The stressed assets situation at Indian banks is the worst when compared to most Asian economies.

The share of non-performing loans in the total (gross) loans in the Asia’s third largest economy is the highest among Asian nations, a report released (pdf) by the International Monetary Fund on May 3, shows.

With a 6% bad loans to the total loans ratio, India is worse than even China (1.5%), where these loans are at the highest level in a decade. A loan becomes non-performing or bad when the borrower stops making any principal or interest payments. The IMF data does not include restructured loans.

Here is where India stands in comparison to other Asian economies:

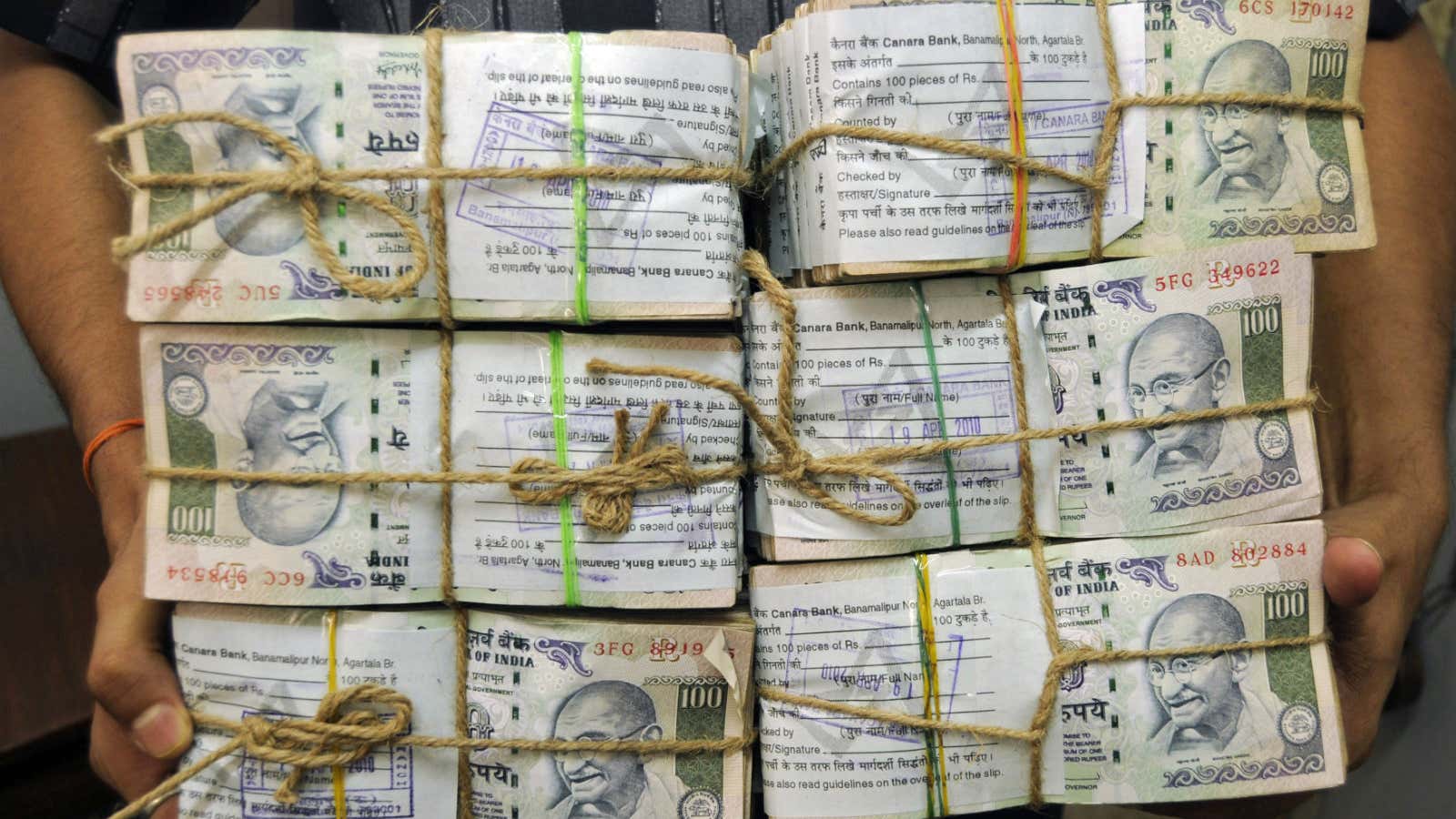

In India, stressed loans are on the rise in public sector banks. As of December 2015, the gross non-performing assets with state-owned banks stood at Rs4 lakh crore ($60 billion).

These loans are already denting banks’ profits with the Reserve Bank of India’s (RBI) drive to clean up balance-sheets. The RBI has asked banks to create provisions to cover for bad loans, which means a large part of their profit goes towards this reserve.

Last week, ICICI bank, the country’s largest private lender, reported a 76% drop in profit for the three months ended March 31, 2015, mainly due to this provisioning.

But RBI governor Raghuram Rajan is pretty confident that this process will help in sorting the mess.

“The market turmoil will pass. The clean-up will get done, and Indian banks will be restored to health,” Rajan said in February.

It better pass.