Google isn’t taking the crown as the world’s largest company, Apple is losing it

The king is dead. Long live the king.

The king is dead. Long live the king.

Google’s parent company Alphabet saw its market value close roughly $30 billion above Apple’s yesterday (May 12), marking Google’s ascension as the world’s largest publicly traded company, according to Dow Jones.

But it’s not as straightforward as that. Howard Silverblatt, the keeper of the S&P 500 index for S&P Dow Jones Indices, cites the most recent filings on shares outstanding for Alphabet’s various share classes, and estimates that the search giant’s market cap is in fact a few million dollars shy of Apple’s.

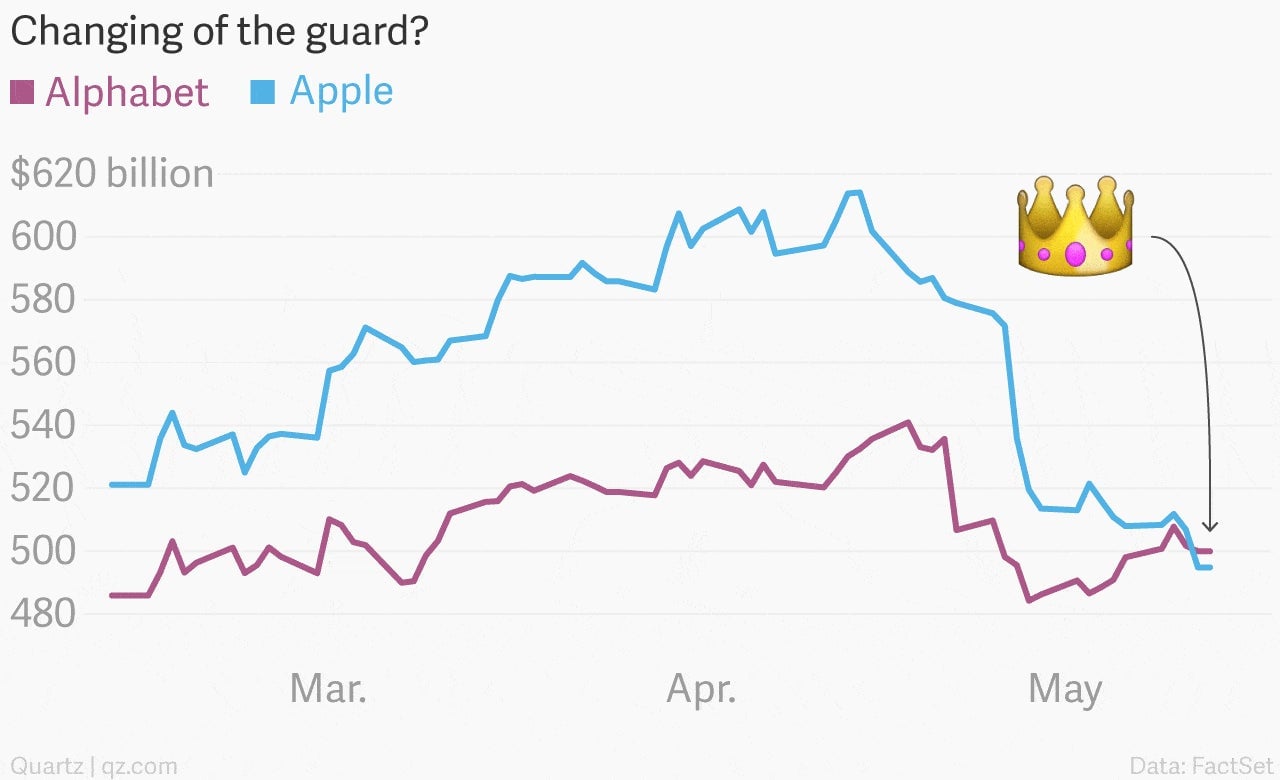

It doesn’t matter. The companies are so close in value now that when share prices wiggle in a few cents in either direction, the crown passes back and forth.

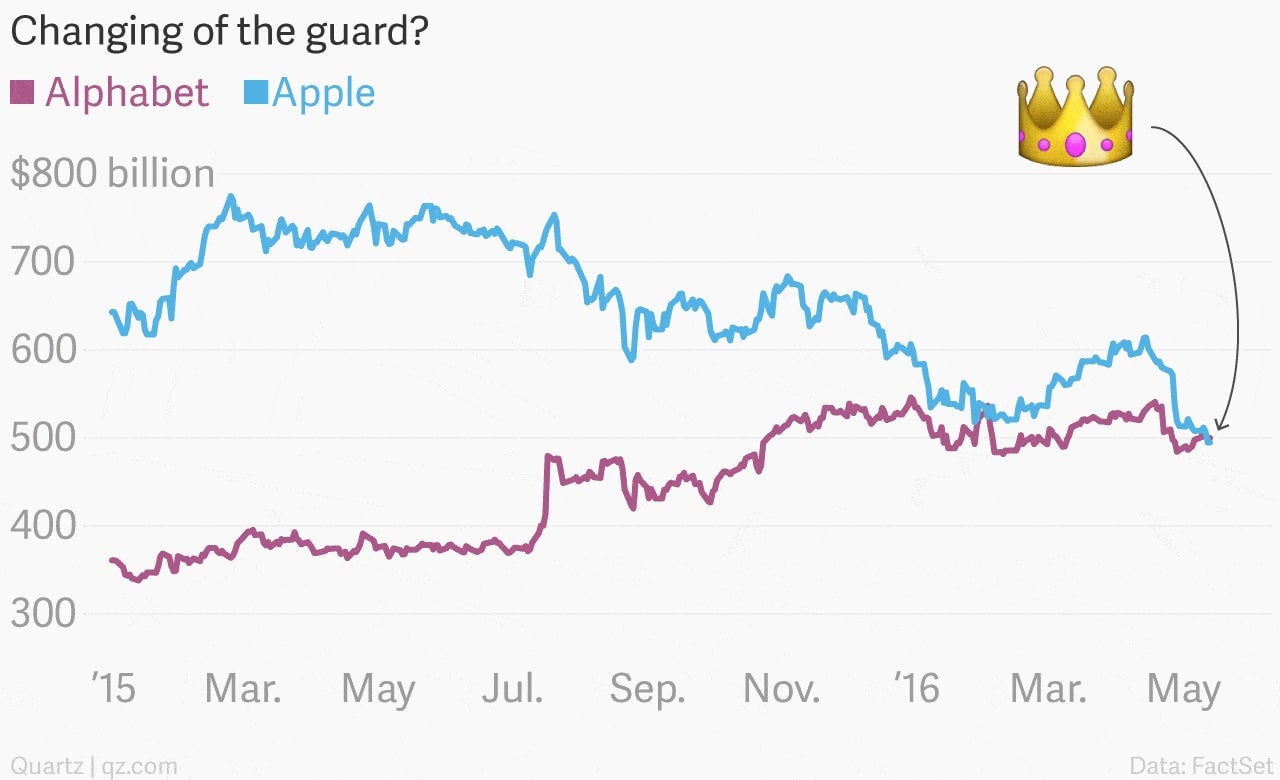

More importantly, the story isn’t about the rise of Google but rather the astronomical amount of shareholder value that Apple has destroyed over the past year. Apple’s market value, as tallied by data provider FactSet, has declined by more than $100 billion—with a “B”!—in less than a month.

But that’s nothing. Last May, Apple’s market value was around $750 billion. People were talking about its potential to be the first $1 trillion company. Since then, some $250 billion in paper wealth has evaporated.

Of course, that Apple is in a position to lose so much value reflects the astounding run of success of the company in recent years. But the signs suggest that this run could be about to end. Apple’s recent posted its first quarterly decline in revenue in 13 years.

The decline was driven in part by sluggish sales in China’s heavily saturated mobile market. Even so, the company was still able to generate unbelievably large profits.

But in the stock market, it’s the prospect for future growth that’s king. And that’s why Apple might not be for much longer.