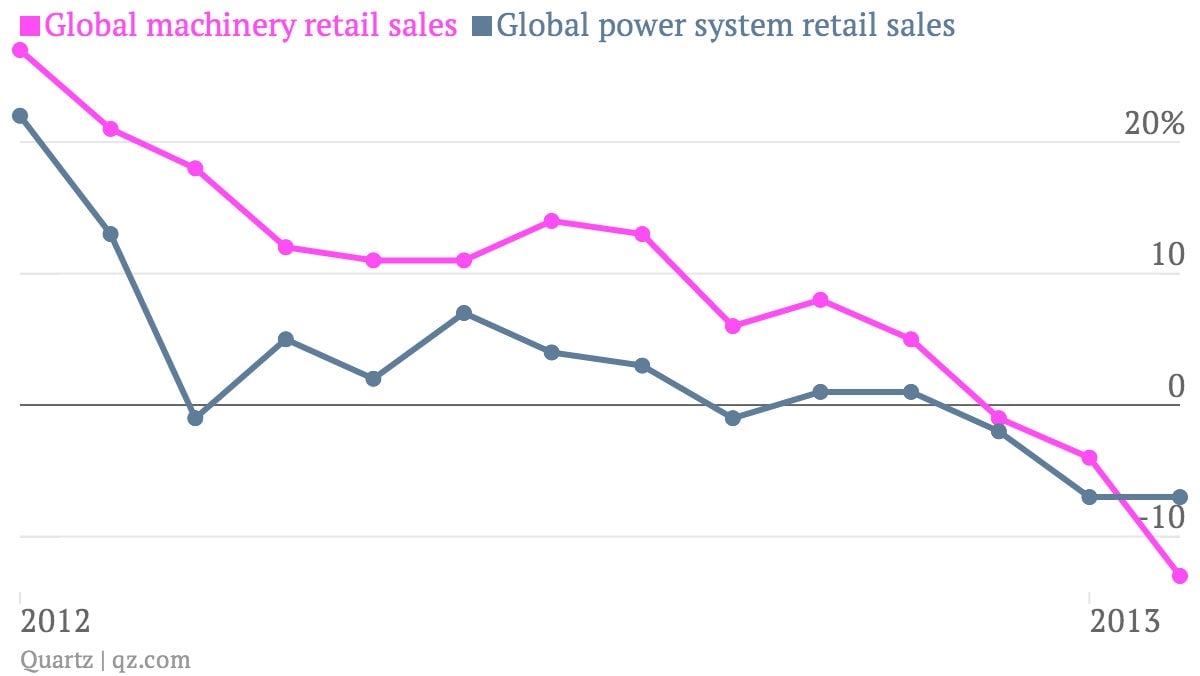

So fresh data showing an ongoing sales slump in Caterpillar’s global dealer network should give those bullish on the emerging markets some pause. Here’s a look at the numbers, which are a three-month rolling average of sales at dealers, compared to the same three months of the prior year. Can you spot a trend?

We’ll give you a hint. It ain’t “up.” The worst downdraft in retail sales is centered in the Asia Pacific region. But over all, the trend seems to be the same. Below are the regional breakouts for machinery sales. Asia Pacific is leading the push lower with average sales for the three months ending in February down 26% from the same period a year earlier.

This shouldn’t come as a complete surprise. In its last earnings call, Caterpillar spotlighted softness in the mining sector, where customers seemed to be tamping down their spending after a big bump in 2011 and early 2012. Speaking on CAT’s fourth-quarter call back in January, executive Michael DeWalt said:

We had massive orders, very large orders in mining throughout much of 2011 and really through almost the entire first half of 2012. That’s when sentiment changed, I think, in the world economy. It was evident that China was softer. You had an easing of commodity demand, although overall mining activity actually did go up in 2012. So orders on hand were quite significant, and over the past six months, customers have really eased off on ordering. It did start to pick up a little bit late in the fourth quarter, but it’s certainly not what we would consider to be at a sustainable level. It needs to go up from here.

No one is saying that growth in the emerging world is falling off a cliff. But the financial markets are all about expectations management, and the fact that Caterpillar shares slipped about 1.5% on this well-telegraphed news suggests that there could be a bit of excess optimism among investors about the prospects for a further spurt of growth in emerging markets.