There are still some questions for Elon Musk to answer about the Tesla Model 3

Silicon Valley’s one and only car company (so far) just announced a low-cost vehicle. Today, we look at the key challenges Tesla will face on its way to the pinnacle.

Silicon Valley’s one and only car company (so far) just announced a low-cost vehicle. Today, we look at the key challenges Tesla will face on its way to the pinnacle.

Elon Musk is on a roll. Last week, Space X, Musk’s space exploration and transport company, managed the feat of putting a NASA payload into orbit and getting the rocket’s first stage to come back and gracefully land upright on a barge at sea.

A week earlier, Musk announced the Tesla Model 3: Five seats, 0 to 60 mph (95 kmh) in less than six seconds, a range of 215 miles, and, of course, the company’s advanced electronics inside and elegant trademark style outside…all for a reasonable $35,000.

325,000 people paid $1,000 each for a place in the delivery queue.

The launch-day enthusiasm was a big, encouraging surprise, even for the many Tesla fans in Silicon Valley. The pre-order number—for a car that won’t be delivered until late 2017—validates Elon Musk’s vision and confirms Tesla’s brand power. As the respected and curmudgeonly industry writer Bertell Schmitt reminds us, the last time we saw such an automative frenzy was in 1955 when Citroën wrote 12,000 orders on the day it launched its epoch-making DS 19.

(If we add in some compound interest over 61 years, 12,000 orders in 1955 is more impressive than I initially thought. I remember the launch, and even as a very young man I pored over the DS 19’s key innovations: hydropneumatic suspension, braking system, robotized gearbox, and so on. Only later did I realize that the design of the production process trumps product engineering prowess.…)

For Tesla and its Model 3, I see three post-announcement challenges: cost, production, and competition.

Regarding cost

If you walk into a Tesla dealership today, you’re looking at $100,000 in order to drive out with a new electric vehicle; a loaded Model X SUV will set you back $140,000. The Model 3 proposes what I call a “lower price but no punishment” product position. The trick to be performed is getting to the $35,000 price point without “punishing” the customer or the company, without destroying user experience or the brand.

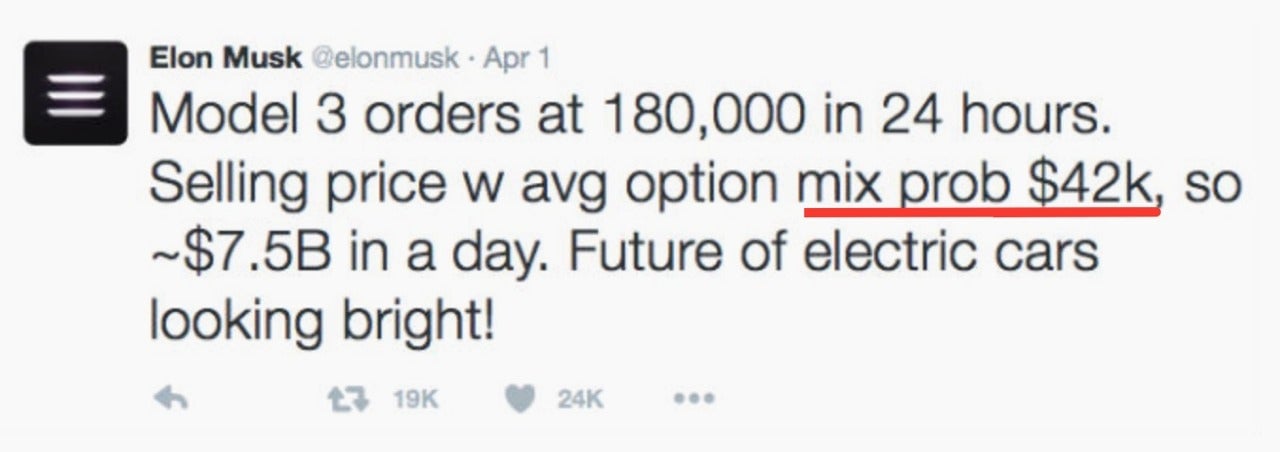

Actually, Elon Musk think the average selling price will hover around $42,000:

Even with this small price bump, some features will have to be removed… but which ones? What do you remove without falling into the de-contenting pit from which few brands escape? (The opposite, “tarting up,” is also a hard slog, just ask General Motors.)

A look at some choice examples shows us that it can be done. In 1983, Mercedes came up with the surprisingly good W201, marketed as the 190 series. Styled by Bruno Sacco, one of the greatest of his profession, the smaller “Baby Benz” looked good, felt good, and cost much less than the S (for Spitzenklasse) without besmirching the marque. Today, the C Class, the W201’s successor, starts at $40,000 while the S Class hovers above $100,000.

Perhaps Tesla will be able to offer what Mercedes and others such as BMW and Audi excel at: The same sausage, at three lengths.

Production is a much tougher challenge

According to the company’s Q4 2015 shareholder letter (a very good read), Tesla delivered 52,000 vehicles in 2015 and plans to deliver 80,000 to 90,000 new vehicles in 2016 (the chart below shows cumulative deliveries):

This helps put Model 3’s 325,000 orders in perspective. Skeptics will point, with reason, to Tesla’s habitual lateness and say “late 2017” probably means sometime in 2018, but that just delays the challenge of moving output from 80,000-90,000 in 2016 to more than 300,000 within two years.

Tesla’s past performance provides no guidance either way: 2014 output more than doubled 2013’s, but 2015 failed to repeat the feat. In explaining the slow deliveries of last year’s Model X, the company admitted its own hubris in a shareholder letter [as always, edits and emphasis mine]:

The root causes of the parts shortages were: Tesla’s hubris in adding far too much new technology to the Model X in version 1, insufficient supplier capability validation, and Tesla not having broad enough internal capability to manufacture the parts in-house. The parts in question were only half a dozen out of more than 8,000 unique parts, nonetheless missing even one part means a car cannot be delivered. Tesla is addressing all three root causes to ensure that these mistakes are not repeated with the Model 3 launch.

2016 is forecasted to achieve 80% volume increase over 2015. Tesla says that financing this increase—the price of ramping up production—shouldn’t be a problem. According to the same shareholder letter, the company had about $1.2 billion in cash at the end of 2015 and expects to show a slight increase by the end of 2016, with improved margins and an approach towards profitability.

Today, however, Tesla’s factory produces a relatively low volume of luxury cars. Tomorrow’s Model 3 production system will need to be meaningfully different in order to achieve the volume and cost reductions that the Model 3’s affordable price tag requires… and reducing production costs means an additional capital outlay. Last February, the company said it didn’t expect to need outside capital, but that was before the deluge of Model 3 orders. (Of course, the excitement for the new product could make it easy to raise money….)

It’s an enormous challenge, but if Musk manages to come up with a new, not merely tweaked, production process, Tesla might be on its way to fulfilling its leader’s prophecy of 500,000 cars a year by 2020… but we’d need to hear more about that process. So far, we have little or no information.

Last but not least: Competition

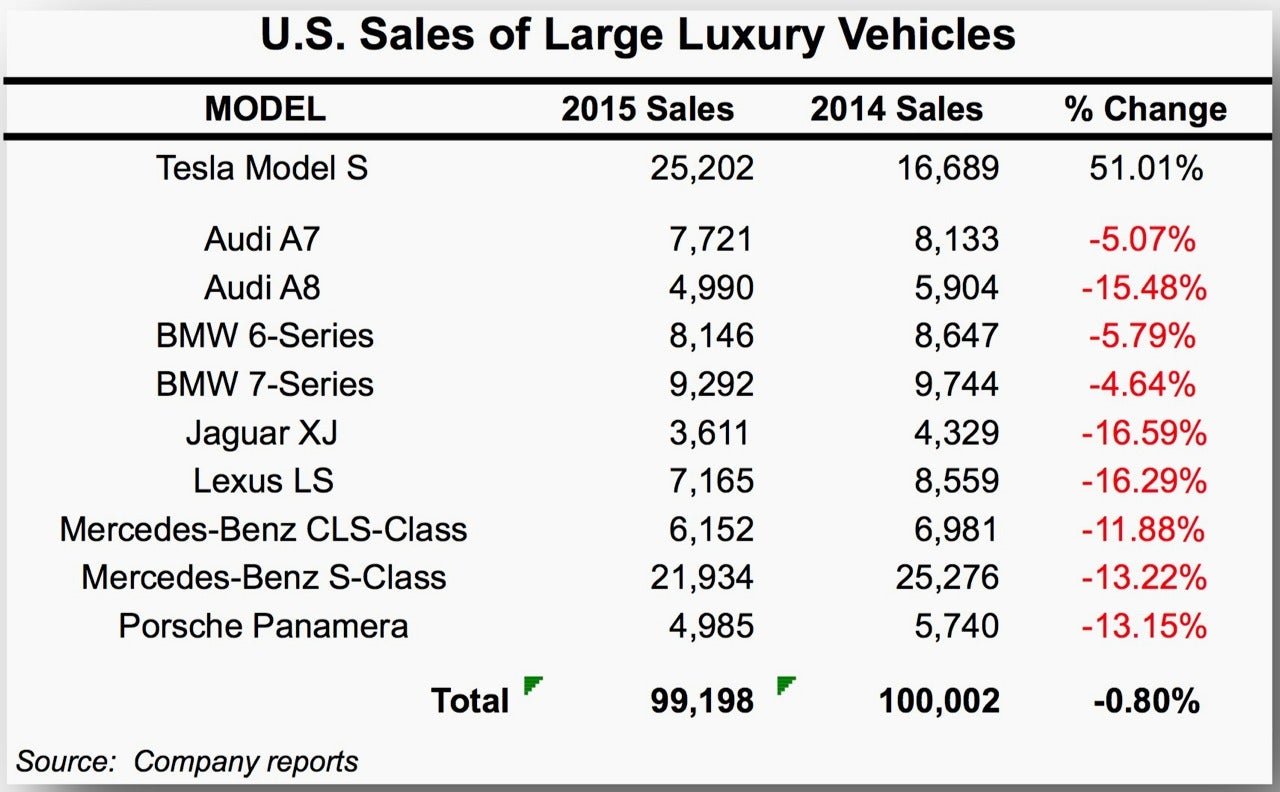

Tesla brags, rightly, about outselling luxury vehicles such as the Mercedes S Class and BMW 7-Series, as this chart of US sales attests (from the same 2015 shareholder letter; Tesla has achieved similar numbers in some foreign markets, as well):

The Model S numbers look very good, but can Tesla’s Model 3 beat its competition in the $35,000-$50,000 segment? This is a much more difficult task when we consider the wide playing field and enormous volumes in that price range: There are millions of Camrys, Accords, and similar vehicles. The field narrows if we limit the Model 3’s competition to the likes of the Nissan Leaf or the newly announced Chevy Bolt, a car whose specs look similar to Tesla’s latest creation—but while Tesla’s style and branding play in the company’s favor, Chevrolet’s vehicle will be available at least 12 months before the Model 3.

Software is another matter. With all due respect to GM engineers, it’s hard to imagine that the Bolt will offer a better user experience than the Model 3. The Model 3 might not reach the superlative experience of the Model S, but we expect it to bear a family resemblance.

But there’s more: BMW’s $42,000, all-electric i3. This is a truly modern car, relying on advanced carbon-fiber design (versus its steel-based competition) and a modern production process. BMW is a determined, well-financed, technically-advanced competitor with proven large-scale production capabilities. The company’s brand is strong, with a good worldwide sales and support network. With all of these pieces in place, will BMW unleash a more advanced i3 successor two years from now, right when Tesla’s Model 3 comes out? This sounds like serious competition on all dimensions.

I’ll only mention the putative Apple Car in passing: It doesn’t look like it belongs in the two-year time frame discussed here and, given Apple’s penchant for secrecy, it lacks “definition” in a ferociously competitive landscape.

Against strong odds and in spite of delays and occasional misfires, Elon Musk has built a truly original electric Silicon Valley car brand that enjoys a passionate following. Converting early enthusiasm for the new Model 3 into cars-on-the-road is a mere matter of implementation, one that will make the next two years quite interesting.

This post originally appeared at Monday Note.