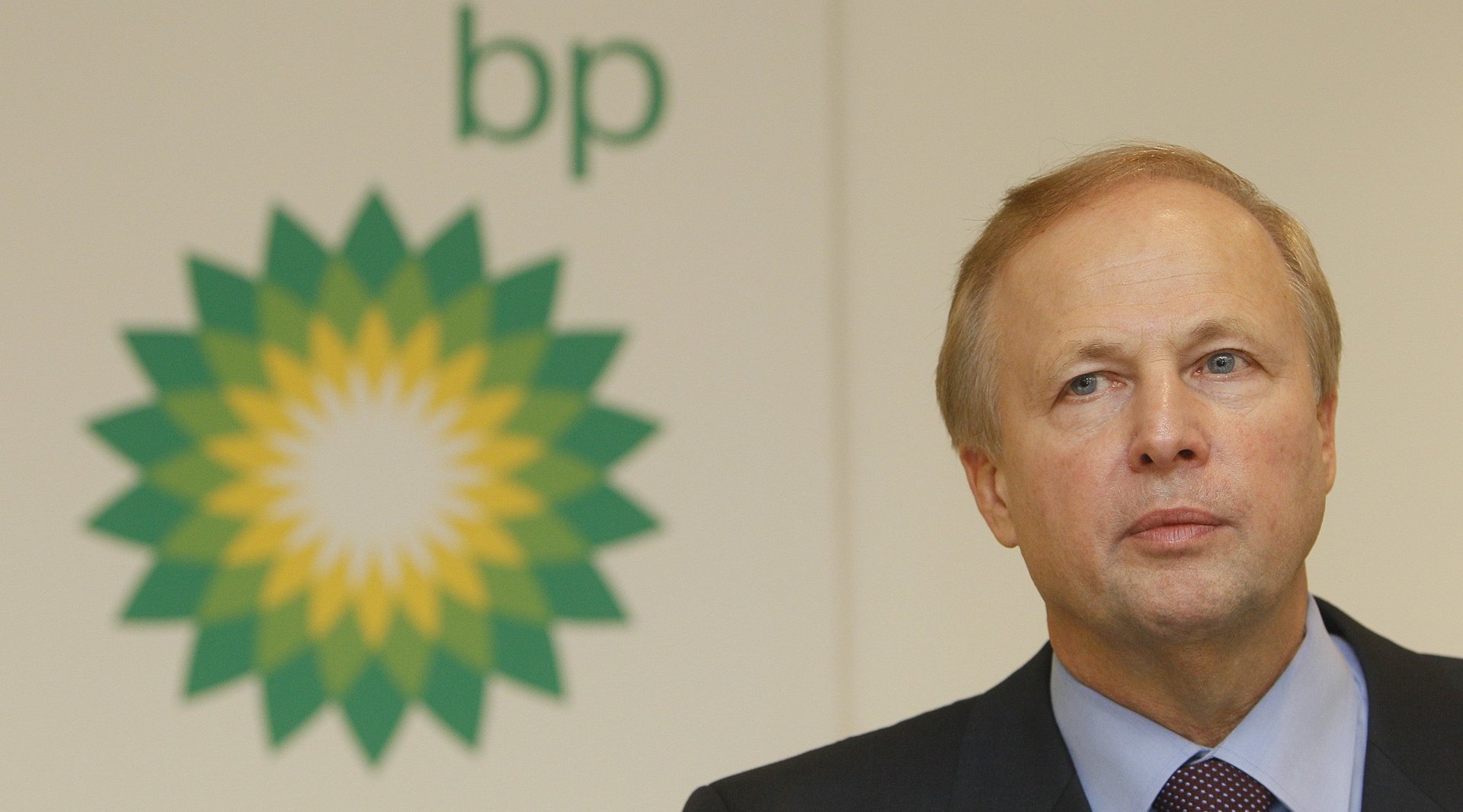

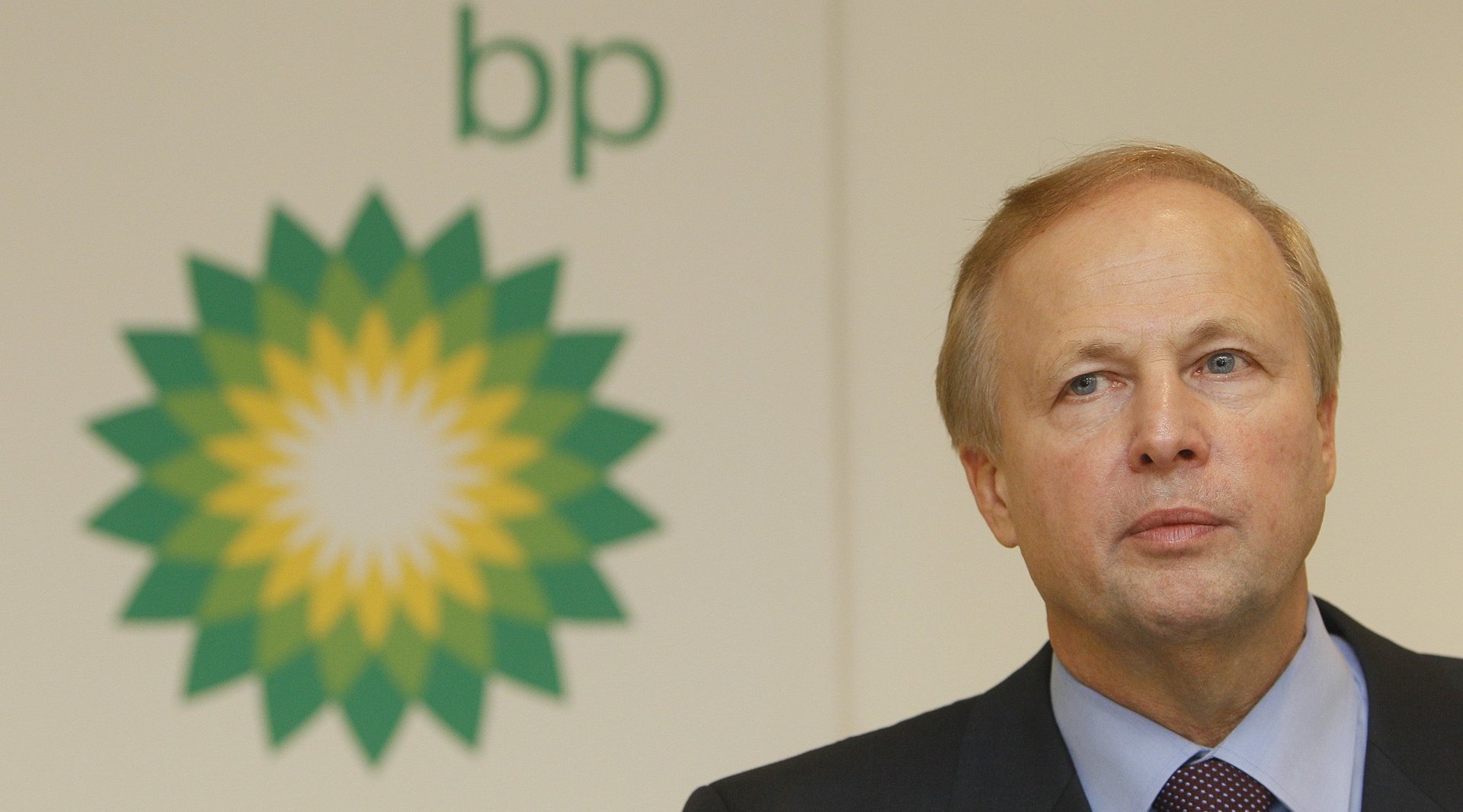

Is $19.6 million too outrageous a pay package for the CEO of BP? Shareholders say yes

Shareholders of BP, the British oil and gas giant, sent a clear message to the company’s board today by voting down recommended 2015 pay for executives that included a 13.8 million pound ($19.6 million) package for CEO Bob Dudley. While the vote left no room for ambiguity, with almost 60% voting against the package, it is non-binding under UK corporate governance rules.

Shareholders of BP, the British oil and gas giant, sent a clear message to the company’s board today by voting down recommended 2015 pay for executives that included a 13.8 million pound ($19.6 million) package for CEO Bob Dudley. While the vote left no room for ambiguity, with almost 60% voting against the package, it is non-binding under UK corporate governance rules.

The board’s reaction? Thanks for your opinion – we’ll get back to you on that.

Or, as Ann Dowling, the board member in charge of pay, told shareholders after the results were announced (according to the Guardian):

We will…review the overall remuneration package. I will report on this next year with our conclusions and with a new proposed policy based on the outcome of this review.

BP Chairman, Carl-Henric Svanberg, was slightly more conciliatory in his remarks.

Let me be clear. We hear you. We will sit down with our largest shareholders to make sure we understand their concerns and return to seek your support for a renewed policy.

BP’s shareholders vote every three years on the company’s pay policy, with the next binding vote in 2017. Today’s vote was to approve–or in this case, disapprove–the report made by the board’s renumeration committee.

The vote was one of the largest and most significant rejections of executive pay for a UK company, and represents growing discomfort with lavish executive compensation. Dudley’s was particularly hard to swallow in a year when the company reported a $6.5 billion loss as oil prices plummeted.

While protests over pay are common among smaller shareholders representing activist groups, the cause was taken up by BP’s larger, institutional shareholders who in past years overwhelmingly supported the recommended compensation. Yesterday, the Institute of Directors urged BP stockowners to vote against Dudley’s pay, a rare step for the a 113-year-old organization that supports good corporate governance.

BP “is not a badly run company,” the institute said in a statement. But pay should be linked to performance, and violating that principle “could send the wrong message to investors and other boards.”

The shareholders spoke. Let’s see how well BP’s board listens.