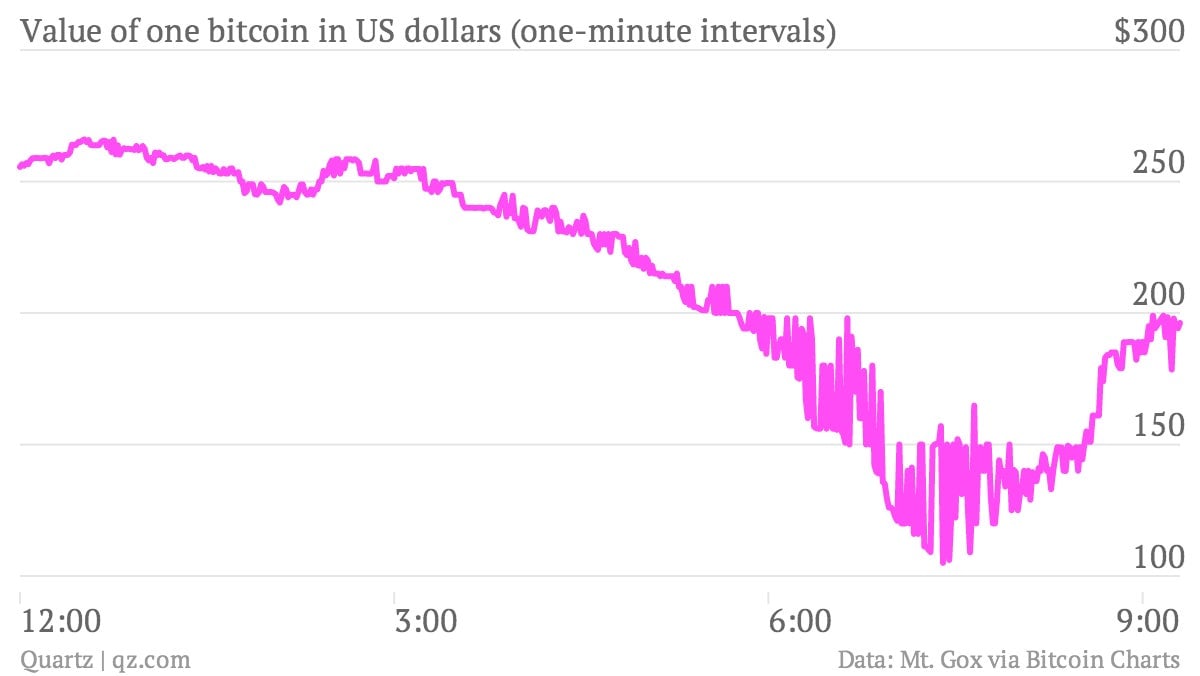

The wild, minute-by-minute chart of bitcoin trading today and what it means

Bitcoin surged above $250 today before falling sharply to $105 and fluctuating wildly thereafter in what most people are calling a “crash.” That’s fair enough, but price swings of this magnitude are fairly common for the virtual currency, which is traded by speculators and extremely sensitive to attention and price expectations, as I’ve written at length before.

Trading in bitcoin today starting at noon GMT

Bitcoin surged above $250 today before falling sharply to $105 and fluctuating wildly thereafter in what most people are calling a “crash.” That’s fair enough, but price swings of this magnitude are fairly common for the virtual currency, which is traded by speculators and extremely sensitive to attention and price expectations, as I’ve written at length before.

If there’s anything to learn from today’s market movement in bitcoin, currently trading at around $196, it’s that alternative currencies can’t bounce around this much if they have any hope of being used as currencies—i.e., to buy and sell things—rather than commodities, i.e., to be bought and sold themselves.

That will presumably be a topic of discussion at Bitcoin 2013, the annual conference in May, which is incidentally a good example of this problem: Currently, you can buy a ticket to the event for $300—which is a fixed price—or BTC 1.4, the price in bitcoins, which the organizers regularly adjust to match the price in US dollars. At various points today, that difference represented an enormous arbitrage opportunity for anyone trying to get into the conference on the cheap.

The very fact that the price is set in US dollars and then converted to a variable rate in bitcoins speaks to how the currency hasn’t yet matured. It was only introduced in 2009, after all, and these are early, if exciting, days for math-based currencies. (And as I’ve argued before, market forces tend to ruin good ideas.)

It’s only really a problem if, say, you take your salary in bitcoin, which is the case for employees of the Bitcoin Foundation, who help administer the software that powers the currency. To adjust for fluctuations in bitcoin’s value, their salaries had been readjusted on a quarterly basis. But more recently, the foundation decided it would start adjusting salaries every month.