Markets do as they’re told after Bank of Japan delivers big

The Bank of Japan has got to be pleased with the market reaction to its announcement of aggressive Bernanke-style easing policies Thursday, which arrived shortly after 12:30 a.m. EST. Here’s a look.

The Bank of Japan has got to be pleased with the market reaction to its announcement of aggressive Bernanke-style easing policies Thursday, which arrived shortly after 12:30 a.m. EST. Here’s a look.

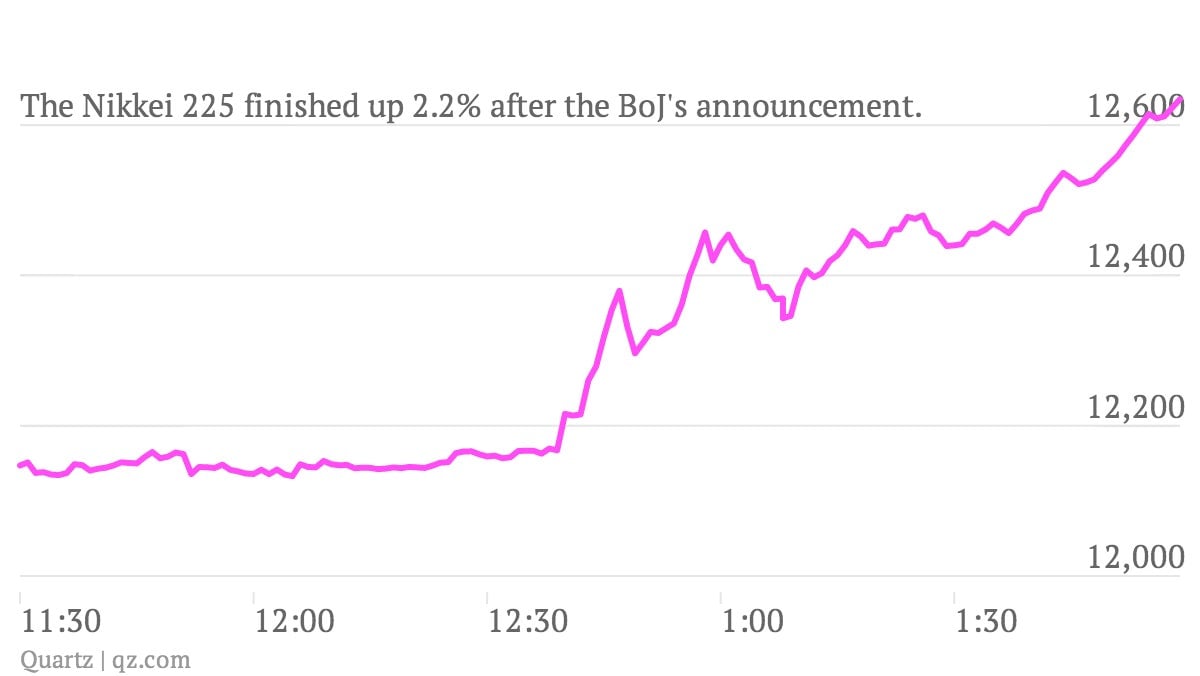

The stock market shot higher…

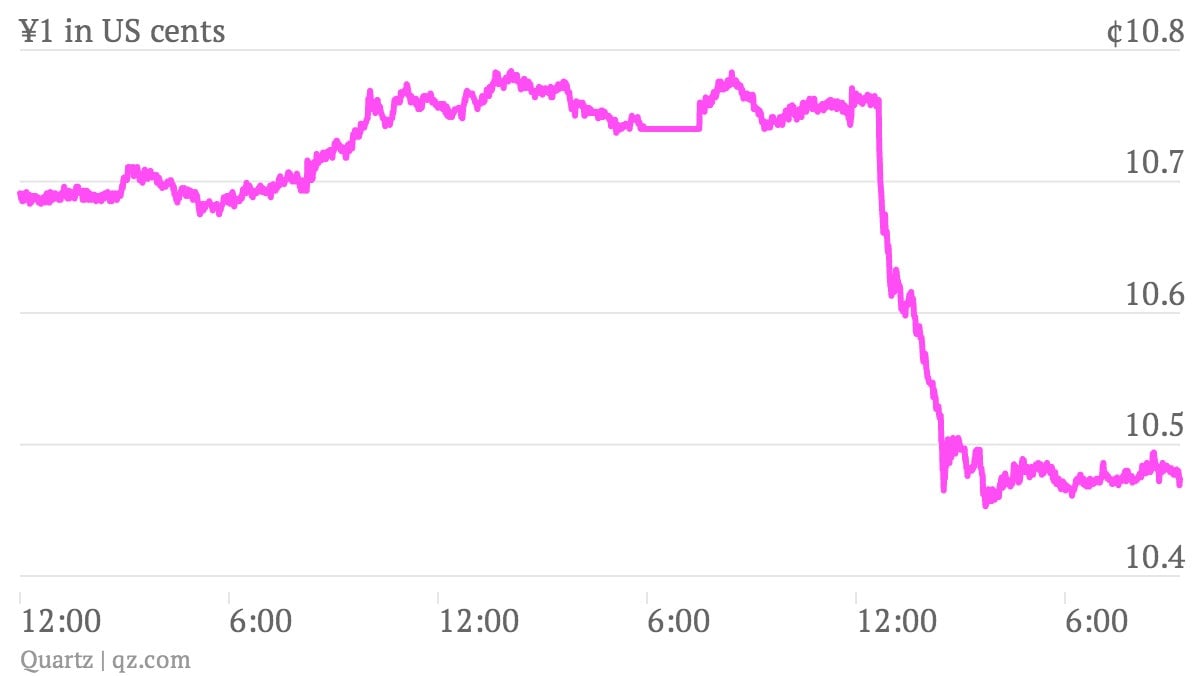

…the yen weakened sharply on the news, which is exactly what a central bank trying to generate inflation would want to see…

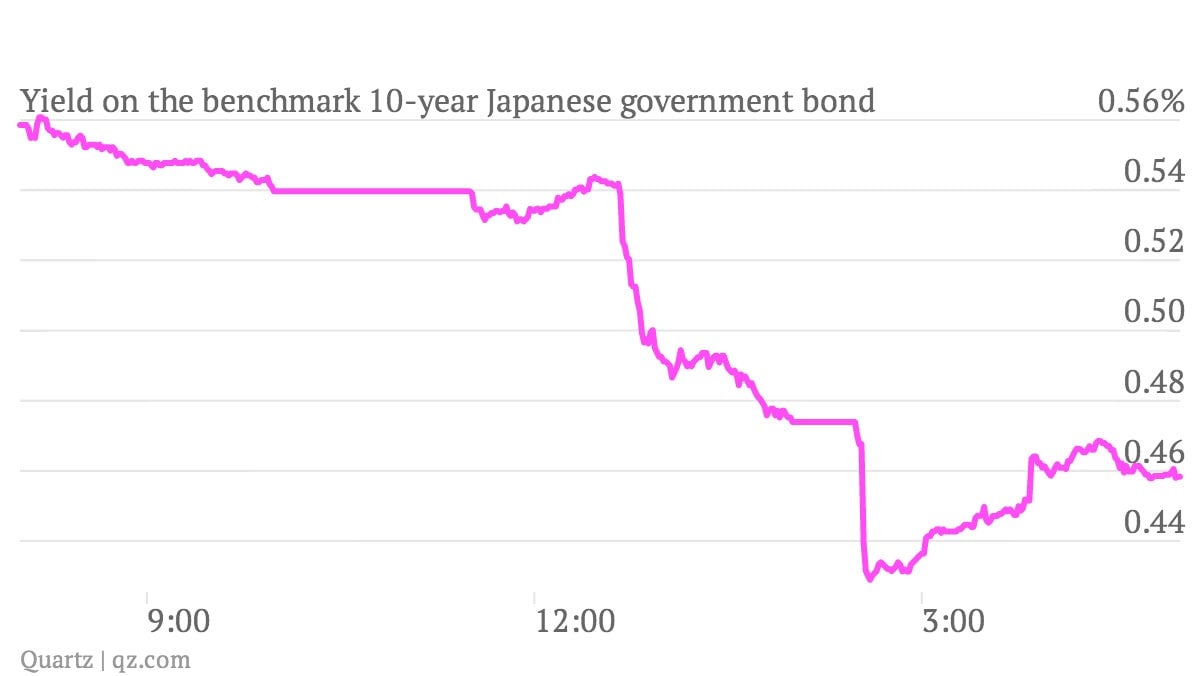

…and already low yields on Japanese government bonds tumbled.

The yield on the benchmark Japanese 10-year neared its all-time low of 0.43% set back in June 2003. This is another win for the BoJ, as one of the main points of the revamped effort to push cash into the system is to push people out of savings instruments such as government bonds, and into investment and spending. With yields this low it and the prospect of higher inflation coming down the pike, the BoJ hopes it can prod investors out of their long-time safe haven.