Family Dollar earnings slightly soft as Washington woes pinch low-end consumers

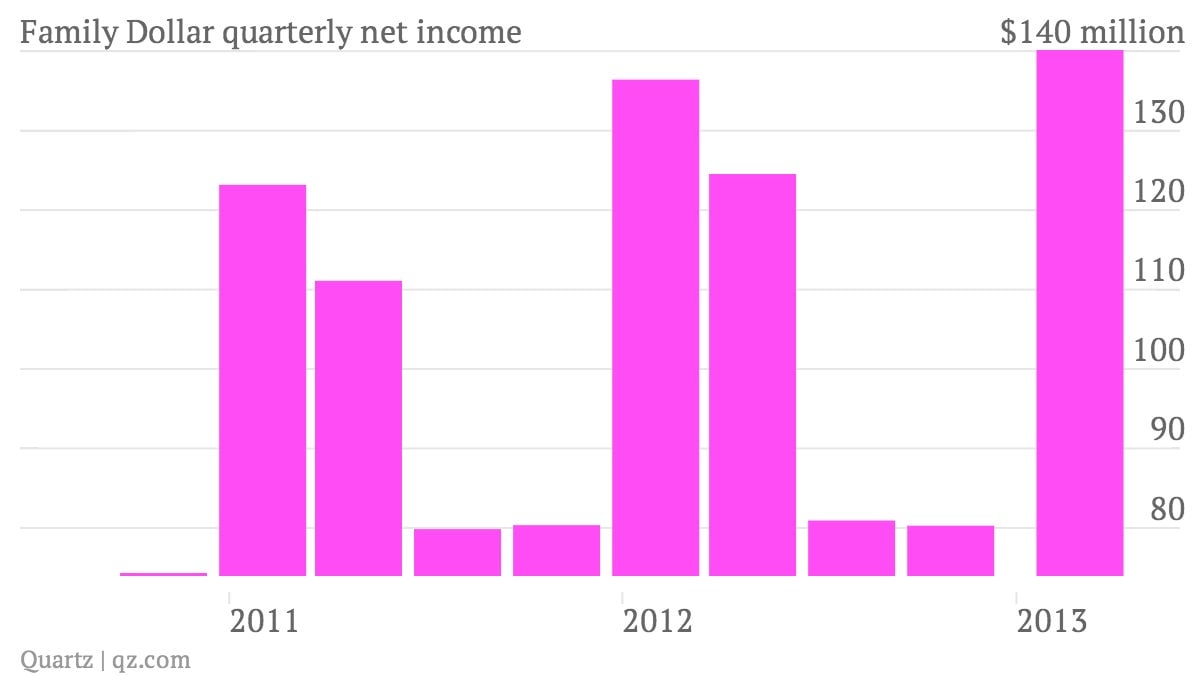

The numbers: Fast-growing US discount store Family Dollar today posted quarterly profits of $140.1 million, or $1.21 per share, just a touch lower than analyst expectations of $1.22 per share. Revenue was up 18% from a year earlier, matching expectations; the quarter benefited from being a week longer than the same one a year ago in the company’s calendar.

- The numbers: Fast-growing US discount store Family Dollar today posted quarterly profits of $140.1 million, or $1.21 per share, just a touch lower than analyst expectations of $1.22 per share. Revenue was up 18% from a year earlier, matching expectations; the quarter benefited from being a week longer than the same one a year ago in the company’s calendar.

- The takeaway: A slightly disappointing quarter for the dollar discount store—a big player in the industry once thought capable of making Walmart sweat, if only a little—suggests that Americans may not be skipping out on large-scale shopping sprees at the likes of Walmart and Target for smaller purchases at dollar stores like Family Dollar just yet. Some are hopeful, though, that the company’s agressive move into groceries will help it gain traction going forward.

- What’s interesting: After Walmart executives exchanged exasperated emails about the company’s disastrous start to February, Family Dollar seems to be suffering from a similar ailment. Normally immune to times of economic trouble, discount stores tend to reap the benefits of what struggling economies fail to sow—namely enough disposable income to buy more expensive goods. But the combination of a recent rise in the payroll tax and untimely delay of 2012 tax refunds seems to have left some consumers questioning whether they should be opening their wallets at all.