If corporations are people, they’re probably sad people

Profits still matter.

Profits still matter.

This may come as a surprise, given the current fixation among the aspirational business class. They all seem set on joining the elite herd of unicorns now frolicking in the suburbs of San Francisco, blissfully free from the burdens of profitability. And no wonder—generating profits is really hard.

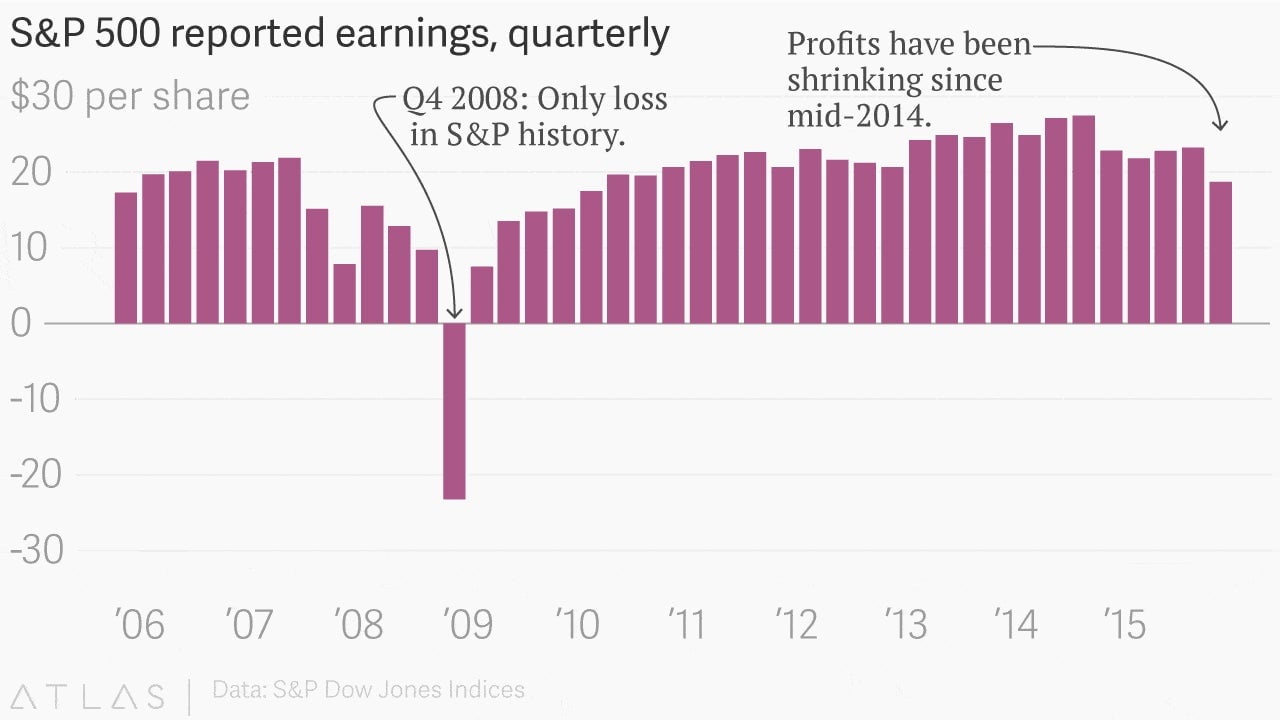

Also hard these days: generating profit growth. Aggregate earnings for companies in the benchmark S&P 500 index have been trending lower for nearly a year and a half.

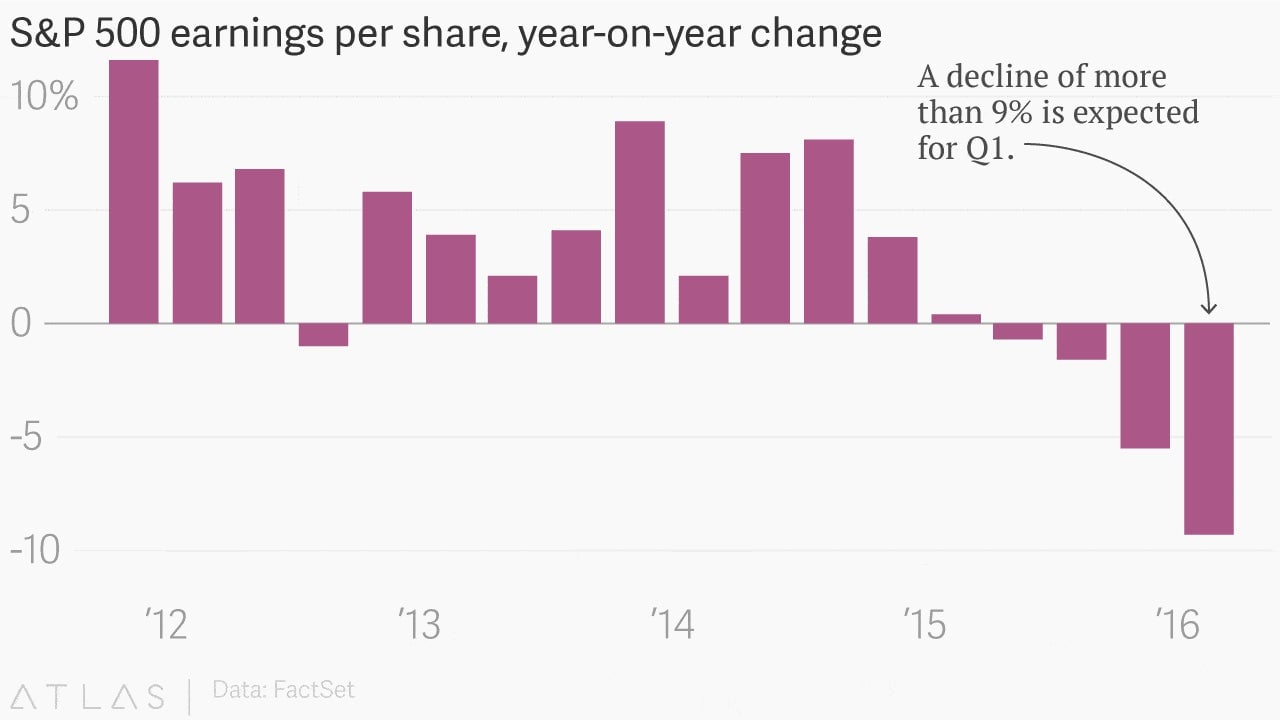

And it’ll likely get worse. According to data provider FactSet, earnings per share for S&P 500 companies is expected to have declined by more than 9% in the first quarter of 2016, compared to the first quarter of 2015. That’d be the worst year-on-year decline since the third quarter of 2009, as the US was emerging from the Great Recession with the shaky legs of a newborn foal.

So is that it? Game over? American capitalism done and dusted?

Nah. A lot of the decline in corporate earnings lately has been centered in the energy sector, which got slammed by the bust in oil prices. According to FactSet, earnings in the energy sector are expected to have fallen by more than 100% during the first quarter. If you stripped out the energy sector, the expected year-on-year decline would be only a bit more than 4%. That’s a bit better, but still not great.