Underground fashion king Hypebeast just had the best stock debut in Asia so far this year

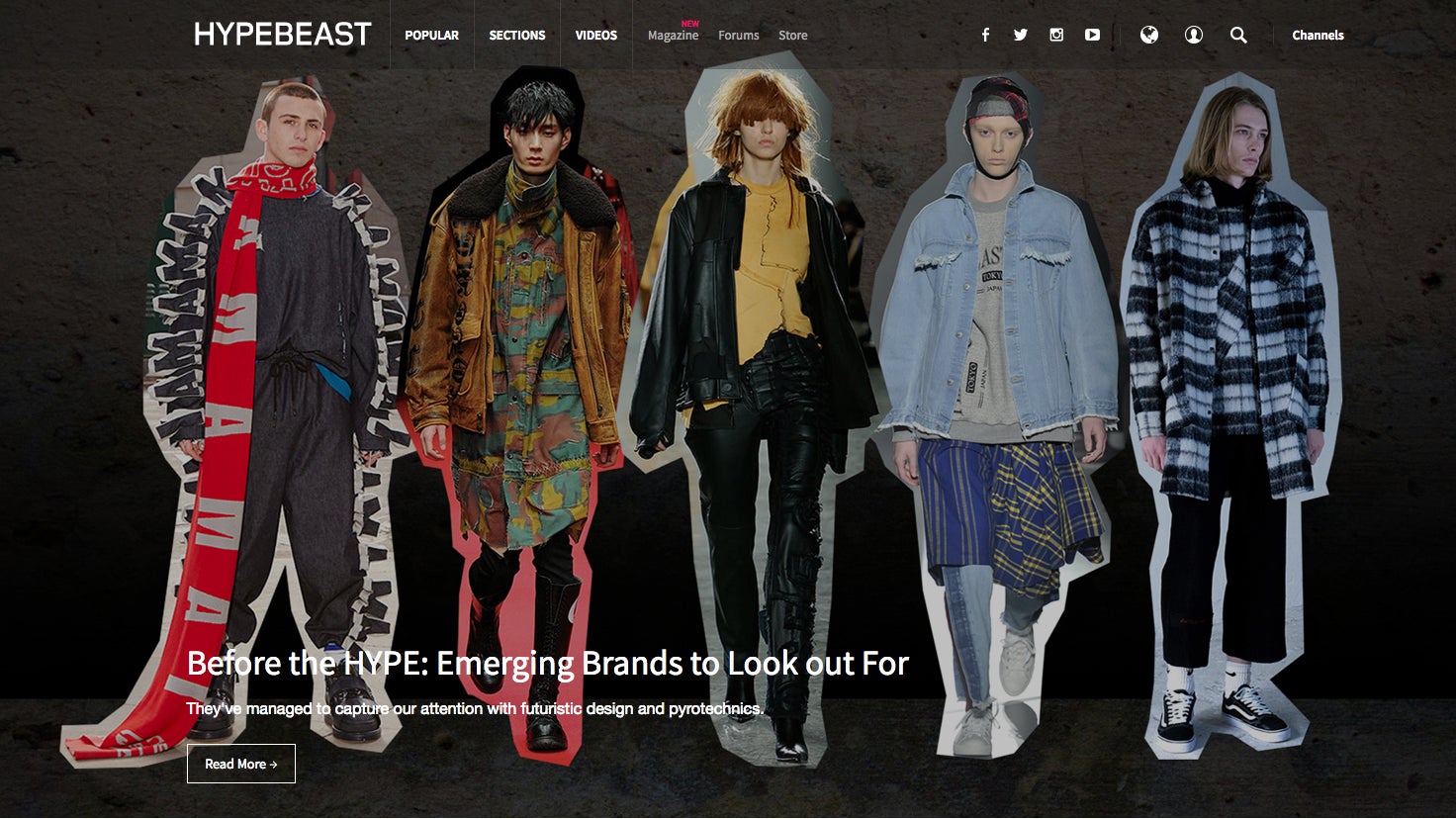

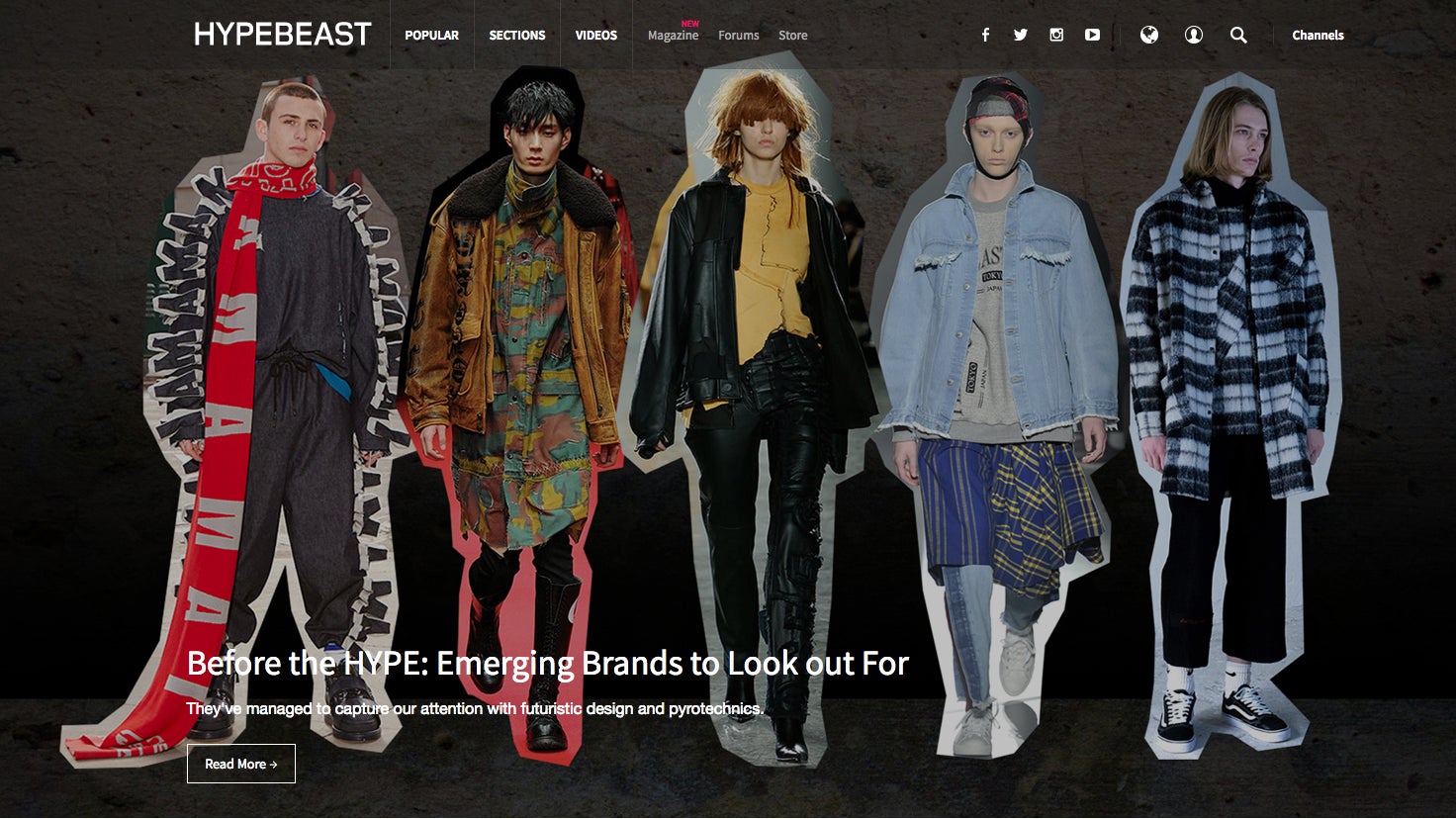

For a lot of young adults in their 20s and 30s, Hypebeast has for years been a blog about what seemed to be a niche of fashion culture. It’s where you go for news about things like sneaker releases, or limited-run collaborations from Japanese designers.

For a lot of young adults in their 20s and 30s, Hypebeast has for years been a blog about what seemed to be a niche of fashion culture. It’s where you go for news about things like sneaker releases, or limited-run collaborations from Japanese designers.

The site was founded in 2005 by Kevin Ma, who started buying imported Japanese magazines while he was a student in Vancouver, Canada, then began writing posts about the latest sneakers and streetwear in Tokyo and Hong Kong. The name is tongue-in-cheek, and refers to the sort of person who buys something because of the hype around it.

The company grew into a publishing empire with offshoot sites, an e-commerce outlet, and a print magazine. It just had its IPO on the Hong Kong’s Growth Enterprise Market (GEM) stock exchange, and incredibly, the stock had the best first day of any Asian company this year, according to Bloomberg.

After raising HK$65 million ($8.4 million) with an IPO price of HK$0.13 on April 11, the shares took off, rising as high as HK$2.80 and closing at HK$1.05. That 708% rise marks Asia’s best first-day performance of 2016, Bloomberg reports, topping the previous record increase for a debut of nearly 700% set in March by Ching Lee Holdings Ltd. At the time of this writing on April 12, the price had steadily risen to HK$1.13, giving Hypebeast a market value of about $271 million.

That’s a big number for a site built on sneakers and designer clothes. Last year, German media giant Axel Springer bought 88% of Business Insider, adding to its 9% stake, for $343 million, giving the company a value of about $450 million. At the time, it had 72 million unique visitors a month. Axel chief financial officer Julian Deutz said the valuation was about six times Business Insider’s projected 2016 revenue, and data compiled by Bloomberg showed such media companies were going for about 2.5 times annual revenue. Hypebeast had HK$99 million (12.8 million) in revenue for fiscal year ended March 2015.

Hypebeast’s market value shows a lot of confidence in the business Ma has built. The company’s digital media sites, which include Hypebeast, a music site called Hypetrak, and women’s site Popbee, now cover everything from art to cars and bring in a good deal of revenue from advertising. According to the prospectus (pdf) Hypebeast filed before its IPO, its sites collectively received around 5 million unique visitors and 46 million total pageviews per month at the end of September 2015. Its average advertising contract was worth $44,500, and at the time it had contracts totaling about $5.6 million.

Brands advertise on Hypebeast because they know it’s influential, and its readers are ready to spend. Hypebeast said in 2013 that 78% of its readers had purchased products they saw on the site. The year before, the company launched its own e-commerce site, HBX, which sells many of the labels Hypebeast writes about. Those sales brought in just over half of Hypebeast’s revenue for the year ended March 2015, though ad revenue is outpacing e-commerce sales so far this year.

Hypebeast’s success also indicates that sneakers, streetwear, and the people on the internet obsessing about them on blogs, internet forums, and resale sites such as Grailed are no longer a niche in fashion. They’re part of a fashion culture that grew up online, and while they don’t quite move the needle for an entire industry the way that, say, moms do, they’re still a powerful market force. Just listen to the investors in Hong Kong.