Apple’s $1 billion investment in Didi is really an investment in its own future

Unexpected news came from the world’s most valuable company today as Apple confirmed it invested $1 billion in Didi Chuxing, the Beijing-based ride-hailing company that rivals Uber in China.

Unexpected news came from the world’s most valuable company today as Apple confirmed it invested $1 billion in Didi Chuxing, the Beijing-based ride-hailing company that rivals Uber in China.

The investment will give Didi bragging rights in the Middle Kingdom, where it can claim to be one of the few companies anywhere to receive funding from Apple. But despite how the $1 billion will sit nicely in Didi’s coffers, Apple is the true beneficiary of the deal.

Didi doesn’t need Apple

Receiving an investment from Apple is cause for celebration at any tech company. But Didi occupies such an enviable position in China that the funding will bring little more than cash for the company, at least in the short term.

If funding is the gasoline for ride-hailing companies, Didi already leads Uber in China. The company has raised $4 billion in secured funding since a merger last year and is valued at $15 billion. Uber China, meanwhile, is reportedly valued at about $8 billion following a $1.2 billion funding round in January. Strong, reliable data comparing the popularity of the companies’ services remains scarce. But company numbers broadly suggest that Didi occupies up to 90% of the ride-hailing market in China.

Moreover, Didi already has funding from the right backers.

In August 2015 news broke that China Investment Corporation, China’s sovereign wealth fund, contributed to Didi’s $2 billion funding round. Government support remains critical for the industry to thrive in China, especially since the ride-hailing business model upsets the taxi industry (which is often affiliated with municipal governments in China) and creates new, complicated labor issues. The wealth fund’s support, therefore, marks one of several indicators that Beijing tacitly supports the spread of ride-hailing.

Didi also has funding from Alibaba and Tencent. As China’s largest internet companies, they have helped Didi expand by promoting its service in e-commerce and social apps. High-profile venture capital firms like Softbank, Tiger Global, Coatue Management, and GGV have also backed Didi. Their support has laid the groundwork for a global anti-Uber alliance that includes Lyft in the US, Grab in Southeast Asia, and Ola in India.

Despite its brand name and influence, Apple is the outlier in this mix of tech heavyweights—a smartphone company amidst a bevy of global investors and Chinese media giants. Apple’s assets in mapping and artificial intelligence could certainly help Didi in the future, if the nascent self-driving car industry overlaps with the ride-hailing industry. But for now, it’s hard to imagine what Apple can bring to Didi that Alibaba and Tencent cannot.

What does Apple gain from Didi?

Apple’s bet on Didi comes just as its access to China becomes more elusive. And access to China is critical for the company’s growth.

Apple has enjoyed success in the Middle Kingdom thanks to the popularity of the iPhone. It now makes almost a quarter of its revenue from sales to China. But its glory days there are fading.

China’s smartphone market is slowing rapidly. While it grew 129% in 2012, it grew just 2% last year.

This means that the bulk of future iPhone sales in China will come from existing smartphone owners, who are harder to court than first-time buyers who have yet to pledge allegiance to a brand.

If the iPhone won’t sell in China like it used to, how will Apple maintain its sales? The answer, both in China and elsewhere, is “services”—a broad category that includes money from media (Apple Music, Apple TV), the app store, and other software.

Its efforts to turn “services” from a side business into a real business remain nascent. But its prospects for doing so in China already look grim. In April the company confirmed that it had shut down its iTunes movie store and iBooks store in China. According to the New York Times, government pressures made it impossible to keep them open (paywall).

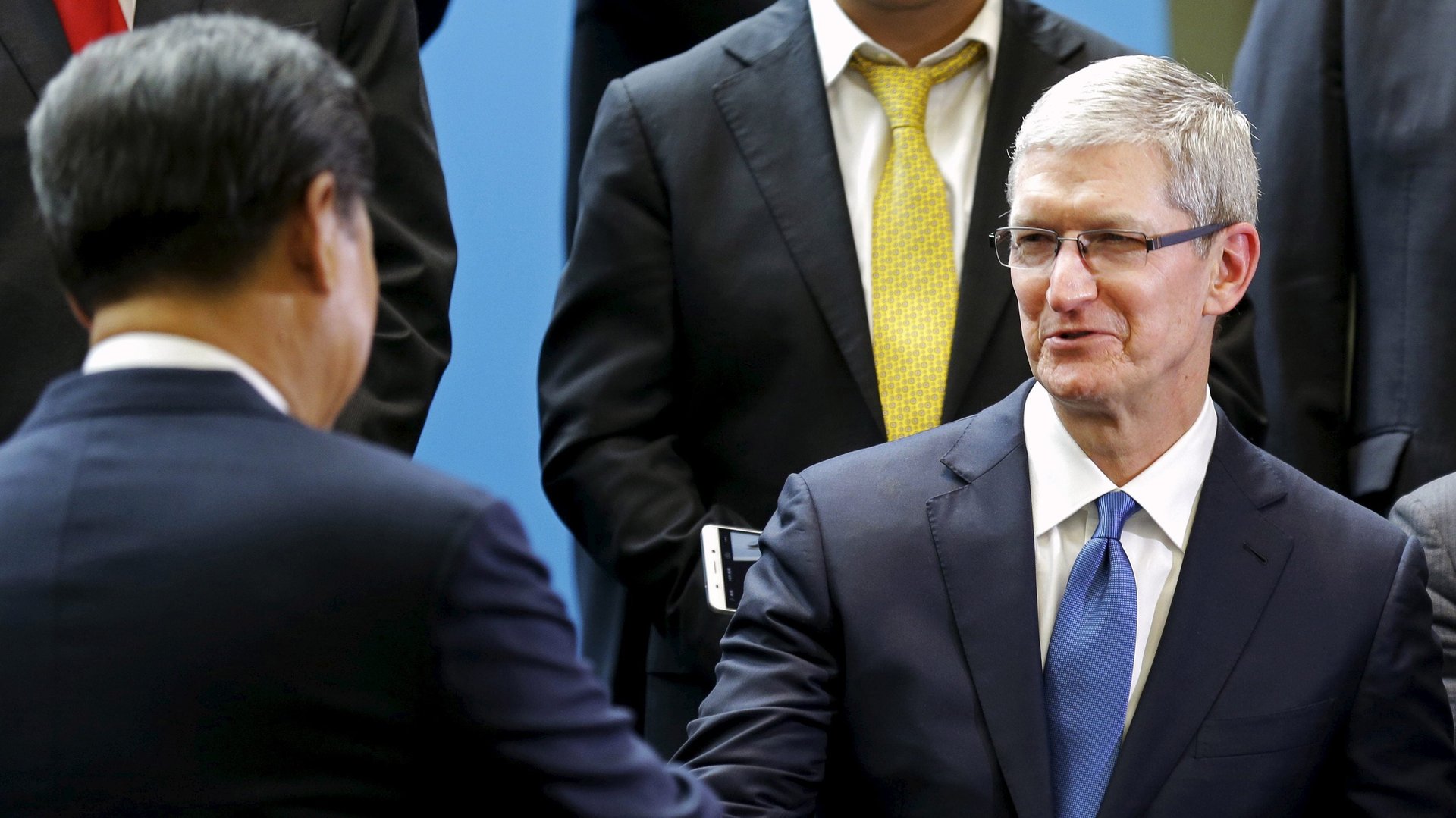

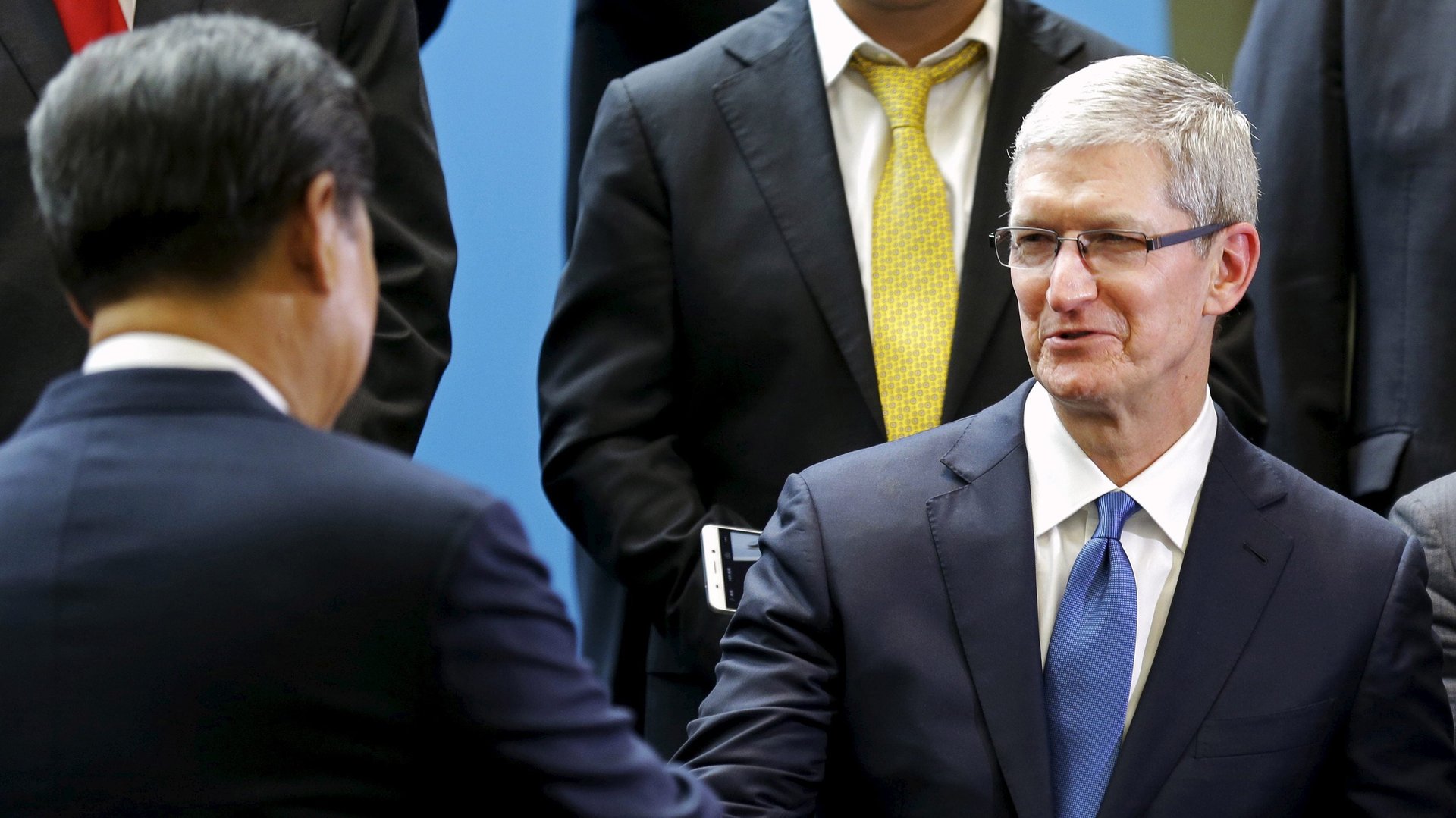

Other signs of stress in China have recently emerged. Carl Icahn, a high-profile Apple investor, confirmed he sold off all his shares in the company two weeks ago out of concern over the Chinese government’s potential to dampen sales. Chinese state media outlets also published coordinated reports that Huawei, the Chinese maker of telco equipment and smartphones, had begun charging Apple patent fees related to wireless communications technologies. While difficult to verify, the timing of the pieces in the wake of other news indicates that the government is casting a stern glance towards the company.

A symbolic appeasement

Investing in Didi is just one way the company can indicate its interests are aligned with those of Beijing.

Authorities are attempting to wean the nation off of foreign technology (2020 has been set as an ambitious target date), while also empowering domestic tech companies to boost R&D.

Amidst this push, Chinese authorities have indicated they consider transportation an industry of critical importance. Government documents discussing ”Internet Plus”—a policy directive intended to push internet companies into businesses once dominated by the state—single out transportation as one of the key industries it hopes to see revitalized by Chinese online players. Conveniently, there is only one Chinese online player, and that’s Didi.

As a result, Apple’s investment in Didi against Uber is a symbolic appeasement. It’s a bet on the government’s preferred horse, in a competition that ranks alongside Baidu’s fight with Google and Alibaba’s war with Amazon.

There is little reason to expect a deep collaboration between Didi and Apple anytime soon. Beyond app store promotions and Apple Pay integration (assuming the government doesn’t toss it out alongside iBooks), there’s not much that Apple can do to help Didi enhance its already dominant position.

But the investment could mark the first in a series of Apple investments in Chinese tech companies. If Apple can’t popularize Apple TV alone in China, perhaps it will work with Alibaba or LeEco, two Chinese companies working to become leaders in online entertainment. If it can’t bring Apple Music to the Middle Kingdom, perhaps it can find a partner in Tencent’s QQ Music.

Apple was once thought to be an outlier in China, a foreign company that could thrive without cozying up to a local partner. But as its fortunes turn in China, it might be left with no other choice.