The US housing market is starting to boom

The evidence is piling up.

The evidence is piling up.

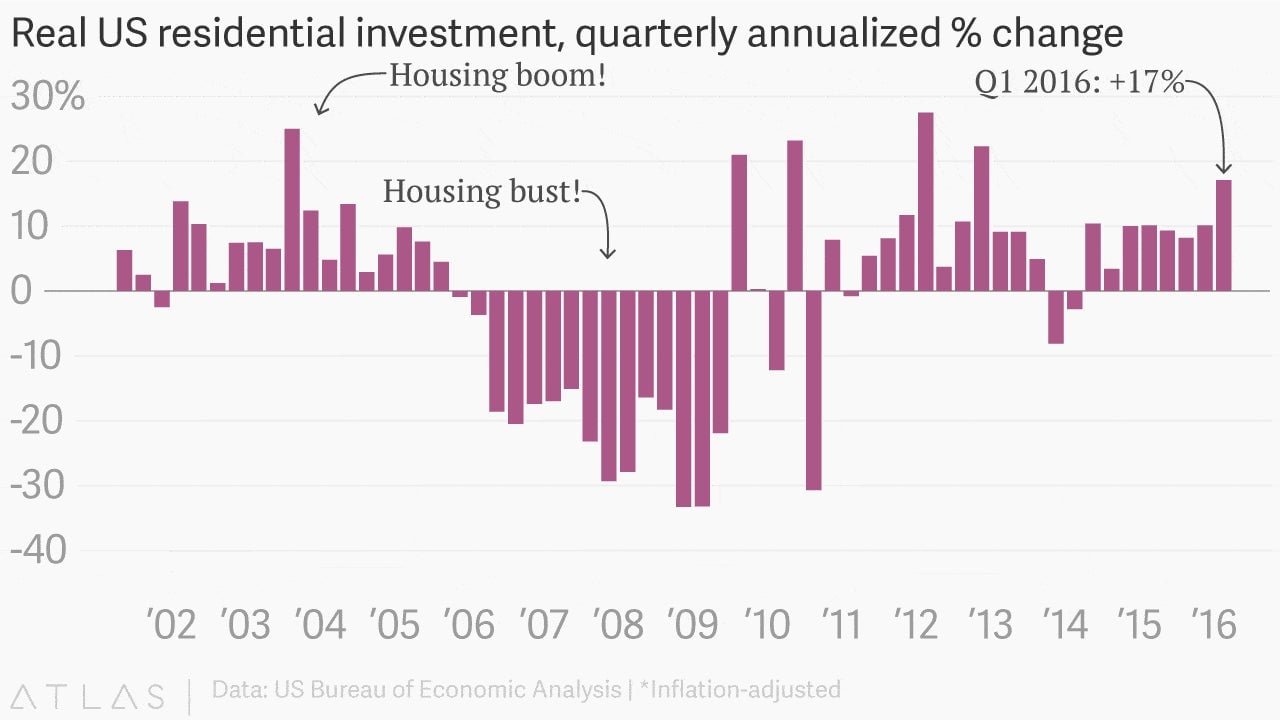

The latest indicator comes from the updated US GDP numbers published this morning, which showed the US growing at a faster-than-first-reported 0.8% clip in the first quarter. They show residential investment in things like homebuilding and renovation rising at an annual pace of more than 17%, a reading that would have put it among the hottest moments during the pre-crisis housing boom.

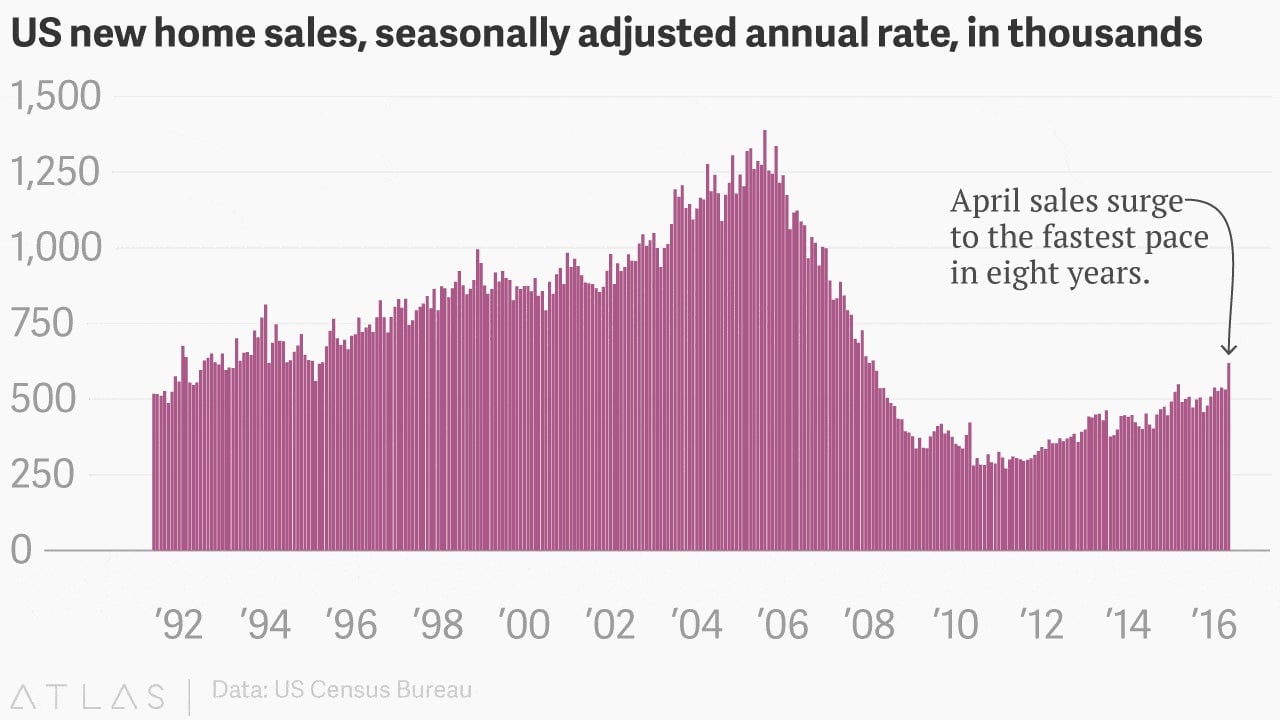

This only confirms what were seeing elsewhere. New home sales surged in April to the fastest pace since January 2008.

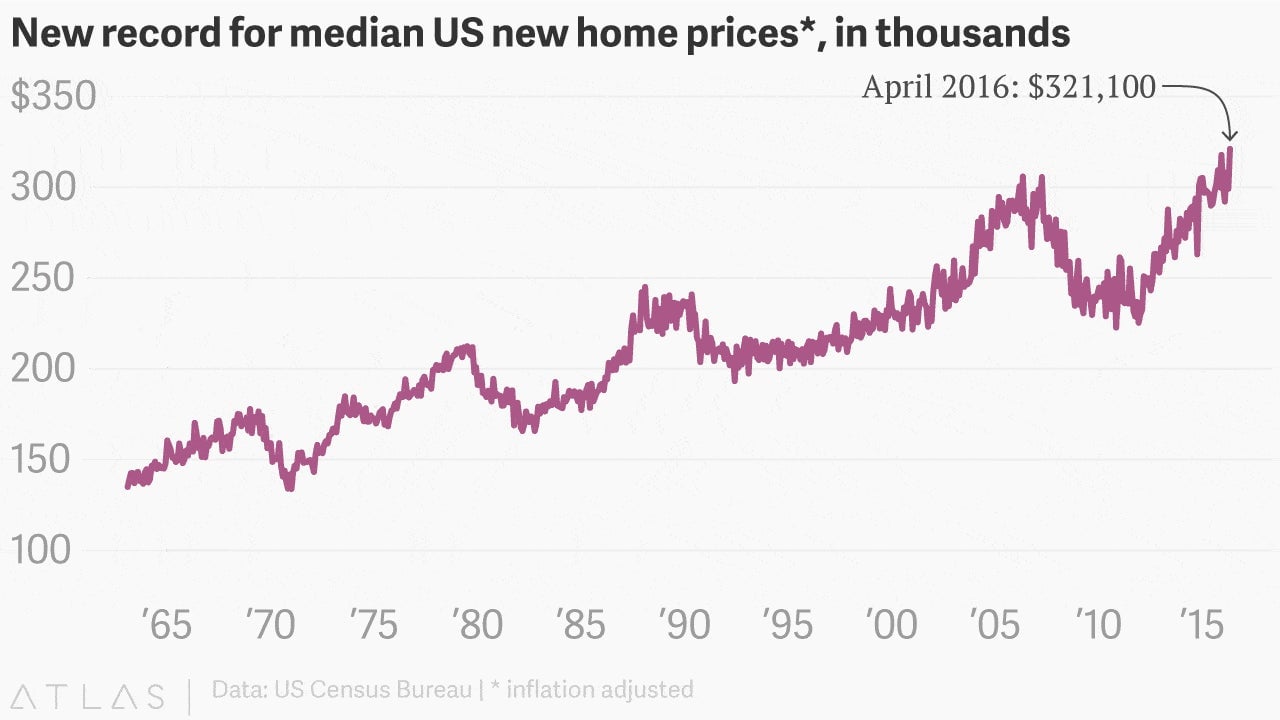

And median new home prices hit a record high.

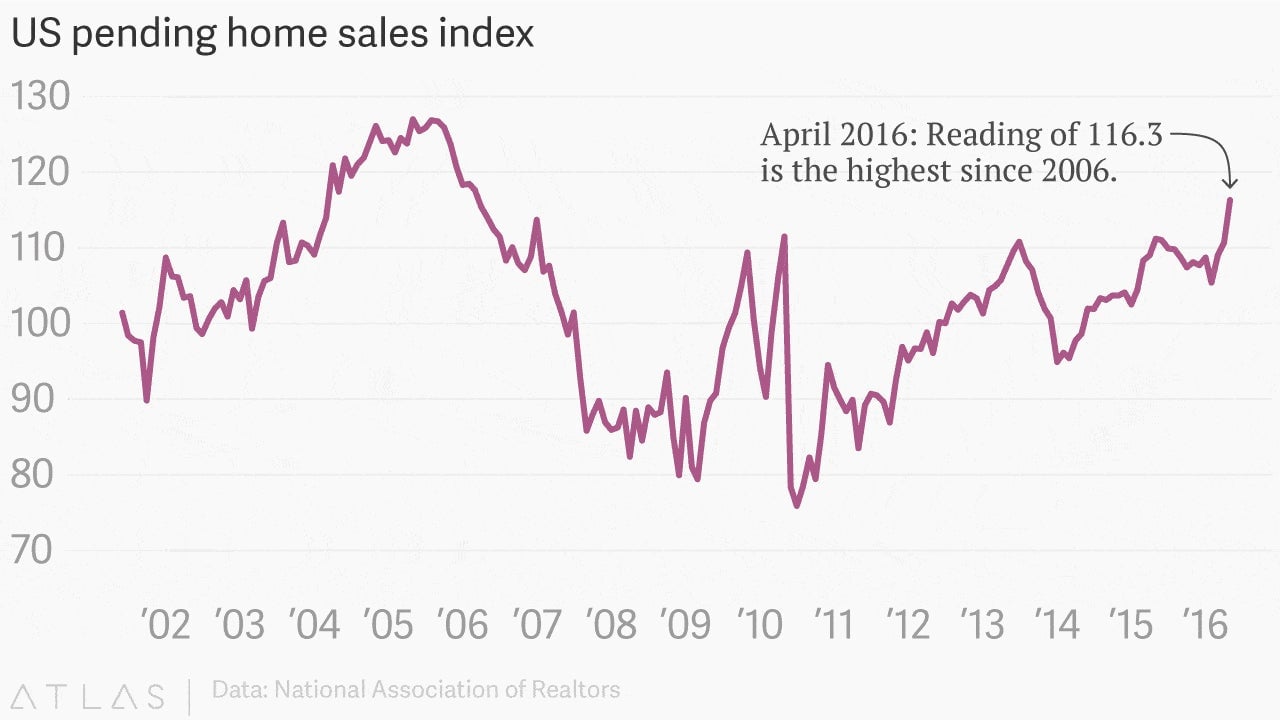

Meanwhile, similar strong conditions are being seen in the much larger US market for pre-existing homes. The National Association of Realtors’ index of pending sales of existing homes rose to 116.3, the highest level since February 2006, at some of the boomiest moments of the US boom.

And of course, corporations that cater to this crucial component of the US economy are in clover at the moment.

Of course, people will be quick to point out that the US housing boom that peaked around 2005 and 2006 was fueled by horrible lending practices and a speculative frenzy that culminated in an economy-crushing bust.

But that was then. Now, mortgage standards are high, wages are starting to pick up steam, and debt burdens remain quite manageable. In other words, this trend has room to run. Underestimate the power of the US housing market at your own risk.