Janet Yellen just said nothing perfectly

When you’re a central banker, sometimes it’s your job to stand up before the world’s financial markets and deliver a statement that conveys almost no new information.

When you’re a central banker, sometimes it’s your job to stand up before the world’s financial markets and deliver a statement that conveys almost no new information.

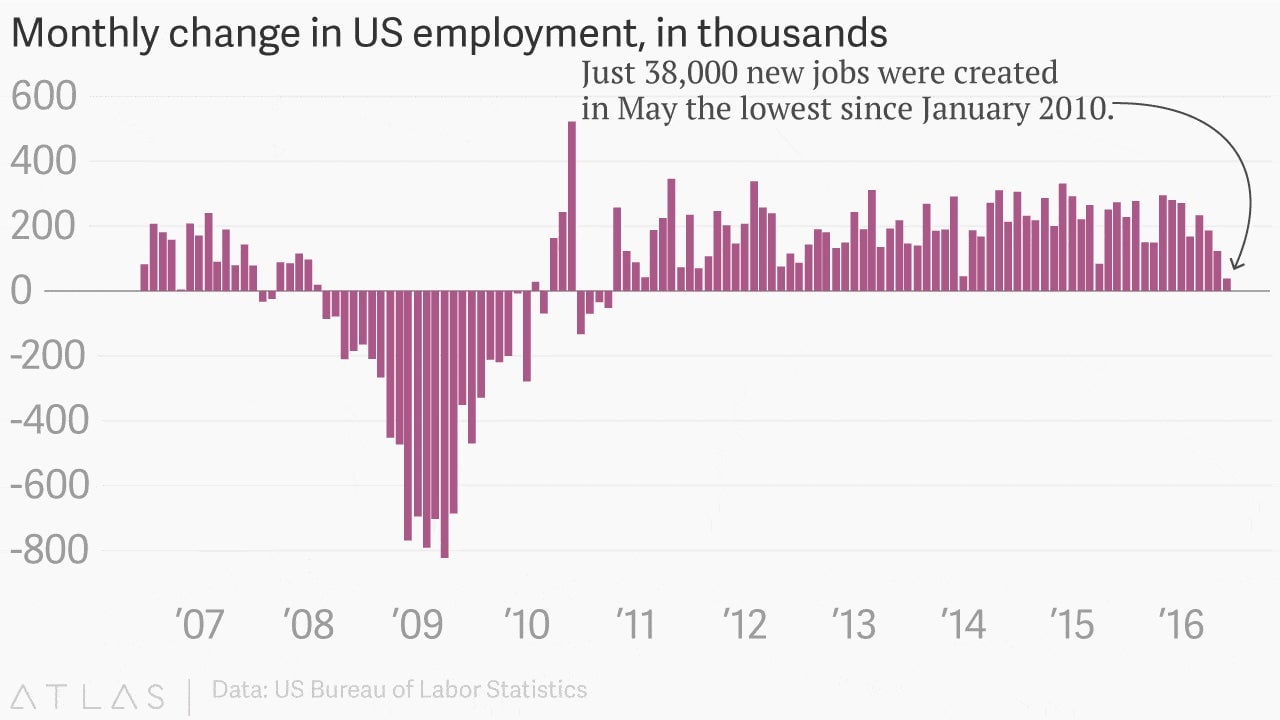

Today is one of those days for Fed Chair Janet Yellen. Investors awaited her speech in Philadelphia this afternoon hoping that she would tell them how she was changing her views on the economy in light of the truly ugly jobs report for May. The report Friday morning showed just 38,000 jobs were created last month, far below expectations of about 160,000, and much lower than the roughly 200,000 monthly pace over the last year or so.

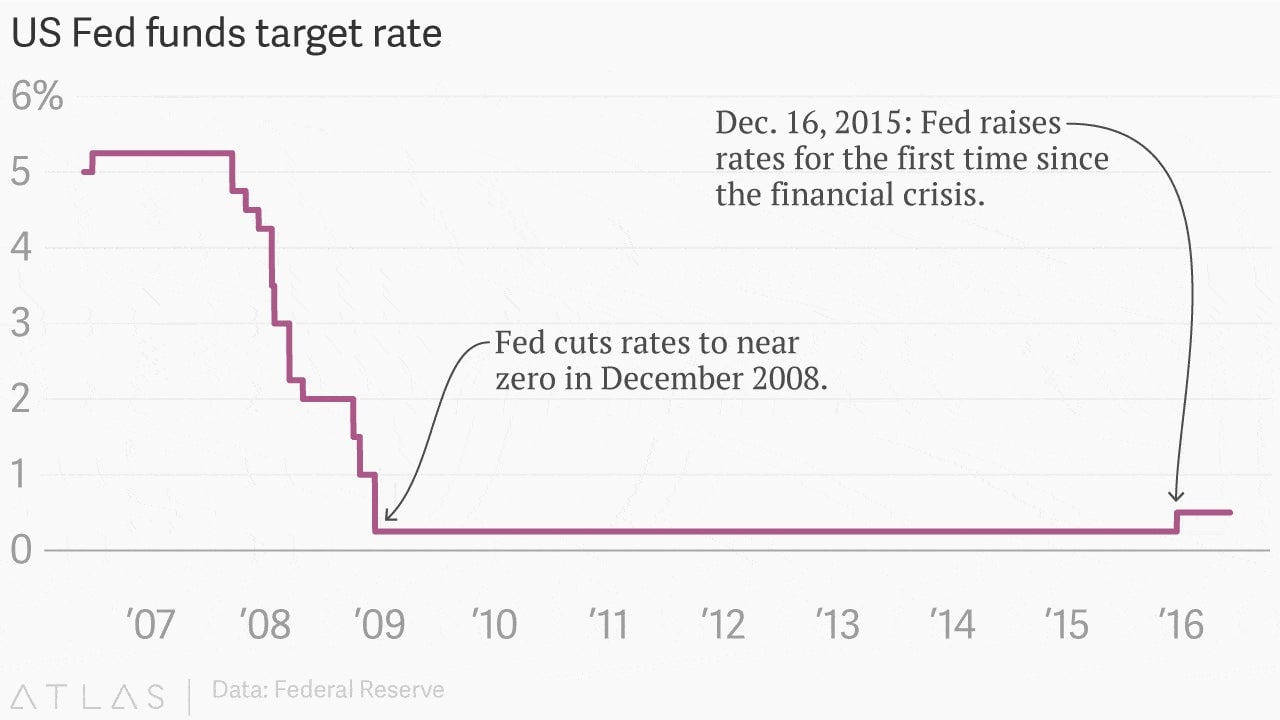

The disappointing report scrambled well-established expectations that the Fed would lift interest rates for the second time since the financial crisis on June 15, when they release their next policy pronouncement. Before the jobs report, May traders in the futures markets put the odds of a June 15 rate increase at roughly 33%. That tumbled to 4% immediately after the May report, according to the Wall Street Journal.

Did futures markets get that right? Yes. Pretty much. In her speech today Yellen seemed intent on not offering any new information suggesting she wants to raise rates in June. Here’s the core of the speech:

Although this recent labor market report was, on balance, concerning, let me emphasize that one should never attach too much significance to any single monthly report. Other timely indicators from the labor market have been more positive. For example, the number of people filing new claims for unemployment insurance–which can be a good early indicator of changes in labor market conditions–remains quite low, and the public’s perceptions of the health of the labor market, as reported in various consumer surveys, remain positive.

Translation: “Yes, we saw the ugly report on Friday the same as you. Other economic data hasn’t confirmed it, don’t know which reports are right, so we’ll have to just wait and see.”

The market didn’t seem to get much more new information from the speech. After the speech, expectations of a rate hike at the June meeting rose, but only very slightly, to 6%. Meanwhile, the odds of an interest rate increase occurring, instead, at the Fed’s meeting in July are up to about 39% after the Fed chief’s utterances today. In other words, it’s the economic data, stupid. Just keep watching it.